The 2025 NIC changes: what you need to know

Since 6 April 2025, employers have been navigating significant changes to their NIC obligations. Secondary Class 1 NICs increased by 1.2% to 15%¹, while the earnings threshold (the point at which employers begin paying NICs) reduced from £9,100 to £5,000¹. These adjustments have led to a substantial rise in employment costs for many businesses.

Salary exchange – a powerful cost-saving tool

A salary exchange scheme remains an effective solution for managing these increased employment costs. This arrangement allows employees to exchange part of their salary for non-cash benefits, creating notable tax advantages:

- For employers: lower gross salaries mean reduced NICs, offsetting the rate increase

- For employees: higher take-home pay and immediate tax relief on pension contributions at their highest marginal rate

Salary exchange can be used for desirable benefits like bike-to-work schemes, childcare vouchers and holiday purchases. Not only does this flexibility help to offset rising NICs, but it also enhances employee wellbeing while strengthening your ability to attract and retain top talent in today’s competitive job market.

Furthermore, employers can achieve additional NIC savings when employees direct bonuses into their pension plans.

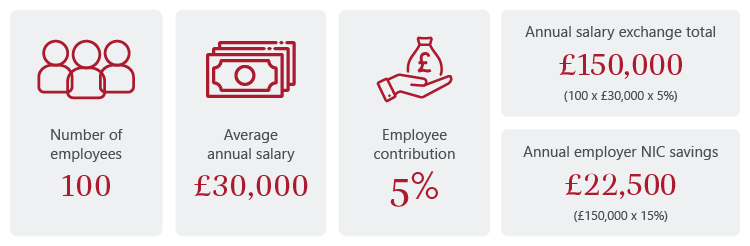

Cost savings in action

This example highlights how a well-structured salary exchange scheme can generate significant savings.

Why partner with us?

With over 15 years of experience implementing successful salary exchange schemes across diverse industries, we combine expert guidance with a personalised service. We will design a scheme tailored to your specific business needs and handle implementation with minimal operational disruption. We will also provide clear communication that drives employee participation and deliver ongoing support to optimise your scheme’s effectiveness.

Get in touch – complimentary consultation

With new NIC rates in effect, now is the ideal time to explore how salary exchange could benefit your business. Contact our team today for a free consultation to determine if salary exchange is right for your business and how much you could save.

Content correct at the time of writing (March 2025).

References:

- HM Revenue & Customs (HMRC), 13 November 2024