Global markets summary

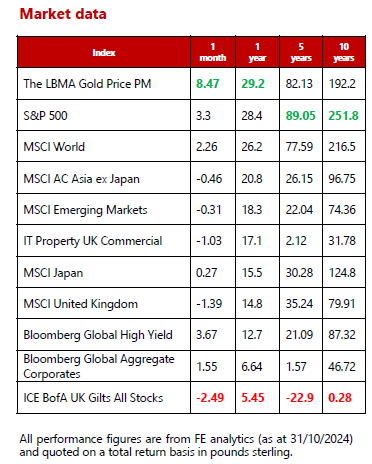

October was an overall turbulent month for investment markets. Equity markets pulled back, but the US S&P 500 did deliver 3.36% to £-based investors, benefiting from the relative weakness of sterling to the US dollar. European, Asia Pacific and UK equity markets all ended the month in negative territory, as growth risks weighed on investor sentiment as well as a handful of idiosyncratic issues across each region. Returns from fixed income assets were also varied over the month, with the less interest rate sensitive segments of the market outperforming.

Following Donald Trumpʼs decisive victory in the US election, global equities have rallied month to date. The current rush into developed-market risk assets could last through the end of the year but thereafter, the outlook could become more complicated as some economists have cautioned that President-elect Trumpʼs plans for tariffs and tax cuts could create a ‘reflationary cocktailʼ that could spill out from the US to the rest of the global economy. As such, while political uncertainties may be known, we remain cognisant that the impact/implications remain variable.

While we have endured bouts of macroeconomic-driven volatility, year to date it has been a good year for multi-asset investors. The majority of asset classes have delivered positive returns, with US equities leading the way as the S&P 500 has delivered just over 24% in £ terms so far this year. Fixed income assets have also held up well, as major central banks have now begun to cut interest rates after years of aggressive monetary policy tightening. Corporate debt has continued to outperform government debt thanks to a robust economic backdrop (particularly in the US).

Looking to the new year, our central case is still that we expect a soft landing for the global economy. This is arguably the ‘Goldilocksʼ scenario, a slowdown but not a recession, and not so hot that it creates inflation. However, given changes to the geopolitical landscape and fiscal policy on both sides of the Atlantic, we have reduced the likelihood of this scenario and now take a more cautious stance. In our view, the risk of a reflationary spike has risen, which would curtail central banksʼ ability to cut interest rates further and could be a potential headwind for financial markets.

United Kingdom

After months of speculation, we finally know the outcome of the UK Budget. For most investors, the main concern was around capital gains tax and allowances to the likes of ISAs and pensions. While capital gains tax increased from 20% to 24% for higher rate taxpayers, effective from 30 October 2024, the move is far less than the 39% that was mooted at one point. In a political move as old as time, it appears that expectations were managed with plenty of negative leaks and speculation. Of course, what followed surprised on the upside, for most people.

The sense of relief was palpable on the day, with small and mid-cap stocks rallying strongly. Londonʼs junior market (AIM), delivered exceptional performance on news that inheritance tax relief would effectively be halved, as opposed to the complete removal that many had expected.

After an initial rush post Budget, markets gave back most of their gains on the final day of the month. Once the relief had died down, the market narrative turned decidedly more cautious. Focus shifted to the implications of increased fiscal spending on inflation and the potential for higher taxes to slow economic growth. As a result, gilt yields ticked up and equity markets sold off, with economically-sensitive names suffering the biggest falls.

What remains to be seen is how consumers and businesses will react to the Budget, with both groups having shown a material drop off in confidence in the months leading up to the announcement. This was somewhat reflected in Octoberʼs Consumer Price Index (CPI) inflation announcement, which came in at 1.7%, the lowest rate since April 2021 and lower than the 1.9% forecasted.

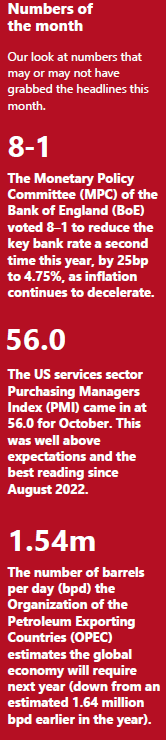

While it is pleasing to see inflation below the 2% target level, the narrative that lower inflation should pave the way for more interest rate cuts was somewhat cooled by the Budget. The decision to increase fiscal spending creates a tailwind for inflation and could lead the Bank of England to adopt a more cautious stance on loosening monetary policy.

For the holdings in our UK Dynamic Fund, the biggest impact of the Budget will be felt by labour-intensive businesses, which tend to pay lower wages. The increase in the National Living Wage and National Insurance Contributions (NICs) are likely to weigh on margins in the short term. In the medium term, we expect businesses to recoup much of these increases through higher prices, lower future wage increases or higher levels of automation.

North America

US equities ended lower in October amid uncertainty ahead of the presidential election and ongoing doubts about the path of interest rates, as well as a handful of disappointing quarterly updates for some large companies. Sterling investors, however, enjoyed positive returns from the market, benefiting from sterling weakness against the US dollar.

In early November, US equity markets responded to Donald Trump’s election victory by anticipating pro-growth policies and higher inflation. Most of the major benchmarks rose to record highs following Trumpʼs decisive victory, as investors wagered that the Republicansʼ capture of the White House and Senate, along with their expected retention of the House of Representatives – a so-called red sweep – would result in faster earnings growth, looser regulations and lower corporate taxes.

The prospects of tax cuts and widescale deregulation could keep supporting US markets, and the outperformance of US companies is likely to continue attracting capital inflows from the rest of the world. We are, however, cautious of this market euphoria given that a full and literal implementation of Trumpʼs proposals across taxes, trade and immigration could have unwelcome consequences for the economy in both the short and long run. Currently, the market is pricing in a more partial implementation, which could net out to be positive for stocks and negative for US Treasuries over the short term.

We continue to see reasons to be positive on US equities, including supportive payroll and economic data, as well as a stimulative stance from the Federal Reserve (Fed) but our optimism is constrained by the potential for inflationary shocks as we move through 2024. We remain neutral on US equities, expressing this in our core portfolios via a blend of active and passive strategies with a broad exposure in terms of sector, market cap size and style.

Europe

European equities ended October in negative territory amid more evidence of a weakening economic backdrop, with Germany at the epicentre as well as uncertainty around the US presidential election outcome. In contrast to US equity marketsʼ reaction to a Trump victory, the MSCI Europe ex UK Index retreated following the election results, as worries about the impact of US President- electʼs trade policies on European economic growth and central bank policy weighed on sentiment. The euro depreciated versus the US dollar, ending the week (November 8) at USD 1.07 for EUR, down from 1.08.

Geopolitical uncertainty persists in Germany, as Chancellor Olaf Scholzʼs coalition government effectively ended when he fired Finance Minister Christian Lindner of the Free Democrats over disagreements on spending and economic reform. Germany is now poised to hold a snap election on 23 February. Although the date must be officially confirmed by the president, Frank- Walter Steinmeier, this is considered to be a formality. The political upheaval comes at a particularly challenging time, with Germany already grappling with economic headwinds. The uncertainty has raised concerns about the country’s ability to implement crucial economic reforms.

Economic data continues to paint a mixed picture for the bloc. The Hamburg Commercial Bankʼs eurozone composite Purchasing Managers Index (PMI) was revised higher to 50.0 in October from an early estimate of 49.7. The reading now indicates that overall business activity was unchanged (PMI readings greater than 50 indicate an expansion in activity; readings less than 50 indicate contraction). Manufacturing contracted at a slower pace than first estimated, while services sector output expanded at a slightly faster rate. However, business confidence fell to its lowest level so far this year.

We maintain a neutral stance towards European equities; although forward- looking economic data has been weak, inflation has eased, giving the European Central Bank (ECB) scope to cut rates in the coming months.

Rest of the world

Emerging market equities fell over October amid widespread risk-off sentiment ahead of the US presidential election and a stronger US dollar. Indian stocks have been a leader for much of 2024 but corrected sharply in October, falling 7.3% in local currency terms, mainly due to weak corporate results. Taiwan was the only emerging market to deliver positive returns over the month, led higher by ongoing positive sentiment around artificial intelligence demand.

Following a sharp rally in September, Chinese equity markets also experienced declines in the month, partly driven by profit-taking but also on the lack of further detail relating to stimulus measures. The country continues to face a plethora of challenges, including the collapse of the countryʼs property sector and high levels of youth unemployment. On the trade front, exports rose an above-forecast 12.7% in October from a year earlier, up sharply from 2.4% in September, marking the fastest rate of growth since July 2022. While the growth in Octoberʼs exports signalled strong demand for Chinese goods – which has been a bright spot for the economy – we must caution that the outlook has grown more uncertain given the possibility of a trade war when President-elect Trump takes office in 2025.

Trump has threatened to impose up to 60% tariffs on imports from China, which would of course be a headwind for the regionʼs stocks. However, we are acutely aware that the Chinese government has a lot of tools it can use, depending on what happens in the US and across other markets. Companies have also dealt with tariffs before, and the possibility is already largely baked into equity prices, supporting our neutral stance.

Japanʼs equity market continued to experience higher volatility over October but rebounded to generate a positive return of 1.9% for the TOPIX total return index in local currency terms. The Nikkei 225 rose more strongly, by 3.1%, indicating that the marketʼs rise was primarily driven by large cap stocks. The weakness of the yen supported large cap exporters such as technology, autos, and machinery stocks. In November, investor risk appetite has so far been supported by the outcome of the US presidential election and the Fedʼs rate cut. These developments largely overshadowed the domestic corporate earnings season, where there were some downgrades to company guidance, and the adverse impact of yen strength on Japanʼs export-heavy industries.

Within our core portfolios, we retain a neutral stance towards Asia Pacific, emerging markets and Japanese equities, viewing Western developed market equities (such as the UK and US) as better positioned over the medium term.

Fixed income

Lack of clarity around the path of major central bank monetary policy weighed on fixed income assets over the month. US and UK government bonds ended October in negative territory, the former challenged by a gradual repricing of anticipated Fed interest rate cuts and the latter pressured towards the end of the month by the UK Budget (despite enjoying an initial relief rally) due to stronger-than-expected levels of spending now planned for 2025. High- yield debt was the only major fixed income sector to deliver positive returns over the month, benefiting from a lower sensitivity to interest rates.

Following the results of the US Presidential election and release of the UK Budget, investors have had a busy start to November, assessing whether the impact on inflation from US and UK government policies will be enough to significantly change the easing path for central banks.

In the US, the election results sent yields upwards on Wednesday (6 November), though the expected rate cut from the Federal Reserve (Fed) helped bring them back down by Thursday (7 November) evening. We continue to believe that the market has priced in too many rate cuts over a short period. President-elect Trumpʼs proposals (if enacted) are set to fuel inflation and increase the US fiscal deficit, which is already high at 6.5% of GDP, putting further upward pressure on Treasury yields. Two- year break-evens (which are structurally higher in the US than the UK as they reflect an older inflation measure) have slightly increased from 2.9% in mid-September to 3.1% following the election results, and slightly more for longer-term inflation expectations.

We retain a neutral position towards UK government debt. Although inflation is falling (and this month the Bank of England (BoE) cut interest rates to 4.75%, in its second reduction this year), we expect the fiscal loosening announced in the Budget and some pass-through of employer NICs to consumer prices to push up CPI inflation, constraining the BoEʼs ability to cut rates further.

In the corporate debt space, credit spreads narrowed significantly in response to the US election outcome, as the markets moved to fully discount a more supportive backdrop (potentially lower corporate taxes and reduced regulation) for the corporate sector. While credit markets continue to provide an attractive yield, valuations remain expensive relative to historic yields, and we expect better entry points to materialise.

We retain a measured exposure to both US Treasuries and gilts across cautious, balanced and growth portfolios, as historically, the start of rate-cutting cycles has often resulted in significant returns for government bond markets in the subsequent years.

Ask us anything

Q: What are your views on the outcome of the US election? How do you see a Trump Presidency impacting markets and how are you preparing?

A: The US election surprisingly has delivered a decisive outcome on the night, with the long-running concern of a close race ending in squabbling having been averted. Control of all three branches of government now looks assured and gives the Republican party few checks. In hindsight, perhaps it should not have been that much of a surprise with a very unpopular leader and even though economic data has been decent, ordinary people contending with higher prices have not benefited – just ask Rishi Sunak.

So, what might Trump 2.0 look like and how might it impact markets? We will begin to get more of a sense of potential policies as Trump announces his team. While painted as impulsive, Trump generally has listened to his selected experts, and their ability to restrain some of the more extreme policies will be key. We examine some potential areas to consider below.

Tariffs

There was a lot of talk of tariffs in the campaign, but not too much on how they might be implemented. Some speculate they will be used as a bargaining chip, with tariffs reduced or removed as part of negotiations – such as in the run up to the renewal of the USA-Mexico-Canada agreement due in 2026. It seems unlikely (but not impossible) a blanket tariff on all imports will be put in action on day one, although targeted tariffs in China are a possibility, with Europe potentially also in the crosshairs. Trump also wants to see an end to near-shoring (the process of moving manufacturing out of China and into Mexico) and jobs come back to the US – as seen in campaign warnings to John Deere. The use of tariffs would be inflationary, but the degree can be managed, depending on how quickly they are implemented.

Foreign policy

Starting with NATO, Trump would need a two-thirds super-majority from the Senate to leave, but that seems unlikely. There are other ways he could frustrate the bloc, including withdrawing US bases from Germany or Poland and/or training less, lowering preparedness. For European nations, higher spending on defence will be required, potentially increasing the overall level of tax needed. This will also include Ukraine, where Trump may see less value in continuing to support Ukraine or want to see Europe increase its commitment. The conflict now looks to be in a state of stalemate, so we expect a settlement to be reached – but heavily sanctioned Russia is unlikely to return to international markets anytime soon.

Taiwan may also be seen as more of a bargaining chip with China, rather than a moral obligation to defend the island. While acting strong, Trump is not keen on war, so conflict with Iran seems unlikely unless provoked.

Domestic policy

Taxes and energy are likely to be two changes in the near term. Trump will look to unleash American energy early in his term, and there is the potential to remove incentives around clean energy and infrastructure under the Inflation Reduction Act. Regulation may also be stripped back in areas such as financials, which have rallied strongly over new consumer protection measures now likely to be scrapped. The tax cuts from the first term are due to expire next year, and we would expect an extension of this and possibly even more cuts.

Migration is also likely to be a day one issue, given the prominence in the campaign. This may have an impact on wage growth and unemployment numbers, with less migration creating a tighter labour market. Mass deportations may also cause issues but may also reduce overall demand, so may not be as inflationary as you may first assume.

Chairman Jay Powellʼs term with the Federal Reserve ends in May 2026. It may be that Trumpʼs experiences with the Fed until then will inform his next steps. The removal of central bank independence would likely cause huge market uncertainty and an increased risk premium as decisions would become political not economic.

Impact on asset classes – For fixed income, Trumpʼs plans require further adding to US debt and, as such, Treasury yields have risen. In turn, this is also negative for US housing, with mortgages likely to be more expensive. Higher treasury issuance will also push up other fixed income yields as more US debt will mean having to pay a higher risk premium for others.

Lower taxes should be beneficial for equities along with deregulation and other pro- growth actions. It is likely we will see more trade wars and non-US equities (particularly Europe and China) may be more volatile.

So, what are we doing in our portfolios? We have taken no immediate action. Our exposure to US value names has been positive, given their generally more domestic bias compared to US growth. Generally, we remain positive on the outlook for equities, and the deflationary recovery remains our central case, albeit a Trump presidency may mean inflation sticks around for a while longer and rate cuts may be pushed back.

KEY TAKEAWAYS

- A decisive outcome on the night has initially been positive for US equities.

- Trumpʼs policies will promote growth, but could also be inflationary and expand the US government debt.

- Control of all three branches of government for the Republicans give a clear mandate to pass legislations.

The Monthly Market Commentary (MMC) is written and researched by Scott Bradshaw, Lauren Hyslop and Jonathon Marchant for clients and professional connections of Mattioli Woods and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investorʼs circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future.

Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

Sources: All other sources quoted if used directly, except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.