United Kingdom

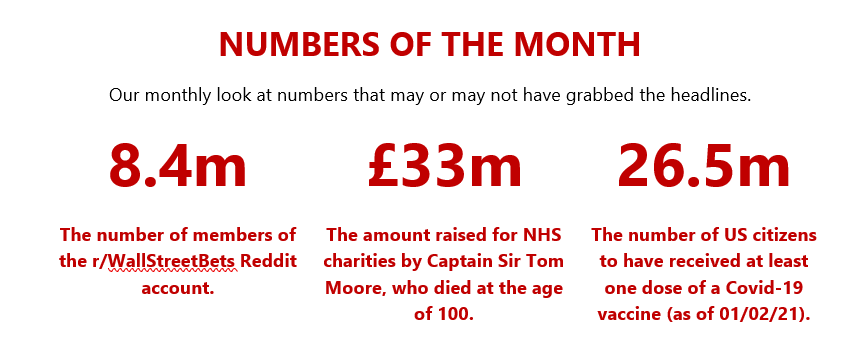

Our theme this month is democracies. According to the Democracy Index published by The Economist Intelligence Unit, 2020 was ‘a bad year for global democracy’. Based on their measures (they rate the state of democracy across 167 countries based on five measures – electoral process and pluralism, the functioning of government, political participation, democratic political culture and civil liberties) – just 8.4% of the world’s population live in a full democracy (including the UK). They judge that more than a third live under authoritarian rule. Many have no choice.

Are equity markets democratic? Our answer would normally be a resounding yes, but very recently events might suggest otherwise … Margaret Thatcher sought to build a ‘shareholder democracy’ through a wave of privatisation of UK state-owned assets during the 1980s. As well as being a useful way for the Treasury to raise money, the ideological message was clear: the risks and the opportunities of owning shares should be open to all. With that would come a sense of participation, not only in the fortunes of companies but also in the economy as a whole. It was the democratisation of capital.

In the same spirit, maybe we should applaud the recent attack by an army of (in the main) small US investors on hedge funds that make their money selling short? After all, isn’t selling short (effectively betting against a share price) the antitheses of responsible behaviour in a share owning democracy? Well, for several reasons, no. First, democracy and the mania of a crowd are very different things. Once the crowd drives a share price beyond its fundamental value, anyone who buys after that point is likely to suffer a fall once the frenzy subsides. Participating in such activity, therefore, resembles a Ponzi scheme and risks wiping out the savings of small investors (many of whom seem to have invested their (US equivalent of) furlough cheques).

Second, the same rules should apply to everyone, and it is illegal for professional investors to collude in order to ‘pump and dump’ shares. The SEC (the US regulator) has not found evidence of collusion on social media message boards, but many believe that collusion is indeed taking place. This may all be ‘out in the open’, and lack a controlling mind, but when it walks like a duck, sounds like a duck and looks like a duck …

Finally, as much as short-selling appears to defy the spirit of stock market investing, it is a useful mechanism by which to flush out fraud. Last year we saw malfeasance at Wirecard in Germany and Luckin Coffee of China (with a US listing) exposed, thanks to research led by short-sellers. What we have seen in recent weeks is not an extension of shareholder democracy.

The news relating to Covid-19 seems to be on a perpetual see-saw: more variants, more vaccines, more deaths, more antibodies, more liquidity, more insolvencies. Looking through the news, taking into account what we know and, yes, with an element of what we foresee, we would again point out that although having been only modestly weighted to UK equities was helpful in 2020, we do see more positive times ahead. Our preference is still for smaller companies.

Term or word(s) to watch: Pent up demand – what is it and is it real? This an expression we are hearing a lot, primarily from those that see an economic boom in consumer-led economies such as ours: it is when the pandemic lessons its grip on the economy. ‘When demand for a service or product is unusually strong’ and ‘when consumers return strongly after a period of reduced spending’ form parts of different definitions.

We urge some caution, however, as there are plenty of areas where one might imagine there is pent-up demand when in fact there isn’t. There are many other areas where a simple return to ‘normal’ might feel like pent-up demand but will in fact only return the recipients (businesses) to business as usual. There are then a few where demand has been excessive since Covid-19 hit that might well see a reduction in demand when so-called normality returns.

The fundamentals of a business or market remain as important as ever – there will be winners in 2021; there will, as ever, be losers. Those purveyors of services/products that are new economy, where there will be renewed or increased demand, will do best and others will, sad as it may be, fall by the wayside.

North America

The Democrats managed to pull off an initially unexpected win in Georgia, meaning they now have control of the Senate, the House and the US presidency. This clearly creates a better opportunity for President Biden to implement a robust economic policy without the restrictions and limitations he may have otherwise faced. Realistically, this means the prospects for an increased fiscal stimulus are now very much on the table and a figure of $1.9 trillion is being proposed.

Republican Senators have balked at this amount having agreed a $900m stimulus already (which is not yet fully accounted for in a formal budget), and the proposal to increase the minimum wage is seen as opportunistic and not related to the pandemic. The package is likely to be scaled back, but it will still prove to be substantial and is possibly sufficient to justify where markets are currently trading. The margins are fine, however.

Any disappointment on this front will likely cause significant ructions in markets and is another reminder of how dangerous investing can be when so much ‘good news’ is already priced into assets.

The proposals have renewed hopes of a stronger economic recovery, possibly accompanied by an increased rate of inflation, and this has been sufficient to boost the case for value stocks in the eyes of investors. We do now face the prospect of a sustained rotation in styles in the markets generally and in the US in particular. Smaller stocks, which have historically outperformed, have recently struggled on a relative basis against larger cap names but have also enjoyed an improvement in fortunes since the election.

None of this will of course be of any use to President Trump who has finally exited the White House. It looks as if he is going to escape being convicted in the Senate as sufficient Republican Senators are willing to stand by him, believing the proceedings to be a distraction from the country moving on. What is for sure is that a return to some political normality makes the US more attractive to some, though even at the height of Trump’s eccentric leadership the market still led the way.

It appears that US democracy and democratic institutions have indeed won out, though at one point last month it felt as if they were genuinely imperilled. The Constitution has been put through its paces and although it has faced an idiosyncratic threat and challenge, democracy appears to have proven sufficiently robust. For true loyalist Trump supporters, it is the very transition to a new administration that represents a fundamental threat to their democracy – everyone else seems willing to breathe a sigh of relief and get on with it.

Our approach remains the same, reluctant to add to generic US exposure on valuation concerns but accessing exposure through our preferred themes, many of which are US equity centric.

Europe

Economic data often takes a while to gather and amalgamate, with revisions invariably made later. Over January the Q4 2020 GDP figures from major European nations were released, with readings more positive than many economists were predicting.

Both Germany (+0.1%) and Spain (+0.4%) posted positive growth numbers and France defied the government’s forecast 4% contraction, by shrinking a mere 1.3%. The collective eurozone figure from the European Central Bank (ECB) was also ahead of the forecast -2.2% rate, with only a 0.7% contraction.

Factory data was also positive, although recovery rates across countries differ. For example, Italy’s manufacturing data was more positive with the PMI figure increasing to 55.1, with Spain slipping to a seven-month low reading of 49.3. These reflect the differing outputs, with Italy more focused on machinery and equipment and Spain more focused on the production of consumer goods. Both have difficult outlooks given their respective economies’ exposure to tourism.

Switzerland stands as the continent’s oldest continuous democracy – after a 27-day civil war, the current constitution was signed in 1848. Plus, cuckoo clocks and chocolate!

While European economic data remains more robust than expected, challenges remain, the highest profile of which is the pace of vaccinations across the continent, which has seen headline spats with AstraZeneca and more recently Moderna over delayed delivery. Progress in Europe remains behind that of the UK meaning a return to the new normal may take a little longer.

This has led to much political discontent and infighting, including in France where far right party leader Marine Le Pen has reached 48% in (Harris) polling ahead of the May 2022 elections. Political noise is always a factor with Europe, not least because of the sheer number of countries and different electoral cycles. This could still be an issue come election time, given the depth of feeling.

Economic data is more resilient than expected, but the global pandemic has hit Europe harder than the US or China. We remain constructive on the outlook for good European companies, some of which are global leaders or emerging challengers across many sectors. We have some direct European equity within our Model Portfolios, towards the higher end of our risk spectrum.

Japan

While the Reddit-driven day trading frenzy shook Western markets in late January, Japan’s throngs of retail investors seemed reluctant to get too involved. Perhaps if this were the 1980s Japanese traders would be eagerly participating, but since the collapse of the bubble economy Japanese investors have generally lacked risk appetite.

Japanese retail traders now use long-term strategies and open-ended funds more akin to those used by institutional investors. While Japan Exchange Group Inc. has been promoting options trading for a limited slate of about 200 stocks, it has seen little uptake among investors.

Compared to the US, in the Japanese market we see a lack of options trading on individual stocks. When retail investors do dip their toes into equity markets their participation, even in the purchase of domestic stocks, pales in comparison to the US. When Japanese traders do buy US shares, they tend to opt for high quality stocks with name value, brand recognition and little risk of failure.

Another reason Japanese investors opt for quality stalwarts when investing in international equities is that many struggle to make sense of English language earnings statements. They were likely even more baffled by the Wall Street lexicon used in internet discussions.

Indeed, terms used by participants in various online forums like ‘baked in the cake’, ‘hunting elephants’ and ‘tendies’ mean little to the average native English speaker in reference to investments. In addition, while Reddit is among the most popular websites in the world, it has gained little ground in Japan, unlike for example Twitter, where Japan is the second-largest market.

An area where we can see significant agreement between Japan and most other developed nations is the prioritisation of climate change policy and investment in renewable energy. We have recently seen a meaningful shift in Japanese policy as officials prioritise reducing carbon emissions after a decade of relying on fossil fuels in the wake of the Fukushima nuclear disaster. Prime Minister Yoshihide Suga has joined the majority of developed nations in making a pledge of zero net emissions by 2050.

However, achieving this will mean a major shake-up in the energy sector as at present 88% of Japan’s energy comes from fossil fuels and almost all of that is imported. Japan’s geography also presents a unique challenge and in order to meet this target, it is likely that it will require deploying all available technologies, including imported hydrogen, nuclear power, and carbon capture and storage.

The Japanese monarchy is said to be the oldest continuous hereditary monarchy in the world. The Imperial House recognizes 126 monarchs beginning with the legendary Emperor Jimmu (traditionally dated to 11 February 660 BC) and continuing up to the current emperor. Since the Constitution of Japan, adopted in 1947, the Emperor’s role has been ceremonial and he has no powers related to government.

The slow and steady approach of the Japanese retail investor does indeed align with our own views on avoiding short-term noise in favour of long-term investing, while the policy shift towards cleaner sources of energy resonates with our positivity on the area and increased investment in the theme.

Asia Pacific

As mentioned previously in this month’s Commentary, retail investors are becoming an increasingly influential part of markets. Low interest rates mean that investors are working their way up the risk scale in an attempt to earn some sort of return on their savings. The issue of short-selling is not just isolated to the US and is a source of contention in parts of Asia.

In South Korea, short selling has become politicised, with the financial regulator under pressure to extend a ban that was put in place in March. The initial suspension was put in place for six months, amid significant outflows from foreign investors.

Since then, the KOSPI, Korea’s main index, has soared. From the end of March to the end of December 2020, the KOSPI rose by 67%, almost double that of the MSCI World Index. Health care stocks in particular have been a beneficiary of large retail inflows and there have been questions over whether a bubble is forming. It is, therefore, no surprise that retail investors are keen to take measures further, with more than 200,000 people signing a petition demanding the ban be made permanent.

While investors are likely to be thrilled with such gains in the short term, banning shorting has wider implications. The first is that a ban on shorting precludes Korea from being classified as a developed market by the index provider MSCI. With such a huge amount of capital tracking its indexes, there are definite advantages for inclusion of Korea’s stocks in the developed market index and it could potentially lead to lower borrowing costs for Korean businesses.

Equally, foreign investors may be less willing to invest in Korean businesses if they do not feel they can hedge their exposure appropriately by using short positions. Generally speaking, short positions help to stop stocks getting ahead of themselves and it is normally considered to be part of a healthy and well-functioning market.

Asia plays host to a whole range of autocracies, which tends to render large parts of the region uninvestable. Most recently, Myanmar’s military appears to have seized control of what was an extremely fragile democracy. While the West has tended to apply sanctions in the past, previous evidence suggests that such moves often have the greatest (negative) impact on the poorest communities.

The number of countries with short-selling restrictions in Asia has slowly been declining over the past two decades. South Korea and Indonesia are currently two major Asian nations with bans in place. We tend to have low levels of exposure to South Korea, with underlying fund managers often citing issues around complex ownership structures and governance generally.

Emerging Markets

Inflows remain strong in this area and the risk-on narrative remains dominant. A recovering China and the prospects for commodity markets have put emerging markets in a strong position and expectations are that investors will continue to add to allocations over the course of the year.

The Biden victory is seen as another general plus point and valuations are attractive enough for investors to be more comfortable adding exposure. Not all emerging market assets have found the start of 2021 so kind, however.

The US dollar has been stronger than expected and the prospect of US bond yields moving higher has put pressure on some emerging market bonds. Indeed, if US yields move out further it will create reluctance on the part of investors to seek yield in areas such as emerging markets and become an issue for both bonds and equities there.

Issuers of emerging market bonds have benefited from the world of ultra-low interest rates and buoyant liquidity, and a true test from the US bond market might prove difficult for some to pass. For now we are comfortable with both our bond and equities exposure, but to not acknowledge the risks of trend reversals would be unwise.

India – the world’s largest democracy with a population of almost 1.4 billion people – is having ‘issues’ at the moment with violent protests from farmers over reforms. Protestors are concerned that the liberalisation of the space will remove protections they have enjoyed for decades in the form of guaranteed prices and bargaining powers. The violence has been extreme and is a reminder of the difficulties attendant upon trying to execute deep reforms. The reform agenda is an important part of the investment case for India, so developments like this naturally make us pause and reflect. We are satisfied the overall investment thesis remains intact but will continue to question whether obstacles to growth are becoming more substantial.

Allocations to emerging markets remain unchanged for now – we will continue to consider the breakdown of the allocation for suitability and breadth.

Spotlight on: Healthcare

This month our spotlight focuses on healthcare, where we have been long-term investors. Changing global demographics put upward pressures on demand as people are living longer and emerging markets develop. This growing demand creates opportunities for healthcare companies for their products, particularly those that can offer governments efficiencies and cost savings, as healthcare spending continues to grow as a proportion of government spending.

It is not all about drugs and medicines, so while pharmaceuticals are a large part of the healthcare opportunity set, other areas such as medical devices and healthcare services are important. Medical devices can help improve treatment effectiveness or be used as a more efficient solution for some issues.

Healthcare services include areas such as distribution, facilities (including the provision of hospitals and doctors’ surgeries) and managed care (including care homes for elderly or vulnerable patients).

Technology is increasingly influencing the winners and losers within the sector. This does not just include advances in medicines, such as the speed of the various vaccination programmes, but also the increased role of analytics and big data. This can help demonstrate the effectiveness of treatments, enabling a cost/benefit analysis of products and providing greater insight into what provides the best outcomes. Technology is increasingly being used for procurement by governments or the large healthcare providers in the US.

Finally, a few companies have become a lot higher profile following Covid-19 vaccine development. While this is a product that is currently in huge demand, vaccine makers may not make much profit from this area. Both the Oxford/AstraZeneca and Johnson & Johnson have committed to a not-for-profit approach for the duration of the pandemic. Others, such as Moderna and the BioNTech/Pfizer, have a for-profit model and while these will be among their best-selling products this year, they are still a small part of these global businesses.

We have been positive on healthcare for a long time and continue to see great potential from this theme. This is not just from drugs, but from medical devices and increasing focus on providing more effective care. We are not trying to buy vaccine producers, which we do not see as hugely profitable, preferring to focus on the long-term demographic drivers of the asset class.

Fixed Income

Convertible bonds are a hybrid asset, where the owners are entitled to cash flows (as with any other bond) while also being provided with an option to convert the bond into a predetermined number of shares at a certain point in the future. The decision on whether to convert or not is predominantly driven by the share price of the issuing firm and this makes for interesting risk and reward characteristics.

The bond itself can provide a ‘floor’ in the value of a convertible, while the equity component provides a theoretically unlimited upside. Therefore, in difficult economic environments, convertibles can be expected to fall, but to a far lesser degree than equities, and in positive environments their upside is expected to be closer to that of the underlying equities.

The option for conversion attached to the bond is known as a ‘call option’ and its value is driven by a range of factors, such as time to expiration, interest rates and dividend yield on the underlying stock. The level of correlation between the convertible bond’s price and the underlying equity is heavily dependent on how close the bond is to being converted.

For issuers, convertibles can help to lower borrowing costs, with buyers of the bonds willing to accept a lower coupon in return for the option of being able to convert their bonds into shares and potentially capture long-term growth.

The market is often polarised, with growth areas such as technology and more cyclical areas such as transport businesses both well represented. Convertible bonds can prove unpopular among existing equity holders, as conversion leads to dilution of their ownership, owing to the fact that new shares are created. However, in March, buyers of convertible bonds helped to save ailing businesses such as cruise company Royal Caribbean.

War Bonds have helped nations to protect democracy over the years. Though unlikely to pass regulatory scrutiny by today’s standards, the eye-catching posters and catchy phrases such as ‘If you can’t enlist, invest’ and ‘Defend your country with dollars’ used by the US are certainly interesting case studies for modern day marketing experts.

We are looking to add a modest amount of convertible bond exposure to lower risk client portfolios. These assets provide something of a halfway house, allowing us to increase equity exposure but with a degree of downside protection.

Commodities

It does feel as if the doldrums in which the commodities space languished have now been left behind. The development of vaccines to remove Covid-19 from the forefront of investors’ minds has been a huge help in this area, which is geared very much to global growth. A resurgent China has already been sufficient to tempt many investors into metals and mining stocks, but other areas of the commodities complex have now staged a recovery as well.

Hopes are high for the oil sector, after it started to look uninvestable for some (the economic difficulties compounded by the prominence being enjoyed by ESG factors in markets). Improved crude prices and refining margins mean that earnings expectations for the largest producers are higher going into the results season.

It is worth bearing in mind that despite this recovery in prospects, the fall from grace in the sector has been swift and significant – Exxon, Chevron, Total, BP and Royal Dutch Shell are now trading at a combined market value only half that of Tesla, though this may of course say just as much about the ridiculousness of the latter’s valuation as anything else!

If progress can be made on cashflow generation, allocation of capital and resumption/reinstatement to previous levels of dividends, there is scope for continued gains here. ESG is a threat to the space – some assets will become ‘stranded’ either because certain projects are not viable at lower oil prices, or because sufficient numbers of investors feel they cannot invest in the sector.

That said it should not be forgotten that these oil majors are not just facing oblivion without taking action. Some are investing significant amounts of capital to put them in strong positions in the green energy space, and it must be remembered that we are not going to be able to run the global economy on clean energy alone for some time to come.

So even oil is joining in. However, other commodities not facing the unique challenges of the hydrocarbon industry are more obvious places to look when making a commodities investment that capitalises on the likely pick-up in global growth later this year and next. We are continuing to research across the whole complex but will only make a concerted move when we feel we have the right option to complement our existing macroeconomic views and portfolio holdings. Metals do look interesting.

Property

In March, the majority of diversified REITs made the prudent decision to cut their dividends. The move, combined with the heightened uncertainty over the impact of Covid-19, sent share prices tumbling. However, drastic times call for drastic measures and managers of REITs moved quickly to ensure long-term sustainability.

Ultimately, REIT dividends are underpinned by rents. Published rental collection numbers have been a key area of focus for investors. In the short term, there are vehicles that can and do operate with dividends in excess of their earnings, but it is not advisable over a prolonged period of time. We like to see dividends covered where possible.

As a reminder, in order to gain REIT status (and the tax benefits that come with it), the vehicle must pay out at least 90% of its income. Thankfully, we have seen strong rental collection numbers from the majority of REITs since March. More recently, rental collection seems to have stabilised at around 90% per quarter. Uncollected rents are likely to remain a source of debate for some time.

Some have already been written off, but most are subject to negotiation. Assuming these tenants remain in business, we favour the prospects of landlords in recouping these amounts, either through the courts or by devising an equitable solution for both parties.

With dividends lower than previously and rental collection close to normalising, most REITs are having to consider how they go about distributing enough cash to meet the aforementioned 90% threshold. There are two obvious routes for managers. The first is instating a progressive dividend policy, gradually returning to pre-pandemic levels once the uncertainty we continue to live with dissipates. The second is less of a commitment and, perhaps, more cautious and involves simply making one-off distributions to shareholders.

From a signalling perspective, increasing quarterly dividends is likely to be favoured by investors, although as we were reminded of in March, dividends are not sacrosanct.

What good is democracy if it cannot be conducted in beautiful surroundings?! Parliament House in Canberra, Australia, was completed in 1988, having taken seven years to build, at a cost of nearly $1bn. The building contains 4,700 rooms and its shape is based on two boomerangs. The Palace of the Parliament in Romania cost over three times as much and heating and lighting cost a staggering $6m per year – it was built by order of a communist dictator.

While the rebound in share prices of most REITs has been pleasing to see, there is still a long way to go before they get to the levels witnessed going into 2020. A number of REITs published positive updates in January and sentiment appears to be improving. We retain allocations for now and keep a watchful eye over our exposure to high street retail in particular.

Responsible Assets

The Nordic region is often held up as being streets ahead of most other Western nations when it comes to investing responsibly. However, Norway in particular has made vast sums of money from the extraction of oil over the years, helping it to amass the world’s largest sovereign wealth fund. As of July 2020, the Norway Government Pension Fund Global stood at an incredible $1.19tn.

The fund is colloquially known as the ‘oil fund’ and if it were to be split between Norway’s 5.3m citizens, each would enjoy a windfall in excess of $200,000.

Norway has undergone a significant PR push to highlight its green credentials. Statoil, their former state-owned oil company, has been involved in several high profile spillages and corruption cases. In 2018, the business rebranded to Equinor and has made a concerted effort to develop its renewable offering, though it still derives the majority of its revenues from oil. Despite its source of funding, the sovereign wealth fund has been very public in its condemnation of certain businesses and business practices. Indeed, they publish a list of businesses they exclude on ethical grounds.

The fund has also been taking a stance at a sectoral level and in January, the fund announced that it had sold its entire portfolio of companies focused on oil exploration and production. In 2019, their exposure to the sector was around $6bn and this has been sold down over a prolonged period. The terminology is key here and the fund has retained investments in integrated oil companies (i.e. those with activities along the supply chain). Indeed, Shell was the fund’s seventh largest equity holding at the end of last year.

Oil and gas exposure had been painful for the portfolio in 2020, causing losses of around $10bn. Perhaps they might not be so keen to divest if it was a key growth area! Ultimately, the fund cannot rewrite history, but it can try to invest responsibly and for the future.

Currency

Should/do currencies matter to investors? Currencies are a source of risk and therefore also of opportunity. Many of the UK stock market’s largest companies, for example, make a significant amount of income from sales denominated in foreign currency. This exposes holders of their shares that are denominated in sterling to any changes in currency rates. The shares become more desirable if sterling looks set to weaken. A stronger pound, in contrast, will reduce their attractiveness. However, a problem for investors who focus too much on the currency rather than the underlying asset is that currency swings can be aggressive and unexpected, and often in the opposite direction to what one hoped for!

Foreign exchange (FX) trading (currency) is around 25 times the volume of stock trading each day. Let that one sink in …

It is possible to buy protection from currency risk through hedging products; these are often crude and can be expensive. As with many of life’s uncertainties, the best cure for FX volatility on a portfolio of investments is a combination of time and diversification.

A burst of strength for one currency over another may reverse over an economic cycle. Some currencies appear structurally stronger than others, rising persistently over many cycles – sterling had a poor history in this respect throughout the twentieth century. International portfolio diversification can help reduce the risk of long-term sterling weakness, important if you have long-term liabilities overseas. So yes, currencies do matter.

UK Interest Rates

‘You can’t always get what you want’ – not perhaps traditional Bank of England wording (penned as it was by Messrs Jagger and Richards) but pertinent to the many millions of us with money in bank and building society accounts.

Given previous comments (and continuing concerns) that the Bank of England may yet take the base rate into negative territory, in their terms being ‘what we need’. Very low rates of return on cash are one thing – paying to have one’s cash kept safely quite another – more than 5% of all household deposits in the EU are in accounts with a negative rate of interest, and more than 25% of non-financial corporates likewise. The challenge for governments and central banks is to persuade consumers to spend their money, corporates to invest theirs. However, caution remains the watchword for now – if the cash starts flowing back, that will be good for economies but is also likely to bring about inflation. Be careful what you wish for.

The Monthly Market Commentary (MMC) is written and researched by Simon Gibson, Richard Smith, Scott Bradshaw, Jonathon Marchant and Lauren Wilson for clients and professional connections of Mattioli Woods, and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future. Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

The MMC will always be sent to you by the seventh working day of each month, usually sooner, is normally delivered via email, and is free of charge as the MMC is generally made available to clients who have assets under our management in excess of £200,000, and to all clients under our Discretionary Portfolio Management Service (DPM). Normally, the MMC costs £397 + VAT per annum. Professional advisers and their clients should contact us if they are interested in receiving a monthly copy.

Sources:

www.bbc.co.uk,

www.bloomberg.com,

Financial Express,

www.thedragonsblade.com,

www.express.co.uk,

www.pitstoppin.co.uk,

www.sibcyclinenews.com,

www.vr-12.com,

www.smalltalkbigresults.wordpress.com,

www.mmn.com,

www.avantida.com,

www.plazmedia.com,

www.viewzone.com,

www.anonw.wordpress.com.

All other sources quoted if used directly; except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.