United Kingdom - November 2022

Social media is often, well, pretty unsocial – UK investors might well feel that the environment is pretty unsocial too. Inflation taking hold, fiscal austerity back on the cards (tax rises, spending cuts), political uncertainty, interest rates on the rise (there are plenty who are happy to see this, of course) and even uncertainty (only too real in the memories of those of us of a certain age) of power cuts this winter. So maybe we should pull the duvet over our heads and say ‘wake me up when it’s all over’?

Not so. There are undoubtedly challenges, and to ignore them would be as reckless as to say there were none. Nevertheless, we know, with hindsight, that similarly challenging times in the past now look like a modest blip on the line of economic and asset growth we have seen for decades. It is that hindsight that is so important, and yet the nature of it is we only ever look back. Maybe we should apply our hindsight now, to where we are – look more closely, think ahead and recognise now that these times will, as past times now do, look much less scary with hindsight, and invest, judiciously, for long-term growth.

Even within the relatively small area of listed UK equity (modest in a global sense), there are companies we can see struggling in this environment, and those that are well set to benefit from one or more of the ‘challenges’ above.

This is the role of the asset allocation team and the fund managers – seeking out opportunities, sticking to their convictions but also challenging their assumptions. UK smaller companies have had a tough year as an asset class. We strongly suspect that it won’t be long before we look back at ‘now’ and see what amazing value existed. Similarly (see later), some areas of fixed interest are now of much more interest than they were (though we aren’t throwing ourselves feet first into that arena just yet).

As ever, in-depth research and analysis, plenty of thought and debate, maintaining our processes and structures, and perhaps most importantly being prepared to be both dogmatic and/or pragmatic (as appropriate) is the approach we are taking with funds/portfolios. Recent (relative) strength in some assets is welcome … but one swallow does not a summer make, and we are conscious that there are still tough times ahead. Using hindsight with where we are now, we do still believe the future is bright and that we will reflect on these investment conditions more favourably in future than we do right now.

Term or word(s) to watch: power cuts. We have already heard about ‘worst case scenarios’ from the leaders of the UK power industry, but we believe we can expect much more noise around this topic, especially if the dark economic winter is accompanied by a hard meteorological one. We don’t expect to see power cuts in the UK but would warn that we should be prepared to read more and, yes, there is the possibility that we all have to adjust our expectations in this regard come the new year in particular…

North America - November 2022

October saw the Dow Jones post its best month since 1976 with US indices generally producing stellar returns. Hopes that this would be the start of something more sustained rather than a bear market rally ran into reality after the latest Federal Reserve (Fed) announcement. So much of the positive case for equities has come to rest on the materialisation of a policy ‘pivot’, but the comments from Jay Powell suggest the bulls have been far too optimistic, far too early. Focusing on inflation is the priority for now, probably meaning rates will stay higher for longer than previously expected, and this will provide a stiff headwind for equities in the US and elsewhere. In reality, there are still many unknowns and it is possible to construct perfectly valid bull and bear cases for US equities, though to us the risks to the downside, especially after such a strong recovery, look more compelling. The bulls will suggest that any recession will be mild and that an eventually less aggressive Fed will ultimately help improve sentiment, but it might take some sort of financial instability risk for the direction of travel to change.

Recent corporate earnings have been mixed, though the market has actually dealt well with the disappointments there have been and supported the bull case. Sentiment was in such a poor state that almost anything would have provided reasons for a rally. Perhaps most striking though is how the wider market has contended with the poor results from the large tech names such as Meta and Alphabet. Their numbers highlighted a considerable amount of weakness in the consumer spending and advertising space, and this would typically give pretty clear clues as to an upcoming recession. Though those individual names saw their share prices suffer, the wider market was pretty sanguine.

This month also brings the mid-term elections in which the Democrats are widely expected to lose control of the House of Representatives. This means divided government, which in turn means it is much less likely that any spending or stimulus plans will be able to be passed. Given the reliance on such measures to maintain markets and corporate profits in the tough times, this might be a relevant and not attractive development for risk assets.

The first social media site in a form similar to those we are now used to (based on a web of contacts model) was thought to be Six Degrees, created in 1987. It was set up by US entrepreneur Andrew Weinrich and its name was inspired by the six degrees of separation theory of Stanley Milgram.

Valuations have become more attractive (at least before the recent rally), but to say they are outright ‘cheap’ would be ridiculous, especially given the headwinds from policy makers. There will be a time to add more here, but this will come when we have a better view of how 2023 plays out.

Europe - November 2022

Inflation is going nowhere quickly and the latest German data was pretty shocking (11.6%). The whole continent is battling a figure north of 10%, 7% excluding energy, and the European Central Bank (ECB) is finally waking up. October saw a 75bps increase in its main rate and the response to the latest data from Christine Lagarde was ‘defeating inflation is our mantra, our mission, our mandate’.

How this commitment stands up under pressures from a deteriorating economic environment is another matter entirely. It is not even clear that inflation has peaked yet and there is an inevitable delay in how long it takes for consumers to feel the true impact of higher prices.

The energy problem has not gone away – this winter may be bearable given the gas storage is running at high levels, but next year might be a different story. The headwinds look considerable some way out. Having spent a decade not wanting their currencies to appreciate too much, the fear of inflation now means that central banks are getting more competitive with each other in terms of monetary policy to prevent a weak currency from creating more price pressures. This is why the ECB is in such a difficult situation – the economy is not as robust as that of the US, but if rate hikes materially lag those of the Fed, the euro will be soft, and more inflation will be ‘imported’. UK gilts have hogged the headlines of late, but European sovereign debt still has the potential to cause major difficulties. Relief has been found of late in that area as Germany has suggested that it may favour some sort of support for joint debt, but how this pans out is unclear. This is another market – not unlike US Treasuries – where liquidity is much worse than previously with widening bid-offer spreads. This is something that will be closely watched by those looking for stresses in the financial system as rates go higher.

There are currently around 280 million Instagram users across Europe, making it the second most popular form of social media after Facebook, with users spending almost 30% of their time on the internet on these platforms.

The rather cliched ‘there will always be good companies in Europe’ is of course true, but as in other geographies, corporate earnings expectations and margins remain very elevated. Profits have been resilient so far, but a lot of this is attributable to energy and currency effects and analyst expectations are still suggesting that margins will actually increase in 2023 across most industries. Next year might bring a dose of reality to both these expectations and valuations, as recession becomes realised. We are not looking to increase exposure at this point and European allocations are modest.

Rest of the World - November 2022

October saw the important Chinese Communist Party (CCP) Congress take place and – disappointingly for some observers – continuity of policy and ambitions was the theme. China continues to focus on strong economic growth as part of its policy roadmap with focus continuing to shift towards innovation and becoming technological leaders. The congress saw the appointment of allies of President Xi Jinping to the top decision-making bodies, further cementing his grip on power.

Many market watchers had been hoping for a move away from the ‘zero Covid’ policy, which has seen lockdowns introduced in major cities, disrupting economic activity; however, perhaps given its strong association with President Xi, this was not changed. Vaccination rates remain low, particularly among the elderly in China, and questions remain over the effectiveness of Chinese-developed vaccines. Elsewhere there was no further support for the troubled housing market, although this was more predictable as keeping house prices flat and affordable is a goal of the Party.

According to the World Economic Forum, global internet users spend on average 2 hours and 27 minutes a day on social media. It is perhaps no surprise that the younger demographics of emerging markets see them top the charts, with Nigeria and the Philippines spending an average of just over four hours a day. At the other end of the scale is the ageing population of Japan with around 50 minutes per day.

Elsewhere the Presidential election in Brazil saw a narrow win for challenger Lula da Silva, beating right-wing incumbent Jair Bolsonaro by 50.9% to 49.1%. Given the closeness of the vote, it is generally expected more moderate economic policies will be enacted, which is positive for markets. At the time of writing, however, Mr Bolsonaro has not conceded defeat but seemingly has begun the transition of power, although should he contest the results it might lead to months of unrest.

We don’t have direct exposure to China at present although recognise it will be an increasingly important part of global markets over the coming decades. We also have no direct exposure to Brazil or the wider Latin America region, although we have selective exposure through emerging market strategies. One area in the emerging markets space that looks interesting is Mexico, a potential beneficiary of shorter supply lines, but high inflation, particularly against the backdrop of a strong US dollar, means there are plenty of headwinds that see us prefer other regions at present.

Commodities - November 2022

October was a particularly strong month for oil and gas companies, with the MSCI World Energy index rising by 16%. Stocks in the sector were boosted by higher oil prices, on the back of a 2 million barrels per day production cut by OPEC+. Despite already high prices and strong demand, the cartel cited a desire to avoid a crash in the oil price in the event of an economic slowdown as the rationale for cutting supply.

The decision has wider, geopolitical ramifications, strengthening ties between Saudi Arabia and Russia. With energy accounting for more than half of Russian exports and oil accounting for around 85% of that number, higher prices are key to propping up the Russian economy in the face of sanctions. Unsurprisingly, US officials were less than impressed by the decision and President Biden ordered the release of yet more petroleum from reserves to try to keep prices down at the pump. Indeed, the US President appears increasingly frustrated with the situation, threatening oil companies with windfall taxes unless they do more to lower prices.

Publicly, resistance from oil firms to higher taxation has been limited, though there is almost certainly a great deal of lobbying behind closed doors. In the UK, a move from a pro-oil, Truss government to Sunak’s more hawkish stance is undoubtedly a negative and there is now a suggestion that windfall taxes could rise from 25% to 30%. This takes the tax rate on profits to an eyewatering 70%. However, record breaking profits continue to flow and Q3 numbers were strong again, across the board.

Just Stop Oil is a movement that has gathered a lot of traction through social media. The group demand that the UK government halts all future licensing for fossil fuel exploration and production. With 32% of our energy coming from fossil fuels, we have a long way to go to reduce our reliance on oil and its use in manufacturing is often overlooked … indeed it is often used to make glue!

We retain exposure to traditional energy companies for more adventurous investors. Valuations remain attractive and more widespread allocations to the sector continue to be discussed.

Property - November 2022

Property is often thought of as a defensive asset class, delivering an attractive level of income and steady capital returns. For those investing in listed property shares and real estate investment trusts (REITs), recent returns have challenged this assumption. During the middle of October, the iShares UK Property ETF, which invests in a basket of property shares and REITs, was down as much as 40% year to date, significantly more than broader UK equities.

The main reason for the fall has been the upward movement in bond yields, diminishing the relative attractiveness of property income. As a reminder, 10-year gilt yields pushed up to 4.5% in October, exceeding the yield available on many listed property vehicles. Having endured years of low interest rates, many investors reached for returns from real assets (i.e. property and infrastructure). With yields pushing up and a less than rosy macroeconomic environment, investors headed for the exit, sending share prices tumbling.

More broadly, sentiment towards the sector has been weak. Higher borrowing costs and a squeeze on tenants from a range of areas stalk the sector. Goldman Sachs published a particularly negative piece, flagging a 15–20% fall between June 2022 and the end of 2024. With so much negativity about, it was no surprise to see open-ended property funds restricting withdrawals, once again bringing into question the suitability of holding an illiquid asset class in a liquid fund structure.

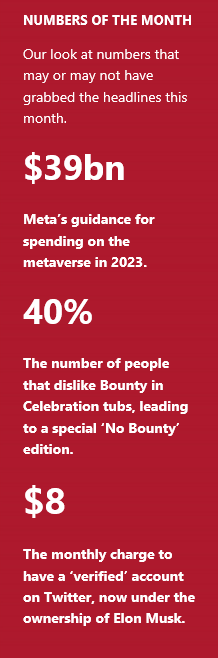

If you believe Mark Zuckerberg, then the metaverse will limit our need for physical offices and our work life will be experienced through a virtual reality headset. Meta’s share price suggests that this is not a vision that the market shares!

We prefer to take an active approach to property investing, which has shielded us from some of the pain endured by benchmarks. The asset class remains a useful diversifier, but recent moves serve as a reminder of the volatility that listed assets in the space can bring.

Technology - November 2022

As October drew to a close, investors eagerly awaited quarterly earnings results from the US technology titans including Meta, Alphabet and Amazon. Spirits were initially high prior to the release of the results but hopes were swiftly dashed as Q3 earnings from Microsoft and Google parent Alphabet were weaker than anticipated.

Investors were disappointed as they had hoped these companies would be resilient in the face of an economic slowdown, but a combination of pressures including a stronger US dollar, falling consumer demand and geopolitical tensions (including US restrictions on the Chinese semiconductor industry) weighed on results. Alphabet and Microsoft both suffered their worst one-day share price declines since March 2020, closing down 9.1% and 7.7%, respectively. Facebook owner Meta disappointed too with its share price dropping over 20% as it reported a decline in Q3 revenue.

Amazon’s results then extended the surprisingly disappointing season of earnings, reporting that it expected revenues to come in between $140bn and $148bn in Q4 – as much as $15bn less than the figure forecast by analysts. To add insult to injury, Texas Instruments Inc., a bellwether for the semiconductor industry, gave a forecast that was weaker than analyst estimates.

Following these results, a number of companies announced cost-cutting measures with many admitting that they had perhaps over-invested and expanded prematurely during the pandemic. Recently, ride hailing service Lyft and payment processor Stripe have both said they will be laying off a number of staff – 13% and 14%, respectively, with Amazon announcing it will pause new hires. Job growth is expected to have cooled over October for a third consecutive month signalling that the Federal Reserve’s rate hikes are having their intended effect.

The pinnacle of social media site Myspace was in 2005. The site had 25 million users and was the fifth most popular site in the US when it was sold to NewsCorp that year. And that was the start of its decline from popular to passé.

Clearly, we are seeing a share price correction in the technology space following the pandemic that had acted as a short-term sugar rush for technology earnings. Given that the restrictions on movement we saw during the earliest days of the pandemic turned out to be temporary, technology companies that expected demand to remain at 2020 levels and over-expanded accordingly have been punished. Over the long term, however, we still see an incredible opportunity for companies in areas like cyber-security, cloud computing and business critical technology.

Fixed Income - November 2022

This year markets have responded to a somewhat united stance from developed market central banks. In order to tame runaway inflation, we have seen the US Federal Reserve (Fed), Bank of England (BoE) as well as, although late to the party, the European Central Bank (ECB) raise interest rates to levels not seen for at least a decade. This has caused pain across the board for fixed income assets as bond yields rise alongside interest rates and, as you may know, rising yields equate to a fall in capital with those bonds (with higher duration faring the worst).

Now, we may be seeing signs that central bank policy is beginning to diverge for the first time since the onset of the Covid-19 pandemic. On 2 November both the Fed and BoE raised interest rates by a further 75 bps as part of an ongoing effort to subdue inflationary pressures. However, the rhetoric from the leaders of each institution was worlds apart. While BoE Governor Andrew Bailey indicated rates are unlikely to increase much higher than current levels, Fed chair Jay Powell warned that interest rates would peak at a higher level than previously expected. ECB President Christine Lagarde too recently said there is ‘still a way to go’ on raising interest rates to counter record inflation.

The BoE is constrained in its ability to raise rates by the UK housing market. In the UK, a majority of households have short-term mortgages, whereas in the US the average mortgage term is 30 years, giving the Fed more leeway to raise interest rates without causing intolerable damage to the housing market and household finances.

In the UK, two million mortgages are due to be rolled over in 2023, which constrains the Bank’s ability to continue aggressive rate hikes. Prior to the press conference, the market expected UK rates to climb to 4–6% in over to tame inflation, but the Bank made it clear that it would likely come in lower.

In order to fund Elon Musk’s $44bn Twitter takeover a group of banks (including Morgan Stanley, Bank of America and Barclays) lent Musk an eye-watering $12.7bn. These banks are now preparing to hold the debt until early next year as credit investors now lack appetite for higher risk technology bonds. A headache for the banks involved but at least they may get their verified blue tick free of charge!

Although some areas of the fixed income market now look more attractive than they have for years, we retain a degree of caution around the space. We favour higher quality bonds in this environment as we remain concerned about the trajectory of global growth over the next 6–12 months.

The Monthly Market Commentary (MMC) is written and researched by Simon Gibson, Richard Smith, Scott Bradshaw, Jonathon Marchant and Lauren Wilson for clients and professional connections of Mattioli Woods and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future. Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

The MMC will always be sent to you by the seventh working day of each month, usually sooner, is normally delivered via email, and is free of charge as the MMC is generally made available to clients who have assets under our management in excess of £200,000, and to all clients under our Discretionary Portfolio Management Service (DPM). Normally, the MMC costs £397 + VAT per annum. Professional advisers and their clients should contact us if they are interested in receiving a monthly copy.

Sources: All other sources quoted if used directly; except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.