United Kingdom - October 2022

We all like to receive a gift, don’t we? What about the unexpected gift? It can be a double-edged sword and some gifts are very much unwanted. We have unearthed a few interesting items for you this month. Prompted by the ‘gift’ of tax cuts from Chancellor Kwarteng, some of which went down as well as U2’s infamous ‘free’ delivery of the album ‘Songs of Innocence’ in autumn 2014 (via Apple iTunes), we have looked at other examples of largesse over the ages.

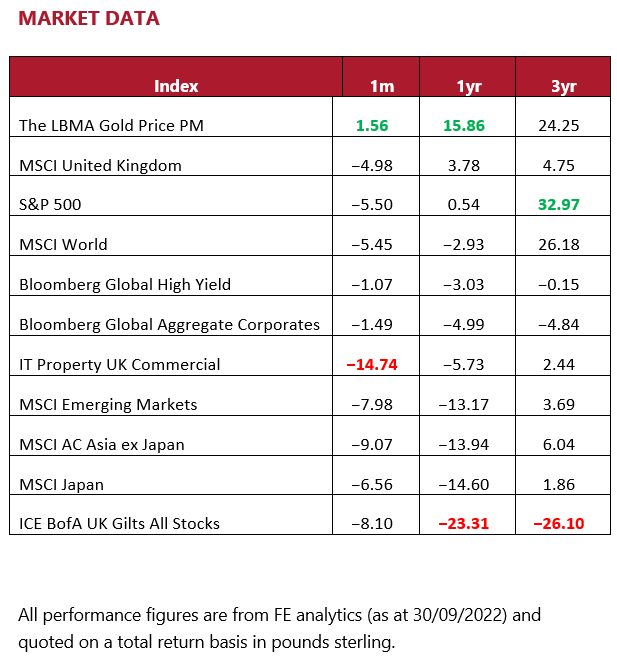

The tax cuts, combined with concerns that they really were about as unfunded as you can imagine, and following less than 24 hours after a less than enthusiastic response to the Bank of England’s latest rate rise (0.5% when pretty much everyone expected 0.75%), created a mini run on sterling. Almost reversed now, just a fortnight or so later, it nevertheless serves to illustrate quite how rapid (and painful/joyful) movements in currency markets can be, even for a currency like sterling, which wouldn’t (normally) be in the list of basket cases.

Though we have stated this many times before, it is worth repeating – the economic growth rate of a country and the fortunes of equities listed in that country do not always match; however, in a longer period of ‘economic downturn’ is it reasonable to expect a higher correlation between the two? Can we see, for example, a period of pressure on UK equities that have their earnings closely linked to the fortunes of UK plc if we simultaneously see a lengthy recession? Of course.

But what about ‘other’ UK listed equities including multinational, large cap names? The benefits they enjoy from weaker sterling may not outweigh the negative sentiment towards the UK, especially from overseas investors who have also to think about the prospect of further weakness in the pound.

UK assets are undeniably under pressure and, just because sterling investors can worry less about weaker sterling than overseas investors, this does not mean they can be relaxed about exposure to the UK economy. Those stocks whose fortunes are particularly aligned with those of the domestic economy – certain areas of mid and small cap, for example – are trading at very cheap valuations, reflecting a moderate recession, but poor sentiment means that they could get cheaper still. Opportunities will be thrown up by this shake-out – until we have confidence in the economic and even (very short-term) the political outlook (the sort of thing we usually say about emerging markets), we will not add to our UK allocations. Nevertheless, we can see a time when we do …

The Bank of England now has an even trickier task – to manage sterling (unofficially) and inflation (officially) while setting interest rates at the ‘right’ level for both. Inflation in particular is an unwanted gift from a) President Putin, b) the post-Covid-19 supply side issues and c) cheap money, which has been in the markets for so long now. Being invested sensibly, but remaining watchful, certainly not panicking, these are the attitudes we recommend for the foreseeable future.

North America - October 2022

One of the reasons that so many commentators have argued that the US is not going to face a true recession (though we’ve already had the standard two quarters of negative GDP growth!) is the strength of the US jobs market. Indeed, its very strength has been a cause for concern because inflation is unlikely to be curtailed unless the Federal Reserve can slow down this part of the economy – with all the unfortunate implications this brings. Recent data has continued to suggest that the market remains robust with initial jobless claims falling and wage growth remaining something of an issue.

If we look very closely at some of the data, however, a slightly different picture can be painted. It looks from the payroll data as if more people are taking second jobs – a reflection of the difficulties facing less well-off sections of society. This is distorting figures, with ‘job openings’ also a little misleading as the criteria for a job opening are quite loose based on not always firm hiring intentions. Also, unemployment is a lagging indicator – the rate generally picks up when the economy has been slowing for some time.

Elsewhere, housing looks pretty troubled and company inventories are a problem for investors (see recent Nike results). Earnings estimates are still stubbornly high and look, frankly, unrealistic. Meanwhile the Federal Reserve has moved into a very hawkish mood and its quantitative tightening programme has stepped up.

The Statue of Liberty, dedicated in 1886, was a gift from France to the US to commemorate the alliance of the two nations during the French Revolution. It has become a symbol of freedom and was designed by Frederic Bartholdi with its metal framework constructed by Gustave Eiffel.

Yes, valuations are lower, but it is perfectly possible we get another leg down here. US equities do have the attraction of being priced in the global reserve currency, which overseas investors see as a tremendous asset at the current time. Long term, its investment credentials are clear, but a stronger dollar will likely weigh on corporate earnings and valuations have some way to go to entice us to increase allocations.

Europe - October 2022

Things really don’t look as if they are improving here. The energy crisis is looming as we head into the colder months of the year and OPEC’s support for the oil price is not exactly providing a tailwind for European economies. German inflation has come in at 10.9% for the 12 months to September and some economists are warning that the continent’s largest economy could contract by up to 8% next year – almost unthinkable. European markets have been weak as indeed most have, but it still feels as if insufficient bad news is being priced in. What is the response going to be here? The ECB is surely limited in its capacity to respond to inflation given the fragility of European sovereign debt markets and the already weakening economies. When we look at the difficulties in the UK gilt market (more on that later), it is difficult to see how strong advances in European yields are not going to cause serious problems at institutions on the continent.

Just as sterling has been overwhelmed by the dollar and the large cap multinationals have benefited, so too euro weakness can translate into the increased relative attractiveness of large cap names. Some of these names are even in more defensive sectors like healthcare, but still it can be dangerous to place too much emphasis on the translational effects of currencies. A real crisis in Europe cannot be dismissed as a possibility now, and overseas investors will take little time to remove assets from a perceived danger zone. The banking system has been on rocky foundations for a long time and concerns that have surfaced around Credit Suisse over the past week are very concerning and inevitably make investors think back to 2008–9.

The European Union has a long history of gift-giving with the rotation of presidencies of the Council often seeing the giving of luxury clothing and gifts to diplomats and journalists. The Finnish presidency broke with this tradition though perhaps compensated by giving Santa an accreditation to the last European Council summit!

Our allocations to European equities are relatively low, but we have engaged in long discussions over whether positions should be maintained. The clouds are gathering for risk assets globally and the region does look sorely exposed. If we conclude action is needed to address any risk posed to portfolios, we will not need to hesitate to take appropriate action.

Rest of the World - October 2022

The debate about whether the weaker yen is advantageous or not to Japanese equities as a whole is still unsettled – there are clearly some winners and some losers. Certainly, the attempts to intervene in the currency market by the Bank of Japan have not been especially useful so far, and after a rally against the dollar, the yen has drifted back somewhat. The events unfolding at a global level and the discussions around the currency have led us to look further at the investment case for the country. After years of trying, they now have some sort of inflation in their system, but as we wrote recently, they have to be careful what they wish for as rising prices are not good news especially for certain parts of the population. There are some clear positives for Japan on both a standalone and a relative basis, however.

Companies have not quite transformed in the way the late Prime Minister Shinzo Abe perhaps hoped, but it is certainly the case they have exceptionally strong balance sheets as a result of fiscal changes and other reforms. This has enabled them to withstand the pressures from energy prices, and in a world of rising yields and debt problems the cash positions look very attractive. In terms of valuation, some of the discount to global peers that has opened up over the last few years has reduced but is still substantial.

Then we have the expected recovery of tourism post Covid. This should help bring about an improvement in the trade balance and support the currency somewhat. Of course, a significant number of visitors to Japan are Chinese, so this may be curtailed by the restrictions still in place in China. There are clearly positives here, but a lot is going to depend on institutional investors from overseas getting excited about the country again. Some commentators are hopeful that earnings being downgraded in Europe and the US (which looks inevitable) will finally help Japan to be viewed in a more attractive relative light.

Etiquette is hugely important in a country like Japan where society revolves around respect. Gift-giving forms a part of this. Sometimes gifts are refused as they are seen as creating an obligation, but to refuse one from a ‘superior’ is seen as rude. Gifts bearing the numbers ‘4’ and ‘9’ are seen as impolite because they can be read as homonyms for death and torture. Makes buying a birthday card for someone turning 49 potentially difficult!

Of course, this positive outcome is far from guaranteed, but the balance of arguments looks favourable enough in these stressed times and we are holding allocations.

Commodities - October 2022

Though it has been a difficult first month in office for Liz Truss, she has won some friends along the way. The domestic oil and gas sector was particularly fond of her energy package, which included a green light for fracking and more North Sea licences, to accelerate production. The former is particularly controversial, with the industry having effectively been paralysed by 2019’s moratorium. The move followed two earthquakes linked to a fracking site in Lancashire, of 1.6 and 2.9 magnitudes.

Fracking (or hydraulic fracturing) is a method of extraction that involves drilling and then pumping a mix of water, chemicals and sand into the layers of sedimentary rock (shale) at high pressure to release gas (known as shale gas). Fracking could help the UK to bridge its gas deficit, with only 54% of our needs being able to be met by domestic production. Estimates around the amount of gas that could be recovered in the UK through fracking have varied wildly over the years. However, one relatively recent study by Warwick Business School calculated that fracking could help to meet 17–22% of UK cumulative consumption between 2020 and 2050.

Proponents claim that fracking could create jobs, improve the UK’s energy security and lower energy bills. Opponents claim that the process causes environmental damage and local communities continue to express safety fears. Both sides have valid points.

Mansa Musa was the 14th-century ruler of the Mali Empire. He is thought to be one of the wealthiest people in history and was renowned for his gift-giving. So generous was Mansa Musa that it is believed he handed out enough gold to cause prices to plummet and crash the economy on a visit to Cairo.

There are very few listed plays on UK shale gas and those that exist are small and often speculative. We prefer the more mature market in the US, with the region also benefiting from more favourable geological composition than the UK. We have a small amount of exposure through our Energy allocation for higher risk clients.

Fixed Income - October 2022

As we mentioned, ‘mini-budget’ feels like the wrong term to describe Kwasi Kwarteng’s first notable act as Chancellor, given the seismic effect it had in financial markets. To recap, Kwarteng announced a package of energy subsidies and tax cuts that he believed would help to save consumers from spiralling energy costs and avoid pushing the economy into a recession. The Chancellor also believed that the range of measures would help boost future growth and make the UK a more attractive place to do business. However, in the context of high inflation and a central bank attempting to tighten monetary policy, the package appears ill-judged. What investors took particular exception to was the aforementioned lack of funding for the measures. This sent gilt prices and sterling sharply lower and the ramifications were felt in a range of places. Given the material uncertainty, thousands of mortgage offers were pulled by lenders, unsure of their ability to hedge.

The most alarming impact was felt in the pensions sector, which relies heavily on long-term government debt when calculating and hedging liabilities. Over the course of a week, 30-year gilt yields moved from 3.06% to 5.06%, displaying incredible levels of volatility. As yields began to rise, hedged liabilities in the pensions space needed to be funded with more collateral, known as a margin call. These pension schemes sold a range of liquid assets to provide more collateral, causing prices to tumble. In order to stop things spiralling out of control, the Bank of England was forced to intervene by announcing a £65bn bond-buying programme (a gift perhaps?). The announcement itself was enough to lift prices and lower yields, avoiding a crisis. However, the event highlighted the levels of fragility that may be ahead, as interest rates are ratcheted higher, to curb inflation.

We do not have any direct exposure to gilts in portfolios. However, as with large parts of the fixed income market, yields are becoming increasingly more attractive. The rate hiking cycle likely has further to go, but the rates markets are pricing in may prove somewhat ambitious.

Healthcare - October 2022

The healthcare sector is one of the few, aside from companies in the Energy space, to have eked out a positive return this year to date. The MSCI All Companies World Healthcare index has returned 1.26% this year (to 3 October), which seems unremarkable until you consider that the MSCI All Companies World Index returned −8.98% over the same period.

The overall healthcare performance figure masks the underlying dislocation within the sector – biotechnology stocks, healthcare technology and equipment and supply stocks have all fallen over the period. The sector has been buoyed by a relatively narrow range of mega cap pharmaceutical stocks that tend to outperform during challenging market conditions. During periods of inflationary pressures these companies are favoured by investors as they can generally still deliver on earnings growth. In contrast, the more speculative, high growth areas have endured a difficult year as the monetary policy support they enjoyed for some time was pulled abruptly from under their feet.

Managers in the healthcare space believe we have now come to an exciting inflection point where some very innovative companies look much more interesting from a risk–reward perspective at their current valuations. They also expect to see an elevated level of M&A over the next few months as pharma companies seek to purchase some of the smaller innovators at an attractive price.

We have recently seen concerns over US drug policy pricing as some significant healthcare legislation was included in the Inflation Reduction Act. There are positives and negatives from this legislation with some products that have been on the market for a longer period of time facing reduced revenue later in their lifecycle. However, seniors in the US are now eligible for greater financial support in order to access medication, which is a positive for the individual and the industry overall.

We all know how important physical activity is in terms of our physical and mental health. This could be the rationale behind Dutch Prime Minister, Jan Peter Balkenende’s, unusual 2008 gift to the US President, George W. Bush of a set of inline skates. Clearly concerned for the President’s safety, the set came complete with wrist guards, knee pads and elbow pads.

Sadly, to our knowledge, there is no footage in existence of President Bush making use of the gift.

We continue to invest in a broad spread of healthcare equities, believing that the fundamentals of this theme remain strong.

Clean Energy - October 2022

The clean energy sector remains in the spotlight for investors due to its key role in achieving energy independence. While immediate energy security remains a vital concern for global governments across the world we see policies in place that will support decarbonisation. The European Union is accelerating plans to boost its share of energy from renewable sources this decade while simultaneously advancing plans for a green hydrogen infrastructure.

Meanwhile, the US Congress passed the Inflation Reduction Act (IRA) of 2022 which will assign $370bn in tax and rebate incentives in clean energy and climate change programmes as part of a larger package. The IRA includes a wide range of funding programmes across renewables, electric vehicles, hydrogen and storage supply chains with the objective to also support domestic content/manufacturing. There will be a number of direct beneficiaries of the legislation in the private sector. Indeed, during September, we saw the solar energy subcluster rally on the back of this.

We do not deny that it will be a challenging winter for many. With Russia increasingly shutting down the natural gas supply, the European energy crisis is worsening. Retail electricity prices are expected to soar over the coming months, which places further pressure on the consumer.

We retain a cautious stance against this backdrop of persistent high energy prices, stubborn inflation and hawkish central banks. However, we believe that decarbonisation is a powerful long-term theme as governments worldwide continue to explore the possibilities for reducing dependency on imported energy sources and fostering local manufacturing and power generation.

We maintain exposure to renewable energy and companies facilitating decarbonisation, believing that the fundamentals of the clean energy sector and the outlook for the underlying themes remain as strong as they have ever been.

The Monthly Market Commentary (MMC) is written and researched by Simon Gibson, Richard Smith, Scott Bradshaw, Jonathon Marchant and Lauren Wilson for clients and professional connections of Mattioli Woods and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future. Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

The MMC will always be sent to you by the seventh working day of each month, usually sooner, is normally delivered via email, and is free of charge as the MMC is generally made available to clients who have assets under our management in excess of £200,000, and to all clients under our Discretionary Portfolio Management Service (DPM). Normally, the MMC costs £397 + VAT per annum. Professional advisers and their clients should contact us if they are interested in receiving a monthly copy.

Sources: All other sources quoted if used directly; except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.