In a world where we all pay tax throughout our working lives, would there be a way to generate a sizable income in retirement without paying any tax at all?

Working with clients such as John and Martha, is every financial planner’s dream. Having been diligent savers over the course of their working lives, we have worked together in utilising a range of tax efficient savings vehicles, allowances, strategies and investments, to ensure they are strongly positioned to generate a tax efficient income in retirement. Now at age 60 they look to bear the fruits of their labour from their combined portfolio of assets, consisting of the following:

| Pensions | £750,000 |

| Direct investment portfolio | £250,000 |

| Stocks & Shares ISAs | £500,000 |

| Buy to let property* | £250,000 |

| VCTs | £200,000 |

*The rental property was purchased in a limited company structure, and generates £10,000 per annum of distributable rents, net of agent fees and costs, which is drawn as a dividend.

John and Martha are looking to create a combined net income stream of £75,000 per annum, to meet their desired expenditure requirements, with a view of maximising tax efficiency, and ensuring sustainability for the long term.

We incorporate some assumptions of future growth rates from the various pots of wealth (these are not guaranteed, and for illustrative purposes only), and consider the position if the investments were to deliver annual returns on the following basis:

| Pensions | 4% |

| Stocks & shares ISA's | 4% |

| Direct investment portfolio | 5% |

| VCT | 5% dividend income |

| Buy to let property | £10,000 dividend |

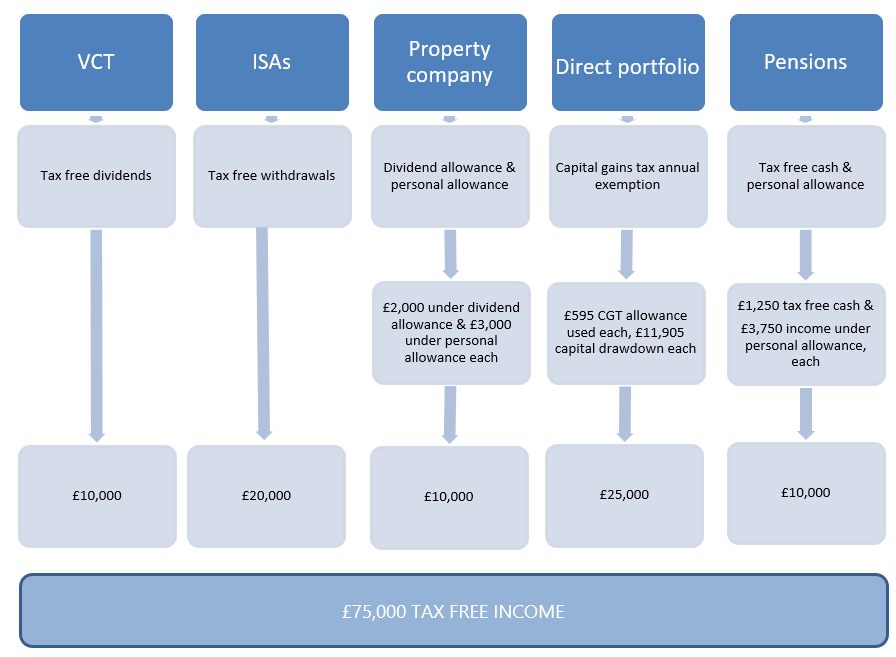

To achieve their objectives, we look to take advantage of the following allowances and strategies (based on 2020/21 tax year figures).

Personal allowance - John and Martha can each shelter £12,500 of income from tax, through their personal allowances.

Tax free ISA withdrawals – all withdrawals from their ISA portfolio are free of tax.

Dividend allowance – from the property company, John and Martha can each withdraw £2,000 of tax-free dividends.

Tax free VCT dividends – VCT dividends are completely tax free. It should also be noted that although VCTs are valuable tax efficient investment vehicles (which offer tax relief on initial investment, tax free dividends and tax free capital gains potential), they are however deemed to be higher risk investments, which are suitable for individuals who have the appropriate capacity for loss to undertake such investments.

Capital gains tax annual exemption – they each have £12,300 of capital gains exemptions, which is a powerful (and often underutilised) allowance, to take advantage of in drawing down on their direct investment portfolio.

Tax efficient pension withdrawal strategy - with a flexible pension vehicle, individuals have the ability to structure their withdrawals so that for each tranche drawn, 25% is tax free, and the balance is subject to the individual’s marginal rate of tax and can be sheltered within the unused personal allowance.

In light of the above, we have looked to structure John and Martha’s income as follows:

The above demonstrates how John and Martha can derive a tax-free income for themselves using their various “pots” of wealth. Their income strategy remains flexible and adaptable to changing circumstances. For example, should dividends from their VCTs or property company fall short in a particular year, they can supplement these by drawing on the ISAs, direct investment portfolio or pensions.

When making withdrawals from the direct portfolio, a proportion of the withdrawal relates to the capital gain, and the residual is deemed a withdrawal of capital, hence they are only using a small proportion of the capital gains tax annual exemption on each withdrawal. Although the withdrawals from the direct portfolio are greater than the returns being generated (which will deplete in circa 12 years) it allows the other tax efficient pots, such as the pension, to continue to grow, and from which increased levels of withdrawals can be made at a later stage. The pension also offers inheritance tax advantages, so it makes sense to preserve its value and draw down on personal assets first.

Looking ahead, they will be eligible for state pension in around 7 years’ time, at which point they can reduce/switch off their personal pension incomes.

Through maximising the use of tax efficient allowances, structures and investment vehicles, the underlying investments are not required to work as hard in generating high returns (which in today’s low interest environment means undertaking greater risk) to distribute a desired level of income, given they are not hindered by tax.

Should you wish to discuss your long-term income planning, and ensure you are well positioned to derive a tax efficient income in retirement, please feel free to contact me.

This article has been produced for information purposes only. It is not intended to be an invitation to buy or act upon the comments made. All investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances and one must satisfy certain investor criteria before being considered eligible to invest. Any forward-looking statements and forecasted returns represent the current views of Mattioli Woods plc and may be subject to change. Your capital may be at risk and past performance is not a guide to future returns. Mattioli Woods plc is authorised and regulated by the Financial Conduct Authority.