Global markets summary - March 2024

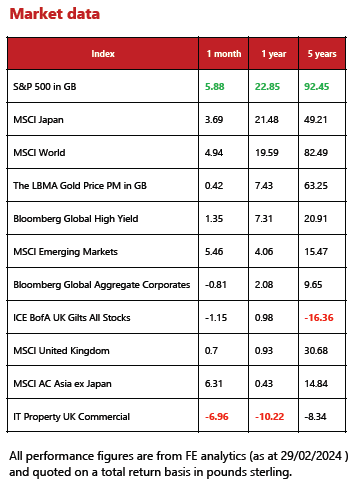

Following a tepid start to the year, the continued resilience of the US economy put a spring in the step of equity markets over February with most major indices ending the month in positive territory.

Last month, we noted that February saw us enter the year of the Wood Dragon according to the Chinese lunisolar calendar, a creature associated with enhanced vitality and creativity. Well, this month, investment markets may just have made us believers in this ancient mysticism, as February saw Chinese shares experience a dramatic rebound. The rally in Chinese equities led most emerging markets higher, with the Asia Pacific region benefiting most. The outperformance of emerging markets bucks the prevailing trend for the past 18 months, but it is a little too early to tell if it will last.

In developed markets, the US and Japan were the strongest areas, with the former driven by the seemingly relentless enthusiasm for mega cap technology companies, and the latter reaching a new all-time high for the first time in over 30 years. UK equities were the clear laggard, with smaller companies faring slightly worse than their larger peers.

In contrast, February was a poor month for most sovereign bonds as investors further reduced expectations for central bank interest rate cuts over 2024. Shorter-dated and higher-risk segments of the market – such as high-yield corporate credit and emerging market debt – outperformed.

We have had a busy start to the year repositioning portfolios in line with our current views on markets. Our expectation for interest rates to remain higher for longer has led us to become more cost-focused than ever and as such we have reduced external manager fees within our core strategies by removing expensive thematic funds and accessing a similar spread of companies via a blend of active and passive regional funds. Our increased exposure to US and European equities (as well as our long-term holding in Japanese equities) has been a helpful contributor to recent performance, where we continue to focus on larger companies with more defensive characteristics.

United Kingdom - March 2024

The MSCI United Kingdom index returned +0.70% in February, with momentum spilling over from the latter half of January. Like most other markets, UK equities continue to be driven by inflation and interest rate expectations. Towards the start of the month, the Governor of the Bank of England had signalled that inflation does not need to fall to 2% before rate cuts would be considered. News that the UK has entered a technical recession (i.e. two successive quarters of GDP contraction) supported the thesis that we could be returning to a lower rate environment sooner rather than later.

The banks however, will be hoping that interest rates stay higher for longer. As a reminder, the core of a bankʼs earnings are based on their net interest margin (NIM), which is effectively the difference between what they pay to savers and charge to borrowers. Increasing the spread between these two numbers and the overall profitability of a bank is easier in higher interest rate environments.

It was a busy month for banks this month, with almost every UK-listed name reporting. With the exception of HSBC, who is enduring its own China-related issues, the market reacted positively to the overall results. While some of those reporting produced weaker than expected numbers, the common themes among them were cost cutting and shareholder distributions.

What really caught the eye of the market was the quantum of capital that could be distributed by banks in the coming years. Indeed, Barclays announced that it expected to pay £10 billion of dividends and share buybacks by 2026, which is staggering considering the business was valued at around £22 billion at the time of the announcement. With most banks trading at material discounts to the value of their assets, balance sheets looking robust and the potential for significant shareholder distributions, could banks finally be about to deliver after over a decade of underperformance?

We certainly think that the risk/reward dynamics in the banking sector are interesting at the current point in time. Low valuations and the quality of balance sheets help to provide a margin of safety, should things get more difficult from a macroeconomic perspective. We retain exposure through our UK equity allocations.

North America - March 2024

US markets had a triumphant February, with the S&P 500 marking its strongest first two months of the year since 2019. The uptick was driven by some well-received corporate earnings; over 90% of S&P 500 firms have now reported fourth-quarter earnings, with around 75% beating analystsʼ forecasts. Corporates have remained surprisingly resilient in the face of higher interest rates primarily thanks to the unprecedented levels of cash generated by pandemic support and other fiscal stimulus measures.

There is little change in the narrative that the US economy remains robust. Data released over the month generally demonstrated ongoing economic resilience and, although annual inflation (as measured by the consumer price index) slowed to 3.1% in January from 3.4% in December, the core CPI component (which strips out food and energy prices as these can be volatile) was up 3.9% year-on-year, in line with Decemberʼs reading. Against this backdrop of a strong labour market and inflation potentially easing on a shallower trajectory, it is no surprise to see rate cut expectations shifting towards ‘higher for a bit longerʼ.

Interest rates remaining elevated could be a headwind for certain companies (those viewed as more growth-orientated or in need of refinancing) and as such we expect the outperformance of larger, more established and cash generative companies to persist. A slightly better growth outlook for 2024 means equities have been much more immune to the prospect of higher-for-longer rates compared to last year. Consensus 2024 GDP growth is now at 2%, compared with below 1% during the second half of 2023 – hardly stunning figures but enough to appease equity investors.

Reading this, it would be reasonable to ask, are we not wary of all the euphoria around the US, particularly during an election year? It may surprise you to learn that the US market is actually at an all-time high more often than you might think; of the 1,176 months since January 1926, the market was at an all- time high in 354 of them, so thatʼs 30% of the time. While elections often cause short- term sentiment-driven volatility, it is important to remember that markets are non-partisan. Indeed, there is some evidence that divided government has historically correlated with stronger market returns, perhaps because government gridlock creates less policy uncertainty and somewhat enshrines the status quo.

As we wrote last month, we have updated our view of the US equity market as consumer confidence continues to grow and we see core inflation moderating in line with the Federal Reserveʼs target. As such, our Balanced portfolios currently have c.20% exposure to US equities, with a focus on the larger, most resilient companies.

Europe - March 2024

European equities have lagged US peers over the past year due to the slower pick up in earning expectations. So far this year, it does not look like much has changed; only 44% of reporting companies beat expectations compared to the regionʼs long-term average of 55%. According to Bank of America, this makes it Europeʼs second worst earnings season for ten years.

Before we get out the balloons and cake for a pity party, there are some compelling reasons to expect a stronger performance from the region over the rest of the year. Growth for the region has been revised marginally higher and although this was driven primarily by a better external outlook, domestic demand is also expected to recover as falling inflation and interest rates later in the year should support a recovery in household spending.

While the European Central Bank has stuck to its cautious tone around interest rate cuts, data released over February supports the narrative that inflation is continuing to moderate with eurozone inflation (as measured by the Consumer Prices Index) easing to 2.6% from 2.8% in January. This is supportive of monetary policy loosening towards the middle of the year. There were also some signs of improving business activity as the Purchasing Managersʼ Index (PMI) rose to 48.9 from 47.9 in January. As a reminder, PMI data is based on surveys of companies in the manufacturing and service sectors and as a reminder, a reading above 50 indicates growth while below 50 indicates contraction. This recent print suggests that the worst may be over for the region.

We maintain an allocation to European equities within core portfolios. In Europe, some 23% of the market is made up of healthcare stocks such as Novo Nordisk, Novartis, and Roche and we continue to see strong drivers of demand growth across the healthcare sector as the industry normalises following the disruption of the Covid-19 pandemic.

Rest of the world - March 2024

Chinese equity markets had hit five-year lows coming into the month; however, stronger activity data over the Lunar New Year holiday period and supportive measures from the Chinese Government (including curbs on short selling and stock purchases by state-owned investment firms) sparked investor interest. This change to the near-term outlook for China led to a rally across Asia Pacific markets. However, we remain cautious on Chinese equities given that the planned fiscal stimulus remains relatively small in the face of weak consumer demand, falling factory output and a real estate crisis.

Outside of China, South Korea was buoyed by rising exports in February (4.8% higher compared with a year earlier) driven by strong demand for semiconductors while ongoing investor enthusiasm for AI-related stocks and technology companies led Taiwanese equities higher.

The Japanese stock market continues to ride high on the back of corporate governance reforms, a weaker yen, earnings improvement, and strong foreign investor interest with the Nikkei 225 reaching its highest level in 37 years in February. This is despite a weaker than expected fourth-quarter gross domestic product (GDP) print, which put the country into technical recession over the second half of 2023.

The stronger return from the Nikkei over the TOPIX reflects the fact that the rally was led by large cap stocks while smaller companies continue to lag. It is notable that across most equity markets the largest firms are increasingly outperforming their peers. We expect this to continue over the short term as large cap quality companies with defensive characteristics are more likely to outperform during periods of uncertainty.

We maintain a measured position, relative to risk appetite, in broad EM and Asia Pacific equities as we expect stronger growth in developed markets, in particular the US, to have some positive spill over to emerging markets. We also acknowledge the potential for areas like Mexico, Thailand, Malaysia and Indonesia to benefit from supply chains relocating out of China.

Fixed income - March 2024

Investor hopes for central bank interest rate cuts over 2024 further declined causing most sovereign bonds to perform poorly over February. Major global government bond market yields increased across the board (meaning prices fell) with the US 10-year yield rising by 0.29% to 4.24% and the UK 10-year yield increasing by 0.32% to 4.12%.

US January inflation numbers were stronger than anticipated, with headline inflation at 3.1% year-on-year, driven mainly by the shelter component. The core measure registered the largest increase since April 2023. This led market participants to dial back some of their enthusiasm for immediate rate cuts and drove yields higher. Similarly in the UK, wage growth fell less than expected in December, prompting investors to scale back their rate cut forecasts for the Bank of England, given that stronger wage pressures suggest inflation might prove stickier than anticipated.

In contrast, credit markets (company debt) outperformed, buoyed by a relatively positive economic outlook and an interest rate environment that looks set to provide longer-term support.

We continue to believe a blend of fixed income assets, including developed and emerging market sovereign debt, investment grade and some high-yield credit, is appropriate for investors with a balanced approach towards investment risk. Given our view that interest rates have peaked but will be held higher for longer, we have kept overall duration (interest rate sensitivity) on the shorter side.

Ask us anything - March 2024

Welcome to the first edition of ‘ask us anythingʼ, where one of our Investment team will answer your most burning questions (within reason of course). This month we have tackled one of the big ‘what ifsʼ of the year.

Q: What happens if the Labour Party wins the next general election and specifically how would it impact sterling?

A: While we are mindful of the impact of currencies over the longer term, we see these as more speculative over the short term given the high level of unpredictability. With this in mind, in response to the question of what impact a Labour Party victory in the next general election might have, we do not see this as a particularly significant event. In our view, geopolitical tensions (especially in the Middle East) and the US election are comparatively more significant for global markets. Furthermore, unlike the last UK general election in 2019, the difference between Starmer and Sunak is far less extreme than Johnson (hard Brexit) and Corbyn (nationalisation of industries). The UK Government balance sheet also does not have much headroom to implement major policies, nor are we anticipating any significant increase in borrowing. Whoever is in power will have little influence over global events, including the actions of central banks, with relative interest rates likely to be the main driver of currency pairs.

In terms of broader views on sterling, we have a strategic partnership with T. Rowe Price, which provides us with insights on currencies. Its current views on sterling are as below:

- relative to US dollar – they expect the US dollar may soften slightly in a more benign market environment, with the US economy slowing and the US Fed likely to lead on rate cuts, and the UK likely to be less aggressive in cutting rates

- relative to Euro – they expect sterling to slightly weaken versus the Euro given declining UK consumer confidence

- relative to Yen – they expect sterling to weaken slightly as the Yen remains a safe- haven currency; Bank of Japan policy changes may also see the Yen strengthen further

The Monthly Market Commentary (MMC) is written and researched by Scott Bradshaw, Lauren Hyslop and Jonathon Marchant for clients and professional connections of Mattioli Woods and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investorʼs circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future. Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

The MMC will always be sent to you by the seventh working day of each month, usually sooner, is normally delivered via email, and is free of charge as the MMC is generally made available to clients who have assets under our management in excess of £200,000, and to all clients under our Discretionary Portfolio Management Service (DPM). Normally, the MMC costs £397 + VAT per annum. Professional advisers and their clients should contact us if they are interested in receiving a monthly copy.

Sources: All other sources quoted if used directly; except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.