Global markets summary - June 2024

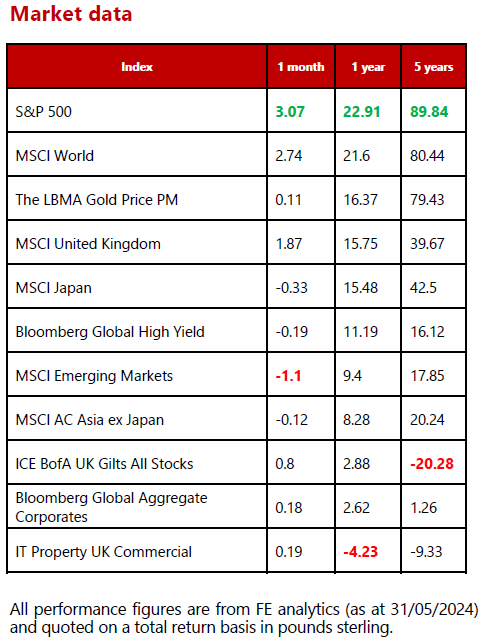

Following a challenging April, the sun shone on both equities and bonds over the month of May with most major markets delivering positive returns. Despite the surprise early announcement of a general election, UK smaller companies staged a particularly impressive recovery as sentiment towards UK equity markets continues to improve. Towards the end of the month, downward revision to US economic growth data increased the likelihood that the Federal Reserve (Fed) may cut interest rates at least once before the end of this year, lending some support to risk appetite globally.

Year to date, US markets are still leading the pack, having returned over 11% (in £ terms) thanks to strong corporate earnings and continued consumer resilience. Despite tentative optimism around the outlook for China, developed markets have continued to outperform their emerging peers with the main UK large cap market and the Euro Stoxx delivering 10.37% and 9.82%, respectively. Government bonds have fared less well over the period as interest rates have remained at elevated levels with expectations for cuts pushed out further in comparison to projections at the end of 2023.

Purchasing Managers’ Index (PMI) figures from across developed markets indicate a recovery across the US, Europe, and the UK but uncertainty around the outlook for interest rates still looms large in investorsʼ minds. Over the past few months, monetary policy divergence between the European Central Bank (ECB) and US Federal Reserve (Fed) has been the leading narrative. The ECB all but promised a June rate cut in recent communications while the Fed officials have continued to highlight the need for patience and being guided by the economic data. However, towards the end of the month, investors had to navigate a curveball as hotter-than-expected eurozone inflation increased uncertainty about policy easing beyond June, while weaker growth figures from the US sparked expectations of at least one Fed interest rate cut by the end of the year.

Over the first half of 2024, the macroeconomic outlook has brightened thanks to continued economic resilience, the prospect of rate cuts in the second part of the year and early signs of a positive inflection in the global manufacturing cycle. However, despite these optimistic indications, uncertainty remains elevated. There are still a multitude of economic, environmental, political, and geopolitical risks lurking which could lead to volatility ahead. Given these risks, maintaining a well-diversified portfolio with strict risk controls is more important than ever.

United Kingdom - June 2024

UK equities recorded another positive month in May, with the MSCI United Kingdom All Cap Index rising by 2.43%. It was a much stronger month for mid and small cap businesses, as sentiment towards UK equity markets continues to improve, aided by a rejuvenated primary market.

As a reminder, the primary market refers to the issuance of new shares, either by companies listing on the stock market or those looking to raise capital. Higher interest rates and a lack of interest in UK equities precipitated a fallow period for primary market activity, but now green shoots are emerging.

News that several companies from a range of different sectors are considering listing on the UK market is welcomed. One of which includes fast fashion giant Shein, whose potential £50 billion initial public offering (IPO) would see it become the twelfth largest business in the UK index. Equally, National Gridʼs plan to raise £7 billion to help grow its electricity networks business across the UK and US suggested a renewed confidence in markets. Even with these deals yet to complete, London remains a long way ahead of European counterparts in terms of capital raised so far this year.

Interestingly, we have seen several large investment banks turn more positive on UK equities and this was also reflected in the Bank of America global fund manager survey, which polls over 200 asset managers, and pointed to a rotation into UK stocks. This improved sentiment is partly driven by the scale of takeover activity, which is at its highest level since 2018. Deals are occurring across the market cap spectrum and in a variety of sectors, helping to highlight the valuation opportunity.

While the UK market has hit record highs over the past month, the market continues to trade at the steepest discount to US equities for decades. We see significant value in the UK, with particular focus on the mid cap and continue to position our UK Dynamic fund accordingly.

North America - June 2024

Last month, we asked if the US market had lost its ‘mojoʼ amid a weaker month for the region. Over May, the market (at least temporarily) silenced the naysayers by once again finding its groove. Over the month, US shares posted strong gains, supported by some robust corporate earnings as well as hopes that interest rate cuts are still on the way later this year.

Technology stocks performed poorly in April amid worries that the Federal Reserve (Fed) would be forced to hold interest rates higher for longer, with murmurs that another raise was not off the table. However, strong earnings reports from Alphabet, Apple, Microsoft, and NVIDIA helped push the sector higher in May. In addition, stock buybacks from Alphabet and Apple, and the announcement of a stock split from NVIDIA also boosted momentum. Overall, Q1 2024 was a solid quarter for earnings results, outperforming long-term averages. At the end of May, 96% of S&P 500 firms had reported first quarter financial results with 78% of reporting firms posting earnings above estimates, which, according to data from FactSet, beat the five-year (77%) and ten-year averages (74%).

Data released in the month showed inflation remaining sticky at levels above the Fedʼs 2% target. Fed chair Jay Powell acquiesced that recent progress has been limited in terms of bringing inflation down but noted that interest rate rises were unlikely. Elsewhere, there were some signs of moderation in the US economy with non-farm payrolls data showing that 175,000 jobs were added in April which was below consensus expectations.

Economic growth for the remainder of this year will depend on several factors, in particular, the pace of job growth, inflation, and actions of the Federal Reserve. The good news is that the US economy is growing, inflation is moderating, and overall fundamentals look fine as increased consumer spending supports underlying momentum.

Our decision to use softer share prices over April as an opportunity to marginally increase exposure to the US equity allocation within core portfolios was rewarded in May. We maintain a positive view on US equities as we believe beneficiaries of the enthusiasm around artificial intelligence (AI) can still gain while earnings growth looks robust.

Europe - June 2024

Eurozone stocks enjoyed a strong month with shares advancing over May, led by the real estate and utilities sectors. These sectors drew support from the widely expected interest rate cut at the European Central Bank (ECB) meeting in June. Energy and consumer discretionary sectors lagged as lower oil prices weighed on the energy sector while the latter was marred by weakness among luxury goods and automotive stocks.

Long awaited ‘green shootsʼ are now emerging across the eurozone economy as PMI data released during the month confirmed that economic activity is improving. Services sectors continue to act as the key pillar of strength, although there were also tentative signs of a recovery in manufacturing. First quarter gross domestic product (GDP) was confirmed at 0.3% quarter-over-quarter, and corporate profits surprised to the upside. The reacceleration in the economy, coupled with relatively low valuations, is starting to attract the attention of international investors.

There are of course still risks on the horizon; the narrative around moderating inflation across the bloc was challenged by data showing that eurozone annual inflation, as measured by the consumer price index, increased to 2.6% in May from 2.4% in April. Nevertheless, investors continue to expect a 0.25% rate cut when the ECB next meets on 6 June. However, the new data prompts uncertainty around the timing of further rate cuts.

Within core portfolios we retain a neutral position towards European equities. While we continue to believe it is a little too early in the market cycle to move to an overweight position, we are poised to take action when the time is right.

Rest of the world - June 2024

Japanese equities enjoyed renewed investor enthusiasm early in the year but the persistently weak Japanese yen and conservative earnings guidance from companies for this fiscal year has caused this to cool. This caution has influenced trading volumes and price movements across sectors with the region being one of the weakest performers over May. While currency weakness is usually received positively by the export-heavy equity market, the extremely low levels of the Japanese yen is now starting to weigh on consumer sentiment. There was a wide disparity in terms of underlying sector performance over the month, with weakness in large-cap technology, automotives and domestic-oriented retailers while the financial sector outperformed, driven by the rise in long-term interest rates in Japan.

Emerging market equities continued to lag developed markets over May, in line with the prevailing trend of the past few years. Lower energy prices weighed on some of the Middle Eastern markets while Brazil ended the month in negative territory following flooding in the southern state of Rio Grande do Sul.

There were, however, some areas of note. Asian technology companies rose towards the end of May following blockbuster earnings results from US chip-maker NVIDIA. There are also some encouraging signs of improvement across Asian economies, albeit with some caveats. Chinese data is generally surprising to the upside, which has also coincided with a rebound in the equity market. Despite this improving optimism, the details of the recovery are less convincing as continued weakness in domestic demand necessitates a reliance on strong export growth. Challenges in the real estate sector remain unresolved, creating some doubts about the sustainability of the Chinese stock market rally. We continue to believe it is premature to proclaim an economic turnaround in the region.

Indiaʼs stocks surged to a record high, while the rupee and sovereign bonds climbed after exit polls signalled an emphatic victory for Prime Minister Narendra Modiʼs ruling party. However, while Mexicoʼs elections also produced a clear winner, the market impact was less positive. The peso slid as preliminary results showed the ruling party winning in a landslide that could empower it to increase state control of the economy and undermine checks on its power.

We maintain a measured exposure to broad Asia Pacific and emerging market equities as well as specific exposure to Japanese companies across portfolios. For now, we remain neutral in terms of our positioning to these areas versus peers. We believe that the outlook for emerging markets remains mixed, with more short-term headwinds on the horizon when compared with developed peers.

Fixed income - June 2024

Bucking the prevailing year to date trend, government bonds broadly outperformed corporate credit in May. After negative total returns in Q1 and in April, the US Treasury asset class recovered modestly returning 1.45% to pound based investors over May. The movement was driven by softer US economic data with the April inflation report showing a modest deceleration, as expected, with moderation in shelter and other core services.

UK government debt also had a more positive month despite the announcement of an imminent general election. It is unlikely that we will experience a repeat of the UK government bond collapse of 2022, in fact an early election means there will be no final ‘give awayʼ budget from the Government, which should assuage the gilt market.

Renewed confidence in the US central bank lowering interest rates later this year supported credit markets. Demand for corporate bonds from investors remains very solid and recent large issuance has been taken up well. While we prefer corporate debt at present, we are cognisant that valuations are not compelling overall and remain mindful that corporate balance sheets will come under pressure the longer rates remain elevated.

Divergent monetary policy across major central banks and uncertainty around the future path of interest rates is likely to remain a source of volatility for government bond markets for some time. However, it is key to note that the pain of the past two years which reset yields to more attractive levels means that bondsʼ dual role in a portfolio – income and diversification against a growth shock – has been restored, even if yields look set to remain reactive to economic data.

While we continue to see value in maintaining a balanced allocation to fixed income across most portfolios, we are now moderately underweight to the asset classes compared to peers. We maintain a slightly negative outlook on longer dated government debt, preferring short-term government bonds for income as interest rates stay higher for longer.

Ask us anything - June 2024

Q: Why did so many economists think the US economy would go into recession? Why has it been so strong, and will this continue?

A: The potential for the US economy to face recession was a popular talking point at the end of 2022. Although timing and severity varied, a number of economists pencilled in a recession in their forecasts for 2023, alongside a selloff in US equities. This of course, very famously, did not happen, leaving several high-profile economists feeling like Michael Fish in 1987, except that after battening down the hatches, the storm they forewarned of, never appeared.

The forecast was built on solid economic theory; historically, when inflation is high and central banks are raising interest rates rapidly, an economy ultimately caves under the weight of higher interest rates resulting in a downturn or recession. Market pricing also pointed strongly towards a recession. The part of the Treasury yield curve that plots two-year and ten-year yields had been continuously inverted – meaning that short-term bonds yield more than longer ones – since early July 2022. The so-called inverted yield curve has been a reliable recession predictor in data going all the way back to 1959.

So, why was this time different? There is no simple answer instead, we must consider the influence of several factors. Firstly, like all other major economies around the world, the US scrambled to buoy the economy from the effects of the Covid-19 pandemic. In March 2020, Congress passed a $2.2 trillion economic stimulus bill that sent cash directly into the pockets of American workers, families, and businesses. Two more pieces of legislation followed to keep small businesses afloat, and workforces employed. This was the largest influx of federal money into the US economy in history. Some $5 trillion flowed to everyone from individuals making an extra $600 in weekly unemployment benefits to state and local transit agencies strapped for cash without commuters. During this period, consumers were limited in terms of where they could spend this windfall of cash and as such savings levels increased, this became known as ‘the Covid piggybankʼ. These excess savings played a role in supporting the overall financial health of American households even as interest rates rose allowing consumer spending, a major driver of the US economy, to remain robust over the past two years.

There were other tailwinds for US consumers helping them maintain robust spending levels. For example, the labour market has been very strong over the past few years. The unemployment rate has dropped to near-historic lows, employment levels are at an all-time high, wages have grown beyond historical averages, and monthly job gains have regularly exceeded 200,000.

Corporate America too, was well armoured as the pandemic hit; corporate debt-service burdens had never been lower, and the banking system had never been as well capitalised or as liquid. The housing market was (and still is) underbuilt while in the past, it has generally been overbuilt going into a recession.

Looking ahead, there are many reasons to remain positive on the US economy and equity market despite the volatility that comes with an election year. A continuing strong labour market could help consumers maintain spending patterns like those observed recently, even without pandemic-era savings. In addition, many households saw notable gains in their equity and other asset holdings over 2023.

Another important point is that immigration has been much stronger than expected. The Congressional Budget Office now estimates that net immigration last year was 3.3 million, more than triple the previous estimate of 1 million. New immigrants have increased the supply of workers which in turn has raised production capacity, closed some gaps in the labour market and allowed the economy to generate jobs without overheating and re- accelerating inflation. The issue is, however, very politically charged, and likely to be a talking point in the run up to this yearʼs presidential election.

Overall, the foundations of the US economy continue to look strong. While credit conditions such as interest rates and lending standards are limiting consumer spending, consumer balance sheets and debt service levels remain in good shape. In terms of consumer debt, overall delinquency rates are below the 4.7% registered during the pre-pandemic fourth quarter of 2019. Although the upcoming election is likely to add volatility to the stock market, we view this as an opportunity rather than a fundamental concern.

If there is a question you would like to pose to our team, please reply to this email or write to

investments@mattioliwoods.com.

The Monthly Market Commentary (MMC) is written and researched by Scott Bradshaw, Lauren Hyslop and Jonathon Marchant for clients and professional connections of Mattioli Woods and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investorʼs circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future.

Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

Sources: All other sources quoted if used directly, except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.