Global markets summary - July 2024

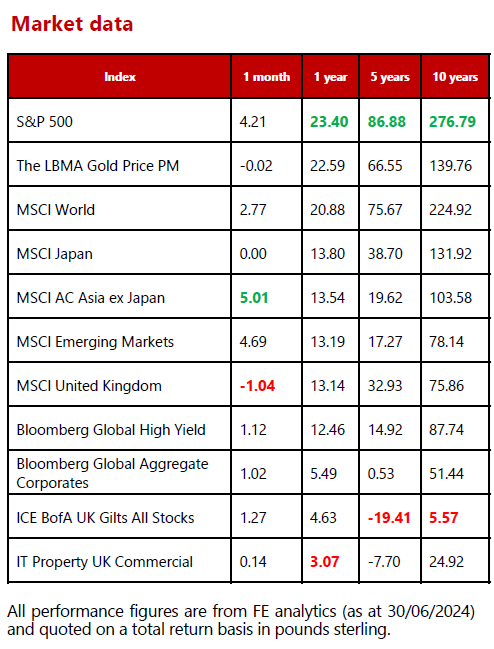

Despite a few geopolitical surprises, June rounded off an overall positive second quarter for the majority of equity markets. The US market continued its ascent over the month with the S&P 500 index reaching record levels. European markets were more mixed as investors displayed a degree of caution following French President Macronʼs call for a snap election. Similarly, UK markets were muted ahead of the upcoming election taking place on 4 July.

Japanese equities endured some volatility early in the month but stabilised towards the end, driven by semiconductor stock rebounds, dividend reinvestment and positive sentiment regarding the performance of US equities. Asia ex-Japan equites also enjoyed a positive month as strong performance from the artificial intelligence exposed Taiwanese stock market elevated the regionʼs markets.

It was generally a good month for most fixed income assets. US treasuries were supported by revived interest rate cut expectations following signs of a cooling US economy, while somewhat improved investor sentiment and equity gains supported the performance of corporate debt.

A relatively supportive earnings season and benign economic data, together with the prospect of rate cuts, lead us to remain comfortable taking equity risk. As such, we maintain our positive stance on global equities, continuing to favour developed markets. We retain an overall neutral stance on fixed income, with portfolios having exposure to a broad spread of government and corporate bonds. We are still negative on alternative assets, viewing fixed income as a more attractive means of diversification given the higher yields currently on offer. We do, however, retain a small holding in physical gold as a hedge for geopolitical turmoil.

United Kingdom - July 2024

Having enjoyed strong momentum since February, June marked a slower month for UK equities, with the MSCI United Kingdom All Cap declining by 1.35%. Economic data continues to show strength, indeed UK GDP data for the first quarter of 2024 was revised up from 0.1% to 0.7%. While this does not sound like a lot, it made the UK the fastest growing economy in the G7.

With inflation seemingly under control and the UK economy in decent shape, the next government appears to be taking the reins at a reasonable time. While the pollsters, bookies and commentators all appear to agree that we are heading for a Labour government, it is more about the size of their majority.

When we look at the long-term polling data, the Conservatives entered Covid-19 with very strong public support. Since April 2020, their majority has eroded, with scandals around lockdown parties, conflicts around Brexit, the ‘mini budgetʼ and several changes in leadership, causing support to collapse.

Where we tend to see volatility around elections is when there is a wide range of potential outcomes. Clearly, the ideological differences between Johnson and Corbyn at the last election were far greater than between Sunak and Starmer. With the country moving from centre right to centre left, we are not expecting significant upheaval.

From a personal finance perspective, Labour has committed to not raising income tax, National Insurance or VAT and the manifesto appears relatively benign. Clearly, what parties say ahead of elections and what they do in government can be very different. However, we do not have significant concerns around the implications of a Labour government at the current point in time.

From an investment perspective, financial markets are forward-looking in nature and are likely to be pricing in a Labour victory. With a limited budget and taxes already at historic highs, it is difficult for them to implement major policy change. This helps to reduce uncertainty and give businesses and investors more confidence in the path ahead.

Generally speaking, small and mid-cap companies stand to benefit most from that increased confidence and certainty. In terms of sectors, housebuilders and building materials companies stand to benefit from Labourʼs plans to build 1.5 million houses within the next five years.

We have not made any changes to our UK allocations ahead of the election, given we are comfortable with the range of outcomes. Within the UK Dynamic Fund, we have strong mid-cap representation and exposure to building materials. We continue to see value in UK equities relative to global peers and a period of political uncertainty could help sentiment.

North America - July 2024

June was another strong month for the US equity market, with the S&P 500 Index hitting fresh highs over the period. In continuation of the trend we saw last year, technology companies have driven the lionʼs share of these returns. Over the second quarter of 2024, six out of eleven sectors in the S&P 500 lost market value, showcasing some record-low breadth for a market at record highs. The current valuation gap between value and growth stocks today is relatively wide, which indicates that there could be stored upside in value stocks. Reflecting this view, we have added a small US value position within portfolios to complement our core, growth- tilted exposure.

While we believe the equity market rally is likely to widen when there is greater clarity around the interest rate outlook, we continue to see potential in the largest US companies. The remarkable performance from these companies is well-founded on superior earnings growth and robust business models, with further support provided by share buybacks. In our view, US technology companies could have more to offer as their still-strong earnings profile means many of the top stocks are not necessarily expensive relative to their growth prospects. We do, however, believe that a selective approach and a focus on quality will be paramount.

In terms of interest rate expectations, for most of this year, the US economy has been ‘too strongʼ with inflation surprises on the top side, resulting in fading hopes for Federal Reserve (Fed) rate cuts. These hopes were revived as data released in June indicated that the US economy has now slowed a touch. May inflation data came in softer than anticipated and consumers are set to lose the shield of savings they built up during the pandemic. While the labour market reports for June looked hotter than the Fed would like, there are signs that it is easing (e.g. the number of job openings is falling). The range of outcomes when it comes to the magnitude of potential rate cuts by the Fed have narrowed significantly since the start of the year. While we think that the bar for the cutting cycle to begin remains high, recent progress on the inflation front has been encouraging.

We believe that robust growth and healthy earnings will support US markets despite potential for increased political noise as we head towards the November presidential election. Our portfolios are diversified in terms of their US exposure with a blend of both passive and active management used in this space.

Europe - July 2024

European equities were mixed over the month as investors navigated increased political uncertainty. On 10 June, French President Emmanuel Macron took a leap of faith by dissolving parliament and calling a snap election after his centrist Together alliance was trounced by Marine Le Penʼs far- right National Rally (RN) in European Parliament elections. Last weekend marked the first round of voting, with the RN making big gains, winning 33.4% of the vote.

The French system is complex and not proportionate to nationwide support for a party. Legislators are elected by district and a parliamentary candidate requires over 50% of votes to be elected outright. Given that no candidate received over half of the vote in this initial round, the top two contenders, alongside anyone else who won support from more than 12.5% of registered voters, now go forward to a second round on 7 July. While the RN appears on track to win the most seats in the National Assembly, it may fall short of the 289 seats required for an absolute majority, suggesting France may be heading for a hung parliament and more political uncertainty.

Since the snap election was announced, French equities sold off on the back of uncertainty. French banks have been among the biggest losers from the turmoil. The big three – Societe Generale, BNP Paribas, and Credit Agricole – are down 10%-14% since Macron’s announcement. These banks have a large amount of debt and they will suffer if credit costs rise or there is a sharp increase in borrowing at government level.

Le Pen has also floated the idea of windfall taxes or taxes on dividends, which has created further uncertainty for banks.

The uncertainty over Franceʼs budget trajectory (because of the current political situation) has also led to an increase in French government bond yields relative to German yields. There is a risk of spreads widening further if markets believe a new government will try to implement tax cuts or spending increases that would lead to the French public deficit moving in the wrong direction.

Generally, markets fear an absolute majority for the far right or the left, which would allow them to implement more of their spending programmes. Following the results of the first round of voting, markets have been encouraged by the lack of an outright winner, with the euro climbing versus peers and European stocks staging a relief rally. The focus now turns to whether Le Penʼs party can garner enough support in the second round of voting to get an absolute majority in the National Assembly.

We remain neutral on European equities as the flare up in political uncertainty has widened risk premia across European assets, eclipsing the regionʼs improved fundamentals for the time being. We are conscious that the economic outlook for the bloc is improving (albeit from a weak base) but we await greater clarity and more attractive valuations before we turn positive. We have no exposure to European government debt.

Rest of the world - July 2024

Japanese markets endured some volatility in early June amid Prime Minister Kishida’s declining approval ratings and the Bank of Japan’s decision to maintain its policy rate, but the market stabilised towards the month end. The Nikkei 225 and TOPIX indices ended the month in positive territory driven by semiconductor stock rebounds and dividend reinvestment.

Asia Pacific markets also forged ahead over the month with the MSCI Asia Pacific (ex- Japan) Index returning 4.61% to sterling investors. Taiwanese equities led the pack as the home to the worldʼs leading semiconductor and high-technology companies, which now form a significant part of global supply chains.

Indiaʼs surprise election outcome, that saw Prime Minister Narendra Modi fall short of his expected majority, introduced some volatility into Indian markets. However, we do not expect that a constrained National Democratic Alliance (NDA) government will disrupt the countryʼs long-term growth story. Indeed, a coalition government with greater checks and balances should augment investor confidence.

Chinese markets came under pressure towards the end of the month as many companies disappointed investors with lower-than-expected quarterly earnings, underscoring the economyʼs weak growth outlook. According to Bloomberg, global funds sold RMB 49.4 billion of onshore shares via trading links with Hong Kong over the last week of June. Chinese policymakers are attempting to restore investor confidence in the region by reducing the dominance of the property sector and rebalancing the economy towards higher- end manufacturing and consumption. While some policy shifts are starting to bear fruit in certain corners of Chinaʼs economy, sluggish consumption and persistent deflationary pressures continue to weigh on sentiment.

We have maintained our neutral stance on Japanese equities, taking profit when shares outperform as, although the structural story in Japan remains intact, the pace of change is slowing. Within core portfolios, we have a measured exposure to emerging market equities with a preference for the Asia Pacific equities outside of China.

Fixed income - July 2024

Heightened expectations for a September Federal Reserve (Fed) rate cut led to a slight decrease in short-term Treasury yields, resulting in a steeper yield curve as June ended. Despite rising investor hopes of a rate cut, the Fed struck a cautious tone at their June meeting, with the predictions from Fed governors now indicating only one cut this year (in contrast to their previous forecast of three cuts). US treasury yields are now in the middle to lower end of our expected range as economic data is inconsistent with an aggressive cutting cycle and implies higher terminal rates. That said, the ‘higher for longerʼ narrative is only unique in the context of the last decade. Current yields on 10-year US government bonds are now back in line with the 250-year average of 4.6%.

Eurozone government bond yields rose towards the end of the month ahead of inflation prints in the eurozone and the US. Although the European Central Bank (ECB) delivered the expected 0.25% interest rate cut, comments from officials hint towards a more cautious approach to cutting interest rates further this year, which put upward pressure on yields.

UK government bond yields climbed ahead of the election on Thursday, 4 July with upward revisions to the UKʼs first-quarter GDP also contributing to the move. Although there are signs that inflation might be coming under control enough for the Bank of England to start to think about a pivot, the risk of devaluing sterling against the dollar leaves the Bank somewhat tied to the Fedʼs cutting cycle. Corporate debt enjoyed positive flows industrywide over the month, which contributed to favourable technical conditions for the asset class, as did moderate issuance. We remain neutral on corporate debt overall as spreads are still tight – a function of strong demand relative to supply and resilient corporate balance sheets. In our view, the income cushion makes high yield more attractive on a total return basis relative to investment grade. Strong growth, especially in the US, means credit risks are likely to remain relatively low for now.

Our overall stance on fixed income is neutral, with exposure to UK and US government debt, investment grade and high yield corporate credit as well as emerging market debt within portfolios. The overheating worries of April appear to have dissipated, and our central case is that the next move for the major developed market central banks is policy easing rather than tightening. As a result, the medium-term outlook for fixed income still looks attractive.

Ask us anything - July 2024

Q: How significant are US elections for the stock market? Is this one particularly significant and how have you prepared for it within portfolios?

A: In the run up to a presidential election, we are often assailed by a barrage of commentary perpetuating the idea that ‘if candidate x wins, the stock market is going to crashʼ. This is a misconception; despite the political zeal behind the idea, this scenario has never really played out. In fact, as you likely know by now, markets hate uncertainty and so it may be unsurprising to read that stocks tend to rally following the election results. When post-election downturns do hit the markets, it is often a symptom of the wider economic backdrop rather than an identifiable adverse market reaction to the president-elect.

Looking back at history, the annualised return for election years then comes out at 7.8%, which is very close to the compounded return during non-election years, meaning there is not much, if any, significant difference.

The political landscape is just one factor influencing the US stock market performance.

Despite Bidenʼs plans to regulate the Artificial Intelligence (AI) industry, it could eventually amass enough political power to quash any attempt to regulate it, mirroring the strategies used by banks before the global financial crisis and social media platforms today.

While there is no evidence that election results determine market performance over the long term, it is important to be aware of potential impacts on specific companies and/or sectors as well as financially significant policies and legislation like the tax code. The 2024 campaign is unique in that the nominees from both major parties have been President before. This provides us with a historical reference of what happened in the markets when they took over the Oval Office. Financials, industrials, and defence stocks rallied following Donald Trumpʼs victory in 2016, while infrastructure stocks outperformed after Joe Bidenʼs win in 2020. The post-election stock market gains were larger in 2020, but that also coincided with positive Covid-19 vaccine news, highlighting that factors beyond election results influence investment markets.

This time around, President Joe Biden and former President Donald Trump have laid out contrasting blueprints for the US economy. However, it is particularly important to note that the US electorate has become so deeply divided that no president is likely to control both houses of Congress for more than a couple of years. With political gridlock becoming the norm in Washington, it is more challenging to push through radical legislation.

Within portfolios, we have maintained our healthy allocation to US equities that we initiated in January. We continue to believe that there are some excellent companies listed in the US that will deliver earnings growth regardless of the political landscape. We have, however, begun shoring up portfolios ahead of the expected election volatility with the introduction of two actively managed funds into core portfolios, the combination of which gives us a diversified exposure in terms of equity style.

If there is a question you would like to pose to our team, please reply to this email or write to [email protected].

The Monthly Market Commentary (MMC) is written and researched by Scott Bradshaw, Lauren Hyslop and Jonathon Marchant for clients and professional connections of Mattioli Woods and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investorʼs circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future.

Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

Sources: All other sources quoted if used directly, except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.