United Kingdom - January 2023

2022 is behind us, and many will say good riddance; now it is the excitement/uncertainty of a new year ahead. Our theme this month is resilience, the definition for which is ‘the capacity to withstand or to recover quickly from difficulties’ and we wonder how resilient investors will be over the next 12 months, or the extent that they will need to be? Huge resilience has been shown since the Covid-19 pandemic first hit (nearly three years ago!) and yet the threats of higher inflation, higher borrowing costs and recession hover over us, especially for UK investors, residents and taxpayers. The words ‘adapting’ and ‘courage’ can easily be linked – starting with the latter first, having the courage to invest when things look at their worst is a great attribute for an investor.

Having courage is not about blindly/irrationally following a dogma; it is about recognising that there is a time to act, and often it is when others are pursuing the alternative, a particularly attractive time for the investor/asset manager who can foresee a tipping point. Being slightly early into a market/asset when value for money presents itself (or even better just a little late) and slightly early to sell the same asset when pricing is untenably high is nirvana. Timing these moments perfectly is a mug’s game. However, this is where matching with adaptability is valuable. Being prepared to adapt ones thinking/portfolio is vital – though too many changes too often can be even more damaging than not changing at all. So, resilience, with the courage to act on one’s convictions, when matched with agility, can pay dividends.

And on the subject of dividends, there is lots of noise about the value of UK dividends and indeed US earnings supporting prices there; a word or two of caution – thus far, high inflation and rising interest rates have been accompanied by (differing levels of) economic growth. If we do see recessions, and longer ones than many are used to in the last decade or two, corporate profits, in some sectors in particular, will come under pressure. We like income as part of the total return that many assets offer, and we are certainly not against owning good companies with quality, sustainable earnings – it is just that not every company is as attractive, in the same way that while everyone can dance, few get close to the sublimity of Fred Astaire. It may soon be time to step back on to the dance floor, as long as the music is right and it is not too crowded. Happy New Year to you and yours – here’s to 2023.

Term or word(s) to watch general strike. While still more possible than probable, we would caution against believing we have had the worst of the winter, either from a weather or ‘disruption’ perspective. The last time there was a general strike in the UK, the unions were all powerful, and around 1.5 million workers downed tools – it was May 1926. However, in December 2022, the same number were on strike in the UK, but to much less effect. As we enter a new year, the rumblings of discontent are louder, the backbones of the strike leaders straighter, and the Government seemingly intransigent on the main issues. Now, while this paragraph could be out of date before it is read, such is the pace of things these days, just watch for an extension or expansion of existing strike action, hope against it, and also hope for a warm winter/spring.

The flip side is that with wage rises at price inflation levels, consumption and spending are maintained/encouraged, which should help to at least dampen recessionary forces. Further, higher wages should fuel a more sustainable recovery in due course, and happier workers offer the prospect of improved productivity, a significant issue facing the Government, and one we will no doubt come back to in further editions.

North America - January 2023

So, what will the New Year bring? Certainly, there is a lot of hope around after a difficult 2022 but as we have written before investors may have to wait before being rewarded.

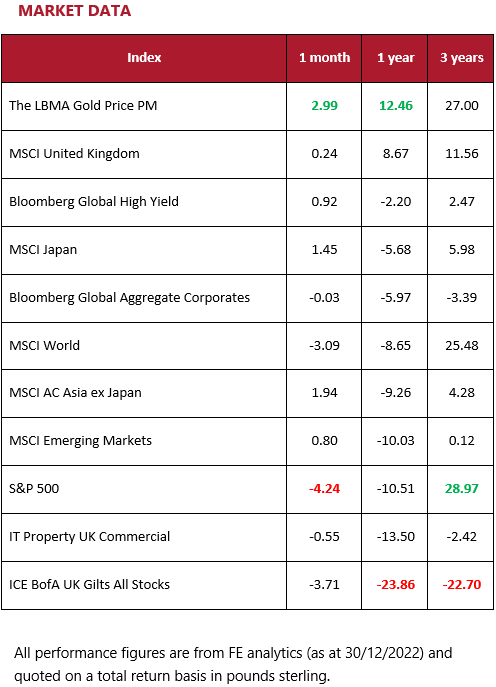

Is the market really that cheap yet? Frankly, no. If we say the US market is trading on 18x earnings (based on the S&P 500), that is much reduced from previous levels after the falls of last year, but it is not at a level where one would typically see a bottom forming. In previous cycles this has been more in the region of 12-14x. Of course, no two cycles are exactly the same but beware the perils of suggesting that ‘this time it’s different’. If we are going to get to that sort of level, there are clearly meaningful falls ahead before one wants to add to US equities, or indeed most others.

Given the yield on Treasuries, the equity risk premium, the excess of the earnings yield over the risk free rate, is just not at the level we would usually see when markets are approaching the point of rebound after a recession. And on that note, markets usually make a definitive turn for the better when we are a significant way into a recession which does not yet appear to be the case in the US. Those Federal Reserve rate rises will make their way through the system and may cause a lot more reckoning as the first few quarters of 2023 develop and it really does just feel ‘too early’. Certainly, for the first half of the year, it would not be a surprise to see a continuation of some of the trends we saw in 2022 – with more defensive sectors like utilities and consumer staples continuing to garner investor interest while the structural challenges of the energy markets provide more momentum in that space.

On a longer-term view, a good case can be made for the US equity space. Once more attractive valuations establish themselves after a period of economic pain has endured, the attractions are certainly there. Betting against the US has not been a successful strategy over many periods – it is just that we chose to not participate as fully as we might have done when valuations were at quite ridiculous levels. But we are opportunistic, and it may be that the time to increase allocations will arrive at some point soon.

The US officially recognised resilience in its 2017 National Security Strategy. It addresses how the country responds to deliberate attacks, accidents and natural disasters, as well as unconventional stresses, shocks and threats to their economy and democratic system. Given the state of the world at the moment, the doctrine is as important as ever.

For now, we maintain our exposure predominantly through themes and our overall US allocation is below that of most peers. This looks sensible against the current market and economic backdrop and remember of course that we have protective and dry powder assets to deploy when we see fit.

Europe - January 2023

Though it has been ugly at times, there is something of a collective sigh of relief from many that things did not turn out much worse for the European region last year. The effects of the Ukraine–Russia war and the ensuing energy crisis could have meant much worse losses for equity investors, but it might be a little too early to get complacent. Many experts are already warning that it is next winter rather than this one when the real energy problems will begin for many European countries. Gas storage supplies were secured this year but a long-term solution is needed with demand reduction and the securing of new supply both likely to be needed this year.

For many exporters in Europe the success or otherwise of China’s reopening is going to be very important to prospects this year and they will need to benefit from the increased demand to offset any additional inflationary forces which are generated from the post Covid reawakening. There is also the non-trivial risk of further escalation of the Ukraine-Russia conflict which would further batter sentiment towards European equities. Of course, proximity to the conflict does not necessarily mean European companies are going to be more affected than those elsewhere, but investors will probably seek out alternative opportunities on any material deterioration of news flow.

Let’s not forget about the ECB’s more hawkish stance on rates too. We are familiar with reading about how the tight US labour market means rate rises there will have to be aggressive and sustained to control inflation. But the labour situation is not dissimilar in parts of Europe either – with the problem being especially acute in Germany, interest making one wonder what a monetary policy geared to the situation in that country will do in terms of impact on others such as Italy with their ‘precarious’ government debt situation? We shall perhaps see, as 2023 unfolds.

The Recovery & Resilience Facility was set up by the European Commission to mitigate the effects of the Coronavirus pandemic and make European economies and societies more sustainable and resilient to deal with the digital and green transition. Hopefully the Covid-19 related provisions of the Facility will not be required as much this year.

It is definitely a time to tread carefully in many sectors at the moment, but Europe still looks like having major vulnerabilities not only to a generalised economic downturn which now appears to be unfolding, but also the idiosyncratic risks which are swirling around the globe. Our allocations remain modest and in the event of our adding equity risk in 2023, there are likely to be other regions and ideas staking a superior claim to receive funds.

Rest of the world - January 2023

The most significant economic news over the last month has been the easing of China’s Covid-19 policies, as the country begins to move away from its ‘zero-Covid’ policy of lockdowns and containment, to one where the country lives with the virus. This includes easing restriction on domestic travel and seemingly an end to local lockdowns unless an area is deemed to be high risk.

Generally, this is positive news for Asia’s largest economy and should help release stress seen in some supply chains however, this will take some time to feed through into the global economy and even then, China might not be able to return to the single high digit growth GDP figures seen in the years prior to the pandemic. Over the next few months, it is likely we will see more outbreaks in China as the country transitions to living with the virus, particularly with a low vaccination rate amongst older citizens. While less disruptive than regional lockdowns, this will still be disruptive and a bumpy start to the year can be expected.

The Chinese property market also remains a potential source of concern, with many developers overleveraged and the affordability of housing being an issue in some cities. This marks the tailing of the urbanisation trend we have seen over the last two decades and it will be more difficult to keep building new cities and infrastructure which has been a key driver of growth.

Elsewhere, Japan’s November inflation rate of 3.7% is the fastest pace seen in over 40 years. Most is still from the supply side, with food prices a notable component, rather than being demand led. The weak yen is also contributing, with the Bank of Japan’s interest rate policy remaining an outlier against rising rates around the world. For Japanese corporates this remains a double edged sword. While around 35% of Japanese company manufacturing is done overseas, pressures on rising wages at home are increasing at a time of global recession, amplified by Japan’s challenges of a tight labour force given its ageing population and reluctance to allow immigration. The Central Bank will need to be watched closely, particularly with a new governor incoming, if Japan is to achieve it’s 2% inflation target once the supply side effects of inflation are passed through.

While Chinese equities do look cheap relative to their history, the issues around the property and economic adjustment to living with Covid means we have not restored our direct exposure to the region just yet. We have been constructive on Japan for many years but are not complacent here. We believe our allocations remain appropriate for now.

Commodities - January 2023

A combination of falling prices, higher levels of taxation and a more difficult funding environment has conspired to make life difficult for North Sea oil and gas producers. While there is not a great deal the industry can do about the former, the latter two points are becoming a flashpoint for tensions within the sector. On the tax front, several firms have stated their intentions to move away from UK production, on the grounds that the tax system is too onerous to make projects economically viable. The industry makes a compelling argument that recent measures have done yet more to weaken energy security in the UK and the number of bidders on new licenses later this year will be telling.

According to industry group, Brindex, London-listed North Sea producers rely on around £14 billion of borrowing from financial institutions. Those institutions lend according to reserves at a particular field and the viability of a project. Clearly, a harsher tax environment makes borrowing more difficult.

A further complication is the drive by shareholders of banks to reduce the level of fossil fuel funding. In December, HSBC announced they will stop financing new oil and gas fields. The move follows criticism around the £6.4 billion of exposure the bank had to new oil and gas projects in 2021, globally.

Unfortunately, Russia’s invasion of Ukraine has highlighted a lack of resilience in the energy mix of countries around the world. While domestic renewable production is certainly helpful, without the appropriate battery infrastructure, resilience remains lacking. However, the long-term trajectory is clear and we are excited by the potential for progress.

For oil and gas firms, the potential for scarce funding opportunities in the future is a concern. However, in the short term, many of these companies are bolstered by significant cash piles. Though prices have come in a little, breakeven costs on a range of projects remains a long way off and cash flow generation is strong. Trading on such a low rating, we think many of these risks are factored in and retain exposure to global energy producers, for clients with higher risk tolerance.

Fixed income - January 2023

2022 was a year to forget for fixed income investors. Higher inflation was combatted with higher interest rates, diminishing the relative attractiveness on low yielding fixed income and leading to a significant sell off. However, for investors with dry powder, the selloff has presented a potential opportunity. Indeed, yields on the broad-based Bloomberg Global Aggregate index have climbed from 1.3% at the start of the year to c.4% by the year end.

With so many investors concerned by the potential for further falls in equities, increasing numbers are turning to fixed income, with its potential to offer a greater deal of insulation from risk asset sell-offs. Indeed, part of the case for fixed income is predicated on the idea that bonds and equities display negative correlation over prolonged periods. That is to say that when equities fall in value, bonds should rise and vice versa. This collective ‘wisdom’ was undermined in 2022, with both asset classes falling in tandem, leaving investors with few places to hide. That is to say that traditional bond and equity portfolios failed to deliver the resilience of years gone by.

The sector has the potential to deliver material news flow over the next year. Will issuance fall, as a result of companies avoiding more expensive debt funding? For those in need of funding, will defaults pick up as higher interest costs start to bite? Will the Bank of Japan continue to pursue a more hawkish approach? What opportunities does the potential for a weaker US dollar present for the year ahead? We look forward to discussing these topics and more in 2023.

The higher yields referenced led us to increase our exposure to the space, during the month of December. We particularly like the risk/reward profile of investment grade bonds and increased exposure at the expense of cash, for Balance and Growth investors.

Responsible assets - January 2023

Over 2022 the priority of many governments became that of energy security, an understandable prerogative in the face of an energy crisis. The insecurity of energy supply chains overshadowed the urgency of the energy transition last year and may have led to the perception that the investment industry is waning in the commitment to fight climate change. Indeed, on the surface, news flow from COP27, the UN climate summit in Sharm El-Sheikh, Egypt was disappointing. There was no bold commitment on any ambitious targets such as phasing out all fossil fuels and having global emissions peak by 2025. In fact, most countries repeated the ‘phase-down-of-coal’ phrase featured in last year’s agreement at COP26 in Glasgow. While it is true that there were no headline-grabbing targets, the gap in funding for the energy transition was much discussed in fact, it was a challenge to pass a day at COP27 without discussing finance. Main news outlets eschewed reporting this given that it is an area with significant complexity – it is hard to generate a snappy and exciting piece of writing around funding (try as we might).

During COP27, there was much attention on the need for structural reform of the financial system. For us as investors, our ears pricked up when we heard that US$4 to $6 trillion a year needs to be invested in renewable energy until 2030 – including investments in technology and infrastructure – to allow us to reach net-zero emissions by 2050. This offers an incredible opportunity for investors as the need for corporations to assist in the energy transition is greater than ever. States are turning more to technology for instance, two United Nations (UN) bodies, the Technology Executive Committee and Climate Technology Centre and Network announced plans to accelerate the deployment of ‘transformative’ technologies to counter the climate crisis. We do not anticipate that 2023 will be plain sailing after a turbulent 2022 but we do believe many innovate climate-solutions providers are relatively well placed in a cyclical downturn thanks to the tailwind of decarbonisation and support from the UN and global governments.

Climate resilience – the ability to anticipate, prepare for, and respond to hazardous events, trends, or disturbances related to climate – has become an essential component of any comprehensive climate action program for governments, companies and individuals across the globe. Improving climate resilience involves assessing how climate change will create new, or alter current, climate-related risks, and taking steps to better cope with these risks.

Although we continue to invest in traditional sources given our view that the energy transition is a multi-decade process, we continue to ensure the inclusion of companies facilitating the shift to clean energy within portfolios. Over the long term, we need to be emitting much less carbon than we are today and for this to happen investment in cleaner fuel sources will need to ramp up materially over the next few years.

Insurance - January 2023

As you may know, one of our key long-term thematic equity ideas is global insurance. Within core portfolios, we invest primarily in non-life insurers viewing the space as a relatively defensive play as insurance is generally considered a non-discretionary spend. This thesis played out well over 2022 as, though the MSCI World Index returned -7.83% (in sterling terms) over the year, our holding in global insurance delivered 24.26% over the same period.

The companies held within the space showed continued solid premium growth, underlying margin expansion as well as an early benefit from the rise in bond yields through increasing investment income. The catastrophe insurance space was the most challenged as we faced a number of natural disasters, most notably from the destructive Category 4, Hurricane Ian, which struck Cuba and the southeast of the United States. We have only a small exposure to catastrophe insurance and do not have an appetite to increase this as 2022 was the sixth consecutive year of elevated catastrophes.

When Hurricane Ian tore through the state of Florida last autumn, resilient design turned a 450,000-SF food distribution centre into a bastion of safety.

While adjacent buildings were completely destroyed, the centre stood strong thanks to a hardened envelope, reinforced mechanical systems, blast-resistant openings, and full backup power.

Underwriting profits tend to be more important than premium growth in terms of performance of the sector and our optimistic outlook continues into the first quarter of 2023. Rising information and interest rates are positive for the insurance companies held within the portfolio. At present, insurance looks to be in a ‘sweet spot’ as it is rare to have well-established underwriting profitability, that may well improve further, coinciding with a significant rise in investment returns thanks to higher interest rates

The Monthly Market Commentary (MMC) is written and researched by Simon Gibson, Richard Smith, Scott Bradshaw, Jonathon Marchant and Lauren Wilson for clients and professional connections of Mattioli Woods and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future. Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

The MMC will always be sent to you by the seventh working day of each month, usually sooner, is normally delivered via email, and is free of charge as the MMC is generally made available to clients who have assets under our management in excess of £200,000, and to all clients under our Discretionary Portfolio Management Service (DPM). Normally, the MMC costs £397 + VAT per annum. Professional advisers and their clients should contact us if they are interested in receiving a monthly copy.

Sources: All other sources quoted if used directly; except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.