United Kingdom - October 2021

Our theme this month is game shows. Call My Bluff and The Price Is Right seem to be good places to start. In the former, teams took each other on to ‘sell’ two incorrect meanings of a word while also describing the correct third option. In the latter, contestants could win prizes based on correctly guessing prices. Both are pertinent in October 2021 – what is the meaning of ‘shortages’ and what price will people pay for goods that are in short supply?

These shortages (labour/goods/commodities) don’t necessarily impact us all every day, but they are significant enough to impact the country economically, which in turn will affect everyone. For example, driving an electric vehicle has probably felt pretty good in the last few weeks; however, getting into the car park at the supermarket that also has a petrol station attached, well, not so much fun (and even not possible on some occasions). With prices rising (not universally, but more broadly now than they were a few months ago) and concerns for supplies in the coming weeks, a winter of discontent (originally coined for 1978/79) is being discussed, at the same time as the PM is promising not to ‘cancel Christmas’. Plenty to think about.

Elsewhere, Party Conference season is in full swing (we will avoid positing on the relevance of Would I Lie To You? and I’m Sorry, I Haven’t a Clue), we have a date for the Autumn Statement (Budget – 27 October) and, as ever, hindsight is a wonderful thing. Inflation that hangs around a bit, that isn’t as transitory as some (us included) believe (see Term to watch below) is one to watch out for, as is the (usually very well considered) wording from the Bank of England when they talk about interest rates in the next few months.

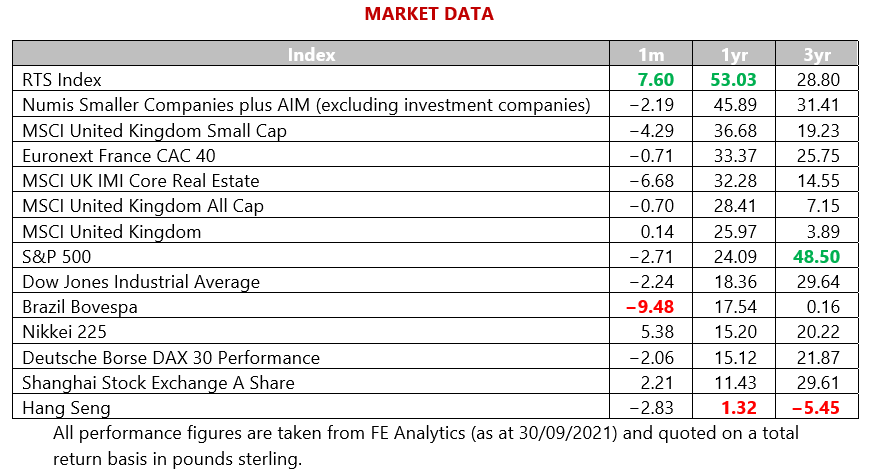

All in all, returns on diversified portfolios over the last year, and longer, look too good to be true, and yet they really have been delivered. The question is, can investors expect to see positive returns in the coming year and beyond in a climate of uncertainty, lower economic growth and increased tension between countries around the world? We believe the answer is yes, though the numbers are likely to be lower than in recent times.

Last month, we stated here ‘we are nostalgic for some short-term certainty’ and that is as true today. Since then, we have seen significant shortages, both in the provision of energy and indeed the delivery of same. Supply side issues include the product and the retailer, and we really haven’t seen the like for many years, with plenty of folk predicting a ‘return to the 70s’, whatever that means. Maybe we should all look forward with confidence and belief and leave the nostalgia to historians, looking back at this time, years from now.

Term or word(s) to watch: stickyflation – yes, we made it up (though please read on). Here’s what we are thinking. Inflation usually follows the growth cycle, both on the way up and on the way down. Now, central banks are warning of a lurking scenario of global growth declining over the next 12 months, while inflation remains ‘sticky’ (i.e. stubbornly high, perhaps unresponsive to higher interest rates).

The recent inflation surge is caused by supply problems, mainly in essential goods such as food and energy. These are, to varying degrees, non-discretionary and in some poorer countries take up the bulk of household incomes. Even in the relatively well-off UK, it is notable. The result is that people continue to pay for these goods, but then, by dint of overall levels of spendable income, consume fewer discretionary goods such as entertainment, white goods and other manufactured and service sector goods. Inflation remains, and short term it is sticky, even as the total consumption of goods, and an economy’s output, is falling. The big question is, will it remain sticky? Stickyflation – a word to look out for … and it turns out it was first used by the Institute of Directors around 13 years ago (though barely at all since) – we didn’t know, honest guv.

North America - October 2021

September saw the worst month for the S&P 500 since the pandemic induced sell-off in March 2020, driven by global concerns on inflation and the potential for rates to rise, along with concerns of wider contagion from troubled developer Evergrande to the wider Chinese property market (more on that later). Inflation concerns have been spurred on by higher wages and higher energy costs (including transportation), which are also likely to weigh on corporate margins in the short term, particularly where costs cannot be passed on to consumers.

Rising inflation is a concern for many, as higher inflation devalues the value of future cash revenues in today’s terms, meaning equity prices suffer.

The US Federal Reserve have also been signalling that they will be tightening monetary conditions, with guidance that the reduction of the pace of the monthly ($120bn) purchases of US debt and US agency-backed mortgage securities bond buying programme could begin in November. Chairman Jay Powell signalled this with his comments that the ‘substantial further progress’ criteria towards the 2% inflation and maximum employment targets had been achieved.

The so-called ‘dot-chart’ showing when members of the interest rate setting committee has also moved expectations of when the next interest rate might be, with indications this could be in the second quarter of 2022 rather than in 2023.

The US gameshow Jeopardy! is often rated by polls as the most popular in the US and with daily streaks possible, the top three total prize winners (US game shows) have all appeared on the show. This includes most successful ever US contestant Ken Jennings, who won $4,522,700 (c. £3.3 million) as part of his overall winnings of $5,223,414 (c. £3.8 million) across five different game shows. Jennings is now one of the hosts.

Politics have also been in the headlines with three important issues that President Joe Biden is trying to pass on:

- Passing a spending bill to keep the government open, which was achieved the day before parts of the government would have been shut down.

- Raising the debt ceiling, which would allow the US to borrow more to meet its debt obligations. Divisions between the Republicans and Democrats has meant a bipartisan solution has not been found. While the Democrats have a majority that could deal with this on a partisan basis, differences within the progressive and moderate elements of the party have seen a public disagreement on how much to raise the ceiling by.

- Passing the $1.2 trillion infrastructure package, where there are also political divisions on different programmes, the most contentious being on expanding welfare spending.

The debt ceiling has so far been negated by ‘extraordinary measures’ by the US Treasury, with the debt limit technically being reached at the end of August and these measures keeping things going. The Treasury has warned that these will run out by 18 October, giving Congress little time to find a solution.

Inflation and rising rates are the most noteworthy considerations for investors in the medium term; however, the tail risk of a default from the debt ceiling is significant and we remain watchful on political developments and ready to take appropriate tactical action. Covid-19 has not gone away, and further waves could set back the fragile US economy. On a valuation basis, we continue to prefer other overseas markets, accessing appropriate areas through our thematic approach.

Europe - October 2021

Eurozone growth slowed through the third quarter as the spectre of inflation there continued to weigh on shares. Supply chain pressures and energy price surges pushed inflation higher in the region’s largest economy. German inflation accelerated at a higher pace than expected in September, up 4.1% year-on-year (on an EU-harmonised basis) compared with 3.4% in August.

This data highlights how global cost pressures are mounting. Despite signs that recent supply chain problems could last longer than expected, the eurozone does look on track for a return to above-trend growth over the fourth quarter and into 2022.

The vaccination programme got off to a slow start, but now vaccination rates are high and overtaking the US. The Delta Covid-19 variant has only dented rather than derailed the European recovery, and stock market valuations remain low versus most developed markets.

The euro area is also set to receive more fiscal support than other regions, with the EU’s pandemic recovery fund only just starting to disburse stimulus. Monetary policy looks to remain broadly positive over the medium term too. Early in the month, President of the European Central Bank (ECB) Christine Lagarde appeared keen to assuage markets, emphasising that the bank has not shifted into policy tightening mode.

Lagarde did announce that the Bank has tapped the brakes on its pandemic stimulus programme, deciding to buy bonds at a slightly slower pace in the next three months. She insisted, however, that the move does not constitute a ‘tapering’, as the size of its pandemic emergency purchase programme (PEPP) will remain unchanged.

Lagarde gave a balanced view of the economic outlook, saying that growth could be stronger than expected if consumers spend more of their savings accrued during lockdown, but also pointed to downside risks such as the possibility that the pandemic worsens.

Equities also benefit from greater political certainty, as the results of the German election show that it will likely take a coalition, probably of three parties, to form a government, with neither the far left nor far right parties likely to be involved. So, we can expect minimal changes to the status quo.

It’s not often that we get rewarded for being bad at something, but that’s exactly the premise of The Very Worst Driver of Netherlands. In fact, during the finale of the first season the presenter and a camera operator were hit by the final ‘winner’ resulting in the presenter being hospitalised.

We currently expect more cyclical upside for economic growth outside the US and believe that European equities have the potential to outperform in coming quarters. Performance from the region could be particularly strong should we see an uptick in economic activity, Delta-variant fears subside and yield curves in Europe steepen given the region’s exposure to financials and cyclically sensitive sectors such as industrials, materials and energy.

We have recently added to our European equity exposure in places and continue to believe that the region is well placed to overtake the US in terms of economic recovery in the medium term. Similar risks apply, it’s just that they seem to have been ignored in some US listed valuations.

Japan - October 2021

As you have already read, September has proved to be a challenging month for many equity markets – how often this has been the case in history. While developed market peers have struggled to tread water at best, Japan has posted decent positive returns (though is clearly not immune from global level sell-offs). Much of this can be accounted for by some of the developments to which we have made reference in some of our other publications.

The momentum that was generated by PM Suga’s resignation has continued to drive the market and significant inflows of foreign capital have been registered since. A new stimulus package is expected following the election of a new leader, Fumio Kishida, and this should mean more support for companies and households alike. The ideal candidate – from the market’s perspective – had been Taro Kono, the administration’s reform minister, but investors will be more than comfortable with the election outcome.

There is an element of Japan ‘catching up’ here too, as it is behind most developed markets when it comes to vaccination rollout programmes. The automotive industry has felt a lot of pressure recently and a likely easing on this, with a resolution of the semiconductor supply difficulties, would also boost sentiment.

Not only has Japan led the way in terms of equity markets, but it is also not to be outdone on the gameshow front. Most people are familiar with Takeshi’s Castle but what about Ultimate Beastmaster or even Adventure Gonzilland! In terms of games featured from some of the more outrageous shows we invite you to take your pick from Marshmallow Rubber Band, Man Eating Spaghetti in a Dryer and Human Slip’n’Slide. Many others cannot be referred to in a family publication.

There are not too many equity markets that one could add to now with a great deal of confidence and so special situation type narratives are especially attractive. No market exists in isolation of course, but the Japan story does seem to tick a lot of boxes at the moment and is a plausible destination for any redistributed equity assets.

Asia Pacific - October 2021

In recent months it has felt as though we ought to give China its own section in the Commentary. A more aggressive stance from Beijing in both domestic and foreign policy has certainly grabbed the headlines, but the pattern of events has become increasingly troubling.

Having effectively seized control over large areas of the South China Sea in recent years, and tightened its grip in Hong Kong, it appears that Taiwan is the latest territory to feel added pressure from Beijing. While not new, the upscaling of military activity alone is nevertheless troubling (see next page).

Suggestions that Taiwan has any kind of sovereignty are not tolerated by the Chinese Communist Party, and tensions have been simmering for decades. While it may feel a trivial, news last month that Washington was considering a request from Taiwan to rename its US offices from ‘Taipei Economic and Cultural Representative Office’ to ‘Taiwan Representative Office’, was met with anger by Chinese officials. Lithuania approved a similar request in July, which led to China recalling its ambassadors and requesting the removal of Lithuanian counterparts.

In September it was announced that Taiwan had applied to join a major transpacific trade deal, only weeks after China had made its submission to join. The bid to join leaves current members in a predicament. Allowing China to join first would give them the opportunity to block Taiwan from the deal. Allowing Taiwan to join first would almost certainly lead to economic aggression from China.

It isn’t just economic aggression that the international community fears. Towards the end of the month, Beijing ratcheted up its military aggression towards Taiwan, sending a record number of military planes into the Taiwanese buffer-zone and engaging in manoeuvres close to US and ally ships on an exercise. Invasion remains a real threat for Taiwan, should pro-independence rhetoric gather momentum.

Nan Sheng Nü Sheng Xiang Gian Chong was a Chinese gameshow where contestants faced a timed obstacle course. The programme is based on the US gameshow Wipeout, which has a somewhat catchier name. The title translates as ‘Race Forward, Boys and Girls!’ and managed two series before being cancelled.

Another worrying trend in China is the state of its financial sector. We cover the Evergrande saga in the next section, but our allocations to Asia and China specifically remain an almost constant source of discussion within the team. No changes for now.

Emerging Markets - October 2021

The main story in Emerging Markets and Asia has been the troubles at Chinese property developer Evergrande. While an exact figure is illusive, some estimate the level of debt at the developer at over $300 billion (£220.2 billion), which is bigger than the national GDP of Finland.

The group sprang to prominence by borrowing aggressively to expand, and last year’s imposition of financial constraints on borrowing and debt levels at developers by the Chinese government have now caught up with Evergrande, which had previously been forced to offer big discounts on new properties to keep ensuring the required level of cash flows.

While the debt level is large, most of the liabilities are to creditors such as suppliers, rather than being all corporate debt. Indeed, Evergrande represents about 0.3% of the total debt market in China, so in isolation the failure is manageable. Concerns in the market, however, rotate around potential contagion to other developers and those suppliers not getting paid. This did lead to a market sell-off after Evergrande missed its debt payments last month.

Consumer confidence in the housing market might also be impacted, particularly if those who have prepaid for a development do not see this delivered. At the time of writing, shares in the firm and a rival Hong Kong listed developer have been suspended due to an ‘upcoming transaction’.

Much of China’s growth has come from its property market and the issues at Evergrande are likely to slow the pace of development. The actions of the Chinese government (indirectly) here and in other sectors (such as education and entertainment) illustrate the higher intervention risks in Emerging Markets generally and China specifically. We continue to like China with a long-term time horizon and support managers with high ESG integration. We expect volatility in the short term, particularly at individual sector level.

Spotlight on Energy - October 2021

It would be impossible to have not noticed that the energy markets are grabbing a lot of attention at the moment. Whether this is from a reading of the financial press regarding the significant moves in oil and gas prices affecting various countries, or our own inability to fill up with petrol, the coverage is unavoidable.

Those blasé about the threat posed by rising inflation have probably had to temper their views in recent weeks, as the potential for higher energy input prices to trickle through the rest of the economy is very real. It might not be a return to the oil price shock of the 1970s, but it certainly cannot be dismissed as an unimportant mover for markets.

While we fret at home about availability of fuel (largely due to supply side issues and a lack of delivery drivers), China has its own peculiar energy problems. Tight coal supplies and emissions regulations have hit production hard and there is now rationing being imposed in several regions. This is likely to impact both Chinese economic growth and also exacerbate the supply chain issues that are being experienced globally.

Commodities have often been a good hedge against an inflationary environment, but this does not mean that playing the energy theme is straightforward.

The energy markets are notoriously volatile and playing them in a reliable way can prove difficult. Portfolios may have some degree of oil and gas exposure, but our preferred theme of the environment means higher exposure to cleaner forms of energy, which should benefit from increased awareness of difficulties in the space.

Fixed Income - October 2021

Investors are fretting about the fixed income space as the possibilities of higher inflation expectations and rate rises, or at least meaningful tapering, are hovering on the horizon. The approaching impasse over the debt ceiling, though ultimately likely to blow over as it has done previously, is certainly not helping matters.

The US 10-year yield has now moved back above the 1.5% level, which may not sound dramatic but represents a significant increase over the level from just a few months ago. If matters do quickly escalate and there is a major move away from Treasuries, capital losses could leave investors feeling both frustrated and rather foolish. It has after all seemed clear that the fixed income markets could stage a reversal at some point with yields as low as they have been.

The action is not contained within the US bond market either. As is often the case with global sovereign bond markets, there have been similar moves elsewhere, with UK gilts also selling off (not least because of some country-specific inflation risks at home) and eurozone bonds also under pressure. The number of comments from central bankers suggesting a more hawkish turn have certainly increased and investors have quite abruptly woken up to some of the risks involved. Of course, this comes at a time when jumping into other areas of fixed income or equities bring their own risks, thus compounding the problems for asset allocators.

We have tried to maintain a balanced position here, acknowledging the risks while at the same time staying invested where we think adequate diversification is on offer. It has been a difficult balance to achieve, and our concerns have been sufficient of late to see us reduce our Treasury holdings where they were greatest – in defensive and cautious portfolios.

Commodities - October 2021

There are two potential lessons from the Covid-19 pandemic. The first is a reminder of how resilient the human race is; the second is an insight into how fragile our supply chains are. As already mentioned, the latter was brought into focus in September and early October, with gas prices soaring to record highs, causing a ripple effect through a range of industries.

So, what has caused the price to spike? As with most commodities it comes down to supply and demand. A particularly cold winter in Europe last year and hot weather in Asia depleted reserves. Lower exports, particularly from Russia, have exacerbated the situation on the demand side.

Higher gas prices have significant ramifications for businesses and consumers. Households look set to be hit with double digit price rises this winter, as utility companies seek to pass on the rise in wholesale gas prices. The consequences for those companies that have less resilient balance sheets and significant portions of fixed rate contracts in place, have been dire. In September alone, nine UK-based energy firms buckled under the pressure of higher prices, affecting over one million customers. While the majority have been reassigned to existing providers, some of those firms that remain have bemoaned the idea of taking on customers on loss-making contracts.

The crisis poses significant issues for heavy industry in particular. British Steel warned that its power prices had increased 50-fold, claiming that current prices make it impossible to produce steel profitably at certain times of the day. For steel, where margins are typically thin and electricity makes up roughly 20% of the cost base, the crisis is deeply concerning. Outside of steel, two large UK fertiliser plants, which supply roughly 40% of the domestic market, have been forced to close, sparking potential shortages of ammonium nitrate that could hit food supplies.

Going for Gold was a BBC One gameshow that ran for almost a decade, having first been aired in 1987. The basic premise was that contestants from different European countries competed against each other to answer questions and win a prize. Yes, it does feel a little flimsy, but somehow it managed a remarkable 703 episodes.

With our focus predominantly on physical gold and precious metals miners, we feel that we have some protection from inflationary pressures that could result from the current situation. Energy firms are potentially interesting, but investor pressure concerning ESG matters is likely to keep a lid on share prices.

Property - October 2021

London’s commercial property market has obviously had a tough time recently. In some areas, such as the West End, footfall declined by almost two-thirds over lockdown, an almost impossible dynamic for any business in the space. Making any sort of prediction as to how this will recover over the next 12 months is fraught with difficulty, but there are a few encouraging signs.

Footfall numbers for August were acceptable, and the return of workers to offices in the capital and the likely pick-up in tourism will help. Will working from home continue to act as a meaningful drag? In all likelihood it is an established trend, but some office space will still need to be maintained of course.

Falls in net asset values and persisting fears over working practices could of course present an interesting buying opportunity at these levels. Residential property has endured (or rather enjoyed) a better crisis than has its commercial peer – the housing market is reported to have been operating at record levels given various forms of support from the government, and listed housebuilders have benefited.

Raise the Roof, which ran from 1995–96, saw contestants compete to win a house. The consolation prize was Bob’s (Bob Holness, the host) Bungalow – a teapot in the shape of a cottage.

The pace of recovery differs area to area, but it is important to remain opportunistic and not rule out the most affected from consideration. We have maintained a highly diversified selection of property vehicles over recent years and this balanced approach seems advisable as a clearer picture emerges of the post (or living with) Covid-19 landscape.

Responsible Assets - October 2021

Another month, another Greta Thunberg speech chastising world leaders for their inaction. The young climate activist took aim at Boris Johnson, among others, slating their ‘empty pledges’. While some of the pledges do seem on the distant horizon and commitments can be loose, progress is being made. All too often, the debate on climate change is filled with piousness and criticism and it is time to inject some positivity!

Last month alone, in the UK, the first converted electric-only forecourt was launched. The site in Stretford has eight charging points, which are able to put 100 miles of charge on car batteries within ten minutes. The new E10 fuel became the standard option at the pumps, containing 10% bioethanol and helping to cut greenhouse gas emissions from petrol engines. Significant sums were pledged to innovation too.

Ofgem and Innovate UK are pushing companies to come forward with proposals to decarbonise energy networks, with £450m of funding in the hopes of turning the UK into the ‘Silicon Valley of energy’. The UK government also tapped the bond market for the funding of environmental projects. It’s first ever sovereign green bond package raised £10bn, with Reuters reporting that orders topped £90bn, surpassing all previous records on UK debt issuance.

On top of that the world’s longest under-sea electricity cable transferring green power from Norway to the UK became operational, with the capacity to import enough hydropower to supply 1.4m homes. All of that from one country, in one month.

Yes, there is more that can be done, but sometimes there is nothing wrong with a bit of back slapping!

Currency - October 2021

Sterling fell around 2% against the US dollar in September … hardly ‘wild’ especially compared to some crypto ‘currencies’ … nevertheless, as we look ahead, pressures in the UK suggest that there may be more currency volatility ahead than we have been used to in recent times.

While supply chain issues are not uniquely British right now, the extent of lost business opportunities and slower/lower consumer spending may yet impact the pound against the US dollar and even the euro. It is probably not a tough call to suggest that we should expect more volatility in currencies in the coming weeks, and perhaps in sterling in particular.

UK Interest Rates - October 2021

Hold the back page (well, nearly) but maybe, just maybe, the Bank of England will have to consider a (modest) interest rate rise rather sooner than they have been suggesting. As recently as August, the Bank was suggesting that a modest rate rise next year was the most we should expect. Now, Governor Bailey has done more than hint – rates could go up even this calendar year. He acknowledges this is a tough call to make, not least as the nascent economic recovery is not even yet toddling, much less striding around with its chest puffed out.

The Monthly Market Commentary (MMC) is written and researched by Simon Gibson, Richard Smith, Scott Bradshaw, Jonathon Marchant and Lauren Wilson for clients and professional connections of Mattioli Woods, and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future. Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

The MMC will always be sent to you by the seventh working day of each month, usually sooner, is normally delivered via email, and is free of charge as the MMC is generally made available to clients who have assets under our management in excess of £200,000, and to all clients under our Discretionary Portfolio Management Service (DPM). Normally, the MMC costs £397 + VAT per annum. Professional advisers and their clients should contact us if they are interested in receiving a monthly copy.

Sources:

www.bbc.co.uk,

www.bloomberg.com,

Financial Express,

www.thedragonsblade.com,

www.express.co.uk,

www.pitstoppin.co.uk,

www.vr-12.com,

www.smalltalkbigresults.wordpress.com,

www.mmn.com,

www.avantida.com,

www.plazmedia.com,

www.sibcyclinenews.com,

www.viewzone.com,

www.anonw.wordpress.com.

All other sources quoted if used directly; except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.