United Kingdom - July 2022

With our theme of investment acronyms, we acknowledge that our profession doesn’t always use language that is conducive to a broader understanding among the investing public. AIM, EIS, ISA, SEIS, VCT and many, many more will be at least familiar. Others are dotted throughout this month’s edition. Some stand the test of time, while the general acceptance of others over the years has almost been a signal to sell (think BRIC – see later).

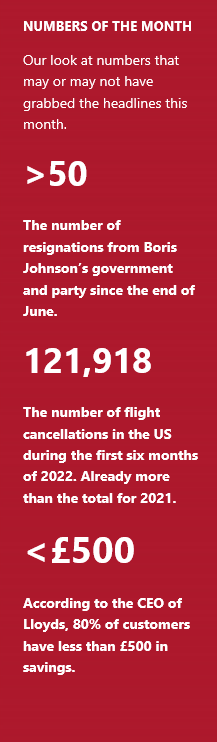

As we write, there are upheavals in Westminster and a cost of living crisis that show no signs of abating. Indeed, in his resignation letter, Rishi Sunak used the following language: ‘I firmly believe the public are ready to hear the truth’, and ‘They need to know that while there is a path to a better future, it is not an easy one’. This encompasses the political and the economic issues, only the last of which is really likely to impact our decision making.

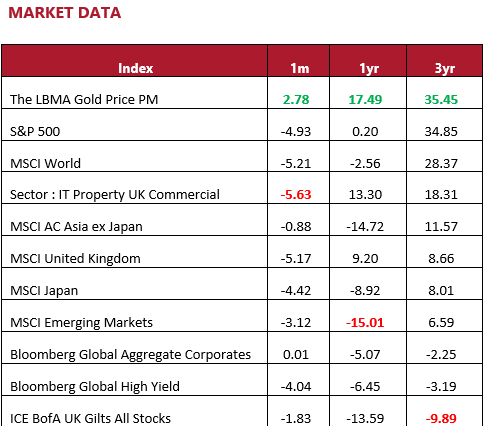

That the path ahead won’t be easy is increasingly reflected in markets, both for equities and fixed income. June was a tough month for most assets, and we make no apology for saying there could be plenty more to come.

There are bright points, and there will be more, but until central banks have completed their (planned) tightening of policy (mainly raising interest rates), and until we can see the extent/depth/length of any recession, there must be considerable uncertainty. Having a binary view to investing is dangerous at the best of times but could be catastrophic now – putting it all ‘on black’ is not the plan.

Assets that benefited most from the massive injections of central bank liquidity during the pandemic have been, generally, the hardest hit year to date. The previously unloved (and dirty) oil and gas sector has performed well, while the new kids on the energy block have generally seen valuations slide, as our reliance on fossil fuels, for a while yet, has been proven. However, very real concerns about supply lines and energy security have at the same time encouraged the renewable energy sector (and investors, including governments) to redouble efforts to safely and efficiently deliver alternatives to carbon-based fuel.

For now, UK equities, under pressure more than they have been for many months (collectively), still look more attractive than other geographical areas, and in any event, sticking to quality names and the themes/sectors we prefer seems to continue to make sense. Choppy waters? Make sure the boat you are in is seaworthy.

North America - July 2022

Having caused investors significant concern by entering a bear market, the US has staged a small recovery over recent weeks. This is inevitable to a degree as markets can get oversold in the short term (however bad the underlying news) and there will always be some rebalancing exercises from pension funds and other institutions. Some of the relief has been provided by hopes that inflation might moderate, meaning that the Federal Reserve will be able to slacken the rate of its policy tightening.

The Michigan sentiment survey provided a sliver of hope on this front (although the rest of the survey was a pretty grim assessment of confidence). Any scaling back of rate hikes will mean equity valuations command a higher multiple of earnings, but clearly that is only half the battle.

Avoiding a recession in the US is going to be crucial if markets are going to hold, as earnings estimates are not reflecting the potential downside and profit margins since the Covid-19 crisis have risen to extreme levels. The country faces a very uncertain economic outlook and even the social upheaval and controversies from the Supreme Court decision on abortion rights seem to fit these troubled times.

Investing according to snappy acronyms is probably not advisable. The number of permutations we have been through in the US mega cap space is dizzying whether it be FAANG, FANGMAT, FANGMANT. As with most of these developments, they are probably best left with the marketing departments of large institutions.

When this difficult market period does abate, it may be that the US looks relatively more attractive than it has of late. Even naysayers on the broader market (such as ourselves!) may find that the valuation premium of the US stock market is much reduced and then the strength of the corporates listed there may justify larger allocations in this area. US smaller companies are likely to bear the brunt of any further sell-offs (as they have to date) and the opportunities here are likely to be considerable.

We have always acknowledged that the US enjoys a number of structural advantages over other markets in terms of the quality of its companies, legal / regulatory systems, etc., and we might be about to get an opportunity to add to exposure more free of the valuation challenges that have made it look unattractive to us over recent years.

Europe - July 2022

It remains difficult to articulate an optimistic outlook for European equities. Considering the proximity to the war in Ukraine it is perhaps astonishing that the indices have not been even more adversely affected than they have to date. Germany and others are now warning that Russia could move to cut off all gas supplies to the continent over the winter, which would add further to the economic slowdown (almost definitely implying recession) and also exacerbate the current inflationary pressures. The European Central Bank (ECB) now looks as if it is going to be forced to raise rates at a time when it would clearly prefer to be supportive in its policy stance.

This environment is likely to pose significant challenges for those European companies that are at the lower end of the credit quality spectrum, who will face deteriorating operating conditions and higher payments on debt at the same time. There are many businesses that have a very low interest cover – meaning that earnings only just cover interest payments – and clearly this is a major risk for investors. Realistically, this will enhance the attractions of higher quality companies as it is arguably doing elsewhere, but the fragility of the European economy means the stakes are probably higher.

Another sovereign debt crisis in Europe would remind investors of the rather offensive acronym, PIIGS that became established in 2011. Standing for Portugal, Italy, Ireland, Greece and Spain, it covered the most imperilled countries at that time. They are in different shape a decade on, but their underlying issues are far from over. Fingers crossed!

We have options to respond to these changes in outlook and investment styles. As has been the case in most geographies, the growth style has found the going particularly tough this year, but we have the ability to employ more valued-focused vehicles or even to adopt an equity income style, which has held up very well not least because of its sector skew to energy and other cyclical areas.

This certainly does not seem like a time to add to European equities, but as with other areas there will come a time to increase exposure opportunistically.

Rest of the World - July 2022

We start this month in Japan, where the Japanese yen has weakened to its lowest level against the US dollar in 24 years. This is somewhat unusual given the yen’s reputation as a safe haven asset class paired with growing concerns of a global recession. However, the Bank of Japan’s continuing supportive policy of keeping interest rates near zero is out of step with other countries, so further weakness may be seen as other global rates increase. It would seem unlikely that we will see any change in rates until the new chair of the Bank of Japan comes in next year to replace long serving Haruhiko Kuroda.

Yen weakness and high commodity prices – with Japan having few of its own natural resources – have seen Japanese inflation reach 2%. Politically, this has proved unpopular, although economically, it can be viewed as a positive given Japan’s sheer amount of outstanding debt. This level is much lower than here in the UK or the US, as Japan has not seen the same level of wage pressure, with Japanese workers acclimatised to stagnant pay rates.

From a market perspective, yen weakness potentially makes Japanese companies more interesting to foreign investors and is less of a concern than historically would have been the case for Japanese profits, with many companies now offshoring elements of their business. One such example of this is Honda, who in cars.com’s made-in-America index had four of the top spots, with those models being made in their Lincoln, Alabama, factories.

Elsewhere, news from China has been mixed this month with panic having been initially sparked by an official suggesting that the country’s outlier zero-Covid policy could last for another five years. This was swiftly attributed as a misquote with some areas of the policy, particularly around international travel, being eased the next day. China, despite having been earliest into the pandemic and to implement controls, has struggled with the transition to living with the virus. A low vaccination rate (particularly among the elderly), along with seemingly less effective domestically produced vaccines, have been key factors. While this could change rapidly, particularly if foreign-made vaccines were used, any significant change in policy seems unlikely until the Communist party conference towards the end of the year.

The acronym BRIC was first used in the early 2000s by Goldman Sachs to cover the four emerging markets that they forecast would come to dominate the global economy by 2050. These nations are Brazil, Russia, India and China, with South Africa being added in 2010 when it became BRICS. Over the period many BRICS investment strategies were launched; however, these are far less commonly used today, with differing drivers for the nations meaning they can perform very differently depending on whether domestic growth or high commodity prices form the backdrop.

We are positive on Japanese equities with ongoing corporate reforms still unlocking value, albeit we are increasingly focusing on the currency implications. We remain only indirectly exposed to China through broad Asia or Emerging Market strategies, where managers have alternative options.

Commodities - July 2022

Looking back into the history books, commodities have been a good hedge against inflation in a number of instances. However, there is a point at which inflation is so rampant that central banks have to act to slow the economy, and a slowing economy is rarely good news for the sector. Having had an exceptional start to the year, June was a month to forget for commodities. Soft commodities and industrial metals were the hardest hit with investors increasingly concerned about demand, as the cost of living crisis bites for consumers.

The term ‘Doctor Copper’ refers to copper’s ability to predict the overall health of an economy. Though not infallible, copper has a range of different applications, making demand and pricing a reasonable indicator of economic activity. Indeed, a 2014 study by ABN AMRO found a high correlation between copper prices and a number of measures of economic activity. Today, the diagnosis from Doctor Copper is not good. On 1 July, the metal rounded off four consecutive weeks of decline and prices are around 25% off highs witnessed earlier in 2022.

With commodities accounting for a significant portion of global inflation, a softening of prices could prove timely for central banks, particularly in the context of falling shipping costs, relatively high levels of corporate inventories and a weaker oil price.

Arguably the most famous acronym in the commodities space is OPEC. Organization of the Petroleum Exporting Countries was founded in 1960 and comprises 13 countries, who account for around 44% of global oil production. The countries operate as a cartel, agreeing production volumes in order to influence pricing.

Most of our exposure in the commodities space remains in gold, which was not subject to recent price weaknesses and dances to its own tune. We do have some broad mining and energy exposure, though reserved for higher risk portfolios.

Property - July 2022

So far in 2022, selling what did well in 2021 and buying what did badly would have been a simple yet effective strategy … if we had had access to a working crystal ball! The same is true in property, with the industrial and logistics space coming under pressure, having been the darling of the sector for many years.

The narrative that had been so supportive was based on tight supply and significant demand, predominantly from the growth of e-commerce. Over the past couple of months, the latter point has been called into question, with a string of profit warnings from e-commerce retailers. Growth in the space had been turbocharged by the pandemic-induced changes in consumer habits, but things appear to be normalising.

In truth, the term ‘industrial and logistics’ covers a vast array of properties, from small industrial units on business parks to huge fulfilment centres. It is the latter that investors appear most concerned by. A warning from Amazon on their future growth prospects sent shockwaves through the sector and led to significant falls in owners of big box warehouses. Given the size of those names in the property shares index, it was a poor month for the sector as a whole.

Property is an area of the market that is littered with acronyms. The most obvious is REIT, which stands for Real Estate Investment Trust. REITs benefit from preferential tax treatment, which is contingent on a number of criteria being met, the key one being that 90% of property income profits must be distributed each year.

Post pandemic, the disparity between property subsector yields reached eye-watering levels. Yield compression was a key driver of returns in the industrial space and there was only so far that could go. The sector still has appealing supply dynamics, but some demand could be pushed back. There remain plenty of exciting opportunities across the property space.

Responsible Assets - July 2022

The US Supreme Court made headlines in June for a number of controversial decisions. One that may have slipped your attention though is the ruling to strike down a plan that sought to forcefully shift power generation away from coal-fired plants and towards renewable sources across the US energy grid. The plan itself – the Environmental Protection Agency’s (EPA) Clean Power Plan – is actually an obsolete rule that failed to get off the ground during the Obama administration. In this way, there was little immediate impact from the court’s decision. Although sentiment has been shaken, the real impact on stocks in the clean energy space will be negligible.

Invoking a legal principle known as the ‘major questions’ doctrine, the majority justices said that the Court expects Congress to clearly legislate for ‘how much coal-based generation’ there should be across the US power grid. Essentially, the ruling decreed that in creating a plan that would force a nationwide energy transition, the EPA simply went too far and over-stepped its bounds. In this way, investors should not dismiss the ruling as it could set a precedent for opponents of agency regulations to challenge any regulation opening up the possibility of challenges to mandates on everything from food safety standards to the Clean Water Act.

CCS or Carbon Capture and Storage is a way of reducing carbon emissions. Put simply, it is a three-step process that involves capturing the carbon dioxide produced by power generation or industrial activity, such as steel or cement making. This carbon is then transported from where it was produced, via ship or in a pipeline, and stored deep underground in geological formations.

Headlines claiming that the ruling has taken the EPA out of the climate change fight are sensationalist. The EPA may have a tougher fight on their hands, but they are still very much in the ring and will be working on a revised proposal on carbon limits for power plants. The agency is still able to use traditional tools to lower emissions at individual plants including potentially blending gas and hydrogen with coal, or investing in carbon capture once it becomes viable.

A number of companies facilitating the shift to clean energy, energy efficiency and electrification continue to be underpinned by strong fundamentals and long-term demand drivers. We invest in this theme selectively as well as having exposure to more traditional commodities.

Technology Equities - July 2022

It is probably not news to anyone that the once beloved technology sector of the market has endured turmoil since late 2021. The US tech-heavy index, the Nasdaq Composite, is off about 25% since the end of 2021 with a number of stocks falling more than 50% and few in the sector having been spared. Some would say this reckoning has been a long time coming as tech reigned supreme as one of the top performing sectors for over five years (despite a number of companies in the space yet to deliver any profit). Winds of change knocked these stocks off their lofty perch in late 2021 first, as investors took profit from pandemic-era winners, then investors swerved the space as interest rates spiked, fuel prices soared and recession worries emerged.

The environment tech stocks enjoyed over 2020 was an anomaly. Speculative tech stocks thrived in a landscape of record low interest rates and additional quantitative easing flooding the market as well as the pandemic forcing us to adopt technology-based solutions to meet a number of needs. Rising interest rates are viewed by many market participants as bad for the sector given that many tech stocks have rapid growth assumptions built into their valuations, so any rise in rates would eat into the present value of the investment.

As mentioned earlier, FAANG is an acronym used to describe some of the major players in the tech sector (Facebook, Amazon, Apple, Netflix and Google). It was exceptionally popular from 2017 to 2020 but since then this basket of stocks seems to have lost its bite. Given some name changes as well as Netflix falling out of favour with investors MAMAA is the new kid on the block – meaning Meta (formerly Facebook), Apple, Microsoft, Amazon and (Google parent) Alphabet.

It looks like those halcyon days are gone, but that does not mean rising rates are kryptonite for all technology stocks. Given the broad-based sell-off in the space there are now some great buying opportunities for tech stocks with resilience of demand and pricing power. While it makes sense to stay wary of consumer discretionary tech, IT solutions continue to look attractive given their status as a necessity for companies to function. In certain business areas, tech solutions actually help to cut costs so become even more valuable in a recessionary environment. IT solutions tend to be the last area businesses cut back on during a period of cost pressures.

We still see value in a number of areas across the technology sector that can be viewed as a non-discretionary spend such as cloud services and cyber security. We do however caution that being selective and looking for companies with resilient demand is imperative at this juncture.

The Monthly Market Commentary (MMC) is written and researched by Simon Gibson, Richard Smith, Scott Bradshaw, Jonathon Marchant and Lauren Wilson for clients and professional connections of Mattioli Woods, and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future. Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

The MMC will always be sent to you by the seventh working day of each month, usually sooner, is normally delivered via email, and is free of charge as the MMC is generally made available to clients who have assets under our management in excess of £200,000, and to all clients under our Discretionary Portfolio Management Service (DPM). Normally, the MMC costs £397 + VAT per annum. Professional advisers and their clients should contact us if they are interested in receiving a monthly copy.

Sources:

www.bbc.co.uk,

www.bloomberg.com,

Financial Express,

www.thedragonsblade.com,

www.express.co.uk,

www.pitstoppin.co.uk,

www.sibcyclinenews.com,

www.vr-12.com,

www.smalltalkbigresults.wordpress.com,

www.anonw.wordpress.com

www.avantida.com,

www.plazmedia.com,

www.viewzone.com,

www.mmn.com.

All other sources quoted if used directly; except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.