United Kingdom - April 2021

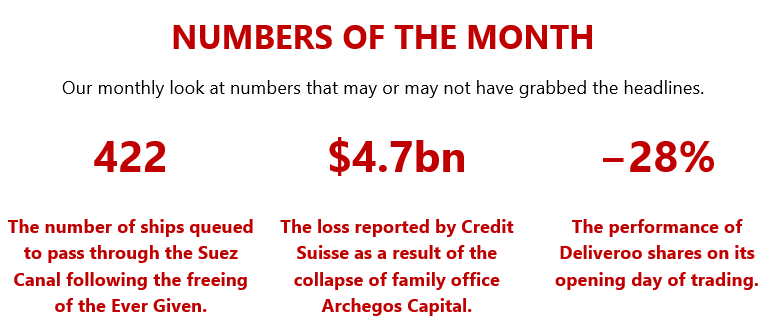

Our theme this month is waterways. Any ‘navigable body of water’ or indeed any river, canal, sea or route for travel by water seems to be the generally accepted definition. Last month we chose boundaries as our theme. It was also only last month that we wrote ‘more vessels traverse the Northern Sea Route each year and choose it with good reason. It is some 40% shorter than via the Suez Canal (from Northern Europe to China and back) and 60% shorter than going via the Cape of Good Hope.’ The Suez Canal has really been in the headlines since, and there is a link to our thinking on asset management.

Historically, the first trading posts were more often than not placed near navigable waterways and today, the stock exchanges of the world are the waterways for equities to be traded. Keeping those routes/markets open is as important to investors as the Suez Canal has been to the billions of pounds worth of merchandise held up by the unfortunate blockage caused by the Ever Given. While minor compared to the Covid-19 pandemic, this incident has had an impact on GDP growth.

The pandemic has delivered the worst recessionary conditions in living memory. More than that, this isn’t even a once in a 100-year event, more like a once in a 300-year event, as it was the early 18th century when we can last see records suggesting UK and European growth fell so sharply, then as a result of the Great Frost. The coldest European winter of the last 500 years, this saw lakes and rivers freeze over and brought horrendous economic hardship, especially to those less well off.

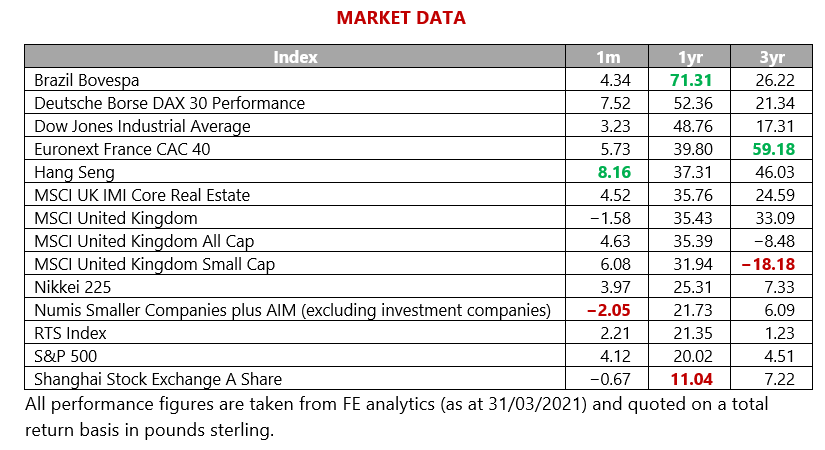

Are there opportunities for investors after a remarkably good year given the conditions? Yes, we truly believe there are. While individual indices and certain sectors may struggle to see growth, and we might reasonably see a scaling back of some of the more eye-watering valuations, we do firmly believe that equity investors, with suitably diversified portfolios, will be rewarded relative to the risk(s) taken.

As you can read later, cash deposits will not keep pace with inflation, whether you are in the ‘it’s going up and staying up’ camp or ‘it will be temporarily high this summer then fall back’ camp. This means we have Hobson’s Choice – take the risk for potential returns or use cash and guarantee falling spending power.

The UK economy is recovering a little quicker than estimates produced even in January. Nevertheless, we do not see GDP recovering to pre-pandemic levels until 2022, and that assumes we end lockdowns as currently outlined in the PM’s roadmap (for England but one can probably look at similar dates for all of the UK). Looking ahead is the only option … and there are brighter skies in that direction; we may just all have to be patient.

Term or word(s) to watch: price – the natural third element after we covered demand and supply in the last two months. The law of supply and demand affects prices of goods and services. So, what of those prices? Typically, when supply exceeds demand, prices fall, and vice versa.

Increasing prices (inflation), if not initially, will usually result in reduced demand, other than for the most essential items. For some products and services, demand is less sensitive to price than others. Consumer perception can also play a part. If there is a perception that, for example, toilet rolls are in short supply, prices could rise, even if the facts do not support the perception. Can a restaurant that is almost always fully booked charge a little more for food than one that always has tables available?

Monetary policy, typically seen in action via the use of interest rates, is also impactful on pricing. It is usual that when rates are lower (as now) more people borrow money, providing impetus to demand. Raising rates can dampen demand and with it prices, bringing inflation down.

Today, we are in a most unusual circumstance – monetary policy is extraordinarily loose, with historically low interest rates. Demand has been tempered due to the pandemic/lockdowns, as have certain supplies. Quite what happens when demand (not pent-up, just a return to the norm) rises and supplies (subject to the idiosyncrasies of Brexit conditions, perhaps) are more normalised is anyone’s guess.

North America - April 2021

Regular readers will know of our hesitation when it comes to the US equity markets. Pockets of excellence yes, but so many areas to which we would be wary of having too much exposure. This has naturally led us to focus more on specialised sectors for portfolios, with healthcare, global insurance, technology and others making up the majority of our US exposure. So, let’s revisit this topic of valuation in some more detail. It is fair to say that there is a mismatch between absolute metrics that one might use to assess US equities (metrics focused on equity oriented measures from a historical perspective) and relative metrics (that focus on how expensive equities are relative to other economic variables and asset classes).

Focusing on the former, the case for valuations being high is pretty solid. Metrics such as enterprise value/sales, enterprise value/EBITDA, forward price/earnings ratio and price/book value all suggest the market is about as expensive (overall) as it has been in almost any previous time period. However, the picture does look different when one looks at the alternative, relative metrics.

To a large degree this is a reflection of the view that equities are not expensive compared with bonds. So if one looks at the earnings yield on stocks (their earnings divided by share price, so the inverse of the price earnings ratio) and compare it to, say, 10-year Treasuries or investment grade credit yields, then they look cheap on a relative basis.

As one would expect, the US boasts some impressive canals – the longest ever built being the ‘Wabash and Erie’. It was over 450 miles in length and allowed shipping traders access from the Great Lakes right down to the Gulf of Mexico. The last canalboat sailed on the Wabash in Indiana in 1874 but other sections of it closed down much earlier. The latest infrastructure drive in the US is likely to focus on areas other than waterways, but it should not be forgotten what a crucial role they played in the country’s development.

Of course, both equities and bonds could prove to be expensive, which means that even given these contrasting metrics, both could see valuations fall over a given time period, but the contrast is interesting. For us, those high absolute metrics cause us sufficient concern to make us doubt the appeal of the relative ones. The US equity market feels uncomfortably expensive – opportunities will lie in the rotation within equity styles and within particular sectors and themes. This is how we will continue to approach a challenging space.

Europe - April 2021

Continental Europe continues to struggle with the pandemic, with a third wave of the virus spreading, which has seen France impose a third national lockdown. As we have previously covered, the slow rollout of vaccination programmes has meant the reopening of European economies lags other regions. Europe has also struggled to contain the B.1.1.7 variant, first identified in the UK, which is more infectious. In particular France, the Netherlands and Germany are seeing a worsening of the pandemic. Not every nation is in the same position, however, with Italy and Sweden near their peaks and rates declining in Portugal, Spain and the Czech Republic.

The pandemic continues to impact different economies in different ways, with those most exposed to the service sector typically hit hardest. Tourism has been practically mothballed in many nations, although there are signs that some southern European nations will be opened at a limited capacity.

Despite Russia having four of the longest five canals in the world, China has the longest waterways. At the other end of the scale, the islands of Kiribati have just 3 miles of waterways.

While we have touched upon the differences between countries, Europe is broadly a leader in many industries and perhaps most prominently in green technologies. With a number of nations targeting economic stimulus towards the energy transition, Europe provides another example of how the fortunes of companies and countries can diverge.

We invest in companies not economies and while the third wave in Europe is a significant headwind for services businesses, there are plenty of interesting world leading companies listed in Europe.

Japan - April 2021

Japan can be confusing both culturally and from a market perspective. Sumo is a sport that everyone should watch at least once in their life, but it’s hard to get one’s head around. Japanese equities have caused a similar confusion for overseas observers over recent decades. For now though, things are looking more comfortable.

Japan seems to have recovered from the disappointment over the Covid-stricken Olympics, and hopes are high for both that event and the wider economy for the rest of the year. The equity market valuation gap to other markets has narrowed and last year was truly exceptional for relative returns.

There are two ways in which the market could be a particular beneficiary of trends in the global economy. Industrials and manufacturing make up a greater proportion of listed stocks in Japan than they do elsewhere, resulting in a disproportionate benefit from a pick-up in global growth. Aside from this dynamic, but still associated with growth, we also have the possibility of inflation.

Japan is a country that has laboured to try to inject some inflation into its economic system for decades. The new economic regime might yet mean that this materialises, which would be a considerable boost to sentiment. Within reason, mentality could be changed by a development such as this, leading to a pickup in consumption and the return of truly bullish instincts to the economy and markets. If this doesn’t happen, investors have access to a market that is much cheaper than its developed peers. And the performance in the health crisis has been pretty good too. True, the pace of mass vaccination has been slower than elsewhere, but the actual crisis was not as deep in Japan as it was elsewhere.

Though few non-Japanese are aware of it, Tokyo is actually built on top of hundreds of rivers and canals. Though four rivers converge on the city (the Arakawa, Sumidagawa, Edogawa and Tamagawa), there are water sources all over the city although the process of industrialisation and development has seen many of them neglected. Attempts to reconnect the city with its waterfronts are ongoing – perhaps the Olympics will help the process of reinvigoration?

We have been concerned at times that the Japanese equity market may be stalling, but for now feel reassured that the allocations in portfolios are justified.

Asia Pacific - April 2021

We are now a few months into President Biden’s term in the US and while perhaps not as aggressive, relations with China remain tense. In a meeting in Anchorage last month, top foreign policy officials from both nations saw diplomats lashing out at each other, something that has historically been kept behind closed doors. The US continues to press China over its actions in Hong Kong, its stance on Taiwan and its treatment of the Uyghur population.

Geopolitics have also seen China’s new trade agreement with the EU come under pressure, with the European Parliament now seemingly unlikely to ratify this. This follows sanctions placed on various European diplomats by China in response to apparent criticism over Hong Kong.

The Grand Canal in China is the world’s longest at a length of 1,104 miles. It connects Beijing, Hebei, Shandong, Jiangsu, Zhejiang and Hangzhou. Despite being nearly four times as long as the UK’s Grand Union Canal (286 miles), it has just under a tenth of the number of locks compared to the London-Birmingham connection (24 v 236).

The question of profit over principle has long been a part of investing in China and with the increased focus on environmental, social and governance (ESG) factors from Western investors, this can clash with China’s domestic policies. For foreign companies operating in China, this can cause problems where the decision is split between following the standards on the ground or those of the domestic investor base, where different.

China continues to be a driver of global growth as the ‘economic centre of the world’ continues to shift East. While President Trump is no longer in office, the tensions between the US and China look set to continue, with Europe and Australia also now involved as multilateralism is seemingly returning under President Biden. We remain positive on China for now but with one eye focused on potential conflicts over principles.

Emerging Markets - April 2021

Emerging markets were always going to find Covid-19 and its aftermath exceptionally challenging, and we have seen a number of warnings issued now about the obstacles that lie ahead. The latest has come from the IMF head, Kristalina Georgieva, who thinks that the ensuing rise in global bond yields could lead to a tightening of financial conditions that threaten some emerging market economies.

US government bond yields have been moving out and are indeed now at their highest level since January of last year. Typically, this sort of move leads to capital outflows from emerging markets as investors can again obtain decent returns from lower risk countries.

A classic reference point here would be the taper tantrum of 2013 that led to some significant falls in emerging market bonds. Those in the firing line are going to be the ones with the usual weaknesses – high debt levels (pre-Covid, now exacerbated by the crisis) and a high dependence on external countries to finance those borrowings.

A specific problem is provided by the impact that Covid-19 restrictions are having on some countries’ tourism industries, which will compound these difficulties. Early April should see the IMF agree to new measures that will provide currency reserves to troubled countries, thereby avoiding the need for more debt to be issued in the short term and measures like these will be important in holding off developing crises.

Much excitement is surrounding the transition to a green economy across the globe, but it is natural to question whether this is affordable and achievable for all. Certainly more developed countries can embark upon this exciting new growth avenue, but many emerging economies may struggle. Really, the combination of the debt issue and the lack of resources to participate in the new growth arena are examples of how the strong are advantaged in times of stress and the weaker often find the challenges piling up.

The US and China seem to be the best placed in terms of their ability to register a quick rebound in economic growth rates and the latter continues to be a key part of our emerging market strategy.

There are likely to be pockets of opportunity provided by other areas – not least perhaps the commodity producing emerging markets due to the recovery in the commodity complex and the developing growth/inflation dynamic – but a tighter focus still looks warranted to us.

Spotlight on: ESG - April 2021

ESG has dominated investment concerns and literature over the last few years and it feels as if we are living through a period where it is becoming embedded in investment culture. There is still much debate about what actually constitutes an ESG strategy and what is the optimum way of implementing the ideas in portfolios, but its worth is now accepted.

This does not mean of course that we should not be alert to some of the critical voices in the space and some of the warnings about the possible unforeseen consequences. And this is not just a point about valuation bubbles that have started to appear in clean energy and other areas of the green investment space.

Some of the companies that will find it naturally easy to score well on ESG will be some of the larger technology companies. But there are other issues here. Many of them can easily avoid taxation given the way their operations straddle countries in a unique way and this surely has to count as a negative from a social point of view.

Beyond this, it should be remembered that many of these companies are high capital, low labour employing industries. If ESG is going to determine capital flows to companies, we have the possibility that it is going to favour those who employ fewer people, with major impacts on society.

We’re not going to improve societies and our environments a great deal if we have large parts of the labour force with no prospects and poorly funded public projects. So scoring well on conventional ESG criteria might not be enough to make a company truly attractive.

Water is an increasingly popular form of investment and one that is usually highly ‘ESG compliant’. Access to adequate water supplies looks as if it will become a real issue in the decades to come, not least due to climate change. Opportunities exist in water purification, pipeline construction, environmental services and specialist technology, and there are investor vehicles ranging from ETFs to funds.

ESG is incredibly important and we take it very seriously. However, this does not mean being swept up in the trend unthinkingly and some of the points above are extremely valid and timely. It is an evolving piece and to truly assess the impact that companies have on society, we may have to think more creatively.

Fixed Income- April 2021

The more constructive outlook for the global economy enabled by vaccinations and the reopening of economies continues to impact global fixed income securities. The accompanying stimulus from various governments – most notably the US – has seen the conversation shift over the last six months from the worries of the economy growing too slowly, to now questioning whether growth is too fast.

As we have previously stated, we invest in companies not economies, and it does not follow that because an economy will do well, that the underlying stock market will too. An economy that is perceived as growing too quickly increases inflation fears, causing central banks to raise interest rates, therefore reining growth in.

Rising rates are generally perceived as negative for bonds (as yields have an inverse relationship with capital values) but also a threat for equities as the risk-free rate – that is the return on government bonds, generally accepted to be that of US Treasuries – is higher.

A higher risk-free rate means that the value of future cash flows produced by companies is worth less when discounted back to today, causing equity prices to fall.

The need to tackle inflation by raising rates will be keenly focused on by markets for the medium term, and particularly over the shorter term where inflation is likely to give some elevated readings given the base effect. For example, changes in energy prices last year will fall out of the inflation basket, causing a temporary spike. Much debate will centre around how sustainable the inflation is, or whether it is just a temporary rebound.

So far, we have seen increased anticipation of higher rates causing bond yields to rise; however, it remains to be seen how much further this will continue. It does not seem realistic that interest rates will increase any time soon, with the US Federal Reserve’s Federal Open Market Committee’s projections from the middle of March suggesting increases in the US are unlikely before the end of 2023.

There has also been the repricing of inflation expectations, with 10-year breakeven rates in the US having increased from just under 2% at the end of 2020, to 2.37% at the end of March according to the Federal Reserve Bank of St. Louis. Given the amount of spare capacity in the global economy, it seems unlikely that inflation will be persistently higher, so we have probably seen the majority of moves in bond yields this year.

Bonds have seen yields increase (as capital values have fallen) on concerns of tightening fiscal conditions. Inflation readings are likely to be volatile given the base effect, but the persistence of the inflation needs to be considered. While we continue to view equities as the best asset class for current conditions, we still view bonds as playing an important role in portfolios.

Commodities - April 2021

In the first half of 2020, gold came into its own. A cocktail of widespread fears over the economy and high levels of fiscal stimulus, which in turn led to question marks about inflation and currency devaluation, helped to send prices rocketing. One year on from the depths of the crisis, fiscal stimulus continues to stoke the global economy and things appear to be running hot.

While inflation has historically been supportive of the gold price, bullish sentiment towards risk assets is a significant headwind. Emboldened by still low interest rates and massive amounts of stimulus, sentiment in the equity market is overwhelmingly positive. For gold, as a defensive asset, this is not good.

Gold investors also keep a close eye on real yields, with prices generally benefiting as real yields fall. With inflation rising, 2020 presented a particularly appealing set of circumstances for gold, but bond yields remained stubbornly low, as investors remained cautious about the economic outlook. More recently, US treasury bond yields have risen sharply, at a faster rate than inflation expectations, causing real yields to rise. This has been painful for gold investors.

It is difficult to know when bond yields will stop rising and central banks may find themselves walking a tight rope for some years to come. Some inflation is a good thing, as it reduces the size of significant government debt piles in real terms over time. Too little and the economy could stagnate and, having used immense fiscal and monetary firepower over the past decade to keep things moving, central banks could be left with limited options to drive growth. Too much inflation and the consequences for consumers and businesses could be dire.

The Klondike Gold Rush saw around 100,000 gold prospectors migrate to the Klondike region of the Yukon, Canada, which centres around the Klondike river. Over a three-year period, late on in the 19th century, many tried to make their fortunes seeking gold along the banks of the river. A handful were successful, but most returned home within a few years.

Gold proved its worth in the depths of the stock market selloff last year and the fact that it has suffered in a period of strong equity markets is not a surprise to us. In fact, it cements its case as a diversifier in portfolios. If we do see higher inflation, the quantity of debt in the economy means there might not be a lot that central banks can do about it. This puts downward pressure on real yields and could help gold to shine once more.

Property - April 2021

Woolworths, BHS and Toys R Us would have all been seen as high quality tenants 30 years ago. All three large corporate entities, with access to plenty of financial support and popular shopping destinations in their own right. Wind the clock on and they no longer exist, illustrating quite how brutal disruption can be to certain businesses and sectors. Despite having ceased trading a number of years ago, some landlords are still feeling the effects of store closures.

Data from Local Data Company (LDC), reported by Property Week, revealed that 38% of Toys R Us stores remain vacant across the country, with 16% of them undergoing structural change or being demolished. Former Woolworths stores fared better, but around 10% of the stores lie vacant 12 years after their collapse.

With demand for industrial and residential properties seemingly insatiable, surely it would make sense to repurpose former Toys R Us and Woolworths stores? The reality is that the rent a landlord can charge to a retail tenant is much higher than an equivalent industrial tenant. As a result, it is likely that owners of former Toys R Us units would prefer to wait, in the hope that the likes of B&Q, Home Bargains or Halfords take up space, rather than leasing at a lower rate for industrial use.

Industrial assets are also far more complex than they appear at first glance. Tenants have stringent requirements around access for lorries, loading bays and the overall shape of a unit, which can mean that conversion for industrial use is not as straight forward as it may seem.

For former Woolworths landlords, there are positive noises being made by councils around the repurposing of retail space for residential use, but again, whether this will make sense for the landlords from an economic perspective remains to be seen.

We like our property managers to have contingency plans in place, as well as strict due diligence processes. Assessing alternative uses and having healthy relationships with major national tenants can help to ensure that properties remain occupied and rental income continues to flow through to shareholders.

Responsible Assets - April 2021

European car makers appear to have awoken from their slumber and are becoming more brazen in their guidance on electric vehicle production. In March, BMW announced that they expect at least half of their car sales to be electric. Considering they delivered 2.5m new cars in 2019 and the business has nine years to meet their target, it is a bold move from management.

VW has made similar predictions around future sales, but news that both businesses will be directing a greater level of capital expenditure to the area was well received by investors. However, relative to peers, BMW and VW might be considered to be behind the curve. Volvo appears to be taking the transition most seriously, stating that, from 2030, it will only sell electric cars.

The acceleration of capex by European car manufacturers should cause concern for Tesla, which many appear to have already concluded will be the ultimate winner in the shift to electric vehicles. True, the technology at their disposal is impressive, but it appears to be an increasingly competitive market.

Picking a winner in an industry that is in its infancy can be extremely risky. Technology in the clean energy space is progressing at such a rapid rate, that some may question whether electric cars are even the way forward, let alone whether or not Tesla will be the world’s largest car manufacturer. Hydrogen is an area that drew a significant amount of attention from investors in 2020 and appears to have enormous potential.

With so many variables involved, it is prudent to assess the entire value chain for opportunities and identify businesses that win, regardless of who the largest car maker will be. Miners and manufacturers of semi-conductors seem like a good place to start, somewhat ironically given the potential for negative environmental impact from both industries.

Currency - April 2021

UK investors, especially those taxed and spending their income in the UK, don’t have to worry about currency fluctuations, do they? Unfortunately (or fortunately depending on direction), the impact on prices (see earlier) of a stronger or weaker sterling can have a big impact on inflation, and unless one’s income is perfectly inflation-linked (almost impossible), this does really matter.

The spending power of £1 can rapidly change based on currency movements. We notice it most when this happens while on holiday. It happens in a less transparent way at home through changes in import prices and the successes and failures of exports. Ensuring our assets, and income in particular, are able to cover the potential (and sometimes stealthy) moves of inflation should always be in our minds.

UK Interest Rates - April 2021

One of our editorial team was lucky enough to be on a call with the Bank of England last week, and the anticipation of negative rates has, thanks to the economic outlook and resulting market forces, apparently disappeared. Nevertheless, the Bank themselves say that, unless inflation becomes more ingrained (they do not expect that scenario), rates will not be raised this year … or perhaps even next! We fully expect an inflation spike in the next few months before that measure falls back within the 2% target by year end.

The Monthly Market Commentary (MMC) is written and researched by Simon Gibson, Richard Smith, Scott Bradshaw, Jonathon Marchant and Lauren Wilson for clients and professional connections of Mattioli Woods, and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future. Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

The MMC will always be sent to you by the seventh working day of each month, usually sooner, is normally delivered via email, and is free of charge as the MMC is generally made available to clients who have assets under our management in excess of £200,000, and to all clients under our Discretionary Portfolio Management Service (DPM). Normally, the MMC costs £397 + VAT per annum. Professional advisers and their clients should contact us if they are interested in receiving a monthly copy.

Sources:

www.bbc.co.uk,

www.bloomberg.com,

Financial Express,

www.thedragonsblade.com,

www.express.co.uk,

www.pitstoppin.co.uk,

www.vr-12.com,

www.smalltalkbigresults.wordpress.com,

www.mmn.com,

www.avantida.com,

www.plazmedia.com,

www.sibcyclinenews.com,

www.viewzone.com,

www.anonw.wordpress.com.

All other sources quoted if used directly; except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.