Global markets summary - September 2024

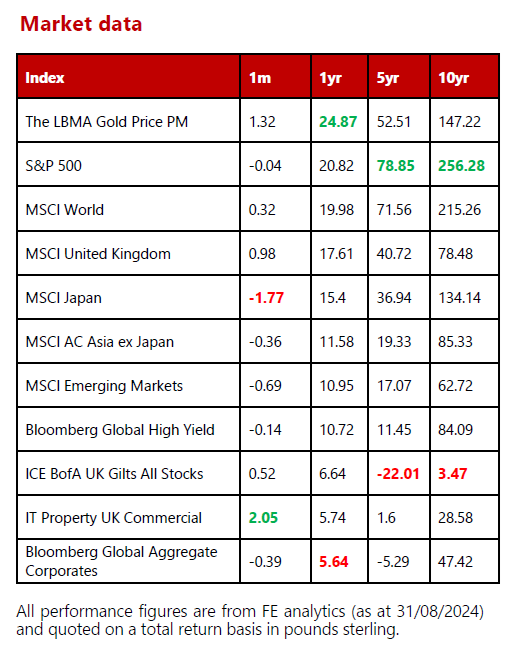

For global investors, August was the best of times and the worst of times. Looking at month-end data, most global equity markets delivered unremarkable returns, but the figures mask volatility endured. The first full week of August began with most major equity indices logging their worst daily decline since 2022 and volatility spiking close to levels not seen since the onset of Covid-19 in 2020. The sell-off was largely driven by disappointing macro data, concerns of weakening growth, and repricing of US recession probabilities, as well as the global unwinding of the yen carry trade (which we wrote about in detail last month).

Then, seemingly in the blink of an eye, the tide turned, and week two of the month saw several markets enjoying their best week of the year. The prospect of lower interest rates as well as a solid Q2 earnings season alleviated investors’ fears of an imminent economic slowdown. The dust settled towards month end, resulting in modest positive returns for sterling investors from the Euro STOXX Index and UK large-cap stocks, while the US S&P 500 and the MSCI Asia ex Japan were flat in £ terms and UK small cap, the Japanese TOPIX, and MSCI China slightly declined.

Fixed income was generally resilient over the month, underlining the diversification benefits of bonds within a portfolio. Clear signals from the Federal Reserve (Fed) that rate cuts are on the horizon supported US government debt, while a stable corporate earnings outlook bolstered the credit market.

In commodities, escalating tensions in the Middle East caused some volatility in oil prices while the gold price reached a new all-time high before pulling back by the month end.

Recent extreme market volatility shows the impact of sudden sentiment shifts and served as a good reminder that stock markets do not always move in a straight line. The recent correction was unsurprising given that most equity markets have enjoyed a good run and the starting point of expensive valuations. Despite uncertainty, we believe that the recent sell-off was overdone and that the current environment supports a modest risk-on tilt in portfolios, favouring equity, credit, and underweight to duration and cash.

United Kingdom - September 2024

The UK equity index is often criticised for its composition, with a number of more defensive and ‘old economyʼ constituents. Sometimes, being more defensive has its benefits and UK equities managed to avoid a large amount of the turbulence endured by global markets towards the start of August. Indeed, the MSCI United Kingdom index delivered a respectable +0.98% over the month, outperforming most markets.

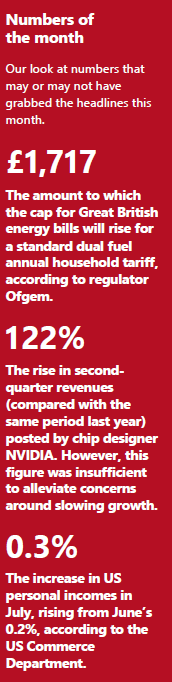

An interest rate cut in August was widely anticipated by the market, which was largely unmoved by the announcement. With interest rates moving from 5.25% to 5%, the rate-cutting cycle has begun. However, the key question remains around how quickly rates are cut from here. The Monetary Policy Committee was split 5-4 at the last meeting, but the lack of references to persistently high services inflation suggested that the Bank of England may consider another cut in November.

This view was supported by CPI inflation data later in the month, which came in marginally below expectations at 2.2%. Pleasingly, the cooling of inflation does not appear to be a harbinger of stalling economic growth. Data on this front remains strong and GDP expanded 0.6% in the second quarter.

The numbers paint a very different picture to the one portrayed by the Labour Government. The Prime Minister and Chancellor have been at pains to highlight the difficulties facing the UK economy, paving the way for a ‘painfulʼ autumn budget. With a number of tax rises ruled out in the run up to the election, Labour appears to have limited options. Changes to capital gains tax appear likely and could move to match marginal tax rates. Inheritance tax and asset disposal relief changes are also rumoured to be in the spotlight and, in the short term, uncertainty is likely to hang over certain sectors.

We continue to closely monitor news flow related to autumnʼs budget, and the targeting of certain sectors could create volatility. We are paying particularly close attention to banks, with some rumours of a levy on interest income, given the extent to which banks have benefited from higher interest rates. To mitigate some of the sector- specific risks, we maintain a diverse portfolio in our UK Dynamic Fund. Overall, we are reassured by the UKʼs economic growth and the stability of the new government.

North America - September 2024

Despite the early August jolt, US equities continued to outperform over the month in local currency terms, with the S&P 500 delivering 2.38%. However, for sterling investors, this moderated to 0.06% given the relative weakness of the US dollar.

Second quarter earnings have generally been positive, with three quarters of S&P 500 companies reporting so far, and three quarters of those beating earnings forecasts. However, second-half 2024 earnings have been revised down 1.5%. There were mixed results in the tech sector. While most mega- cap earnings reported so far have been satisfactory, showing strong year-on-year growth, many semiconductor names have corrected following the moderation of AI- hype. Chipmaker NVIDIA produced very strong earnings numbers and forecasts, but shares fell back regardless, suggesting many investors were expecting something even more blockbuster.

Despite encouraging signals from the Federal Reserve on the imminency of interest rate cuts, US smaller companies were weak over the month, suffering in the wake of an unwinding of the ‘Trump trade’. The potential return of the ex-President to the White House was viewed as positive for many small and mid-sized companies given the Trump administration’s stance on extra trade tariffs, more ‘reshoring’ of operations, and lessening the legislative burdens and taxes on business owners. However, as Democrat nominee Kamala Harris has made a stronger showing in the polls, the odds of a Trump victory, particularly an overwhelming one where Republicans take both Houses of Congress, have faded.

Over the month, we saw plenty of data to counter concerns over weakness in US employment. Strong retail sales in July highlight that the consumer remains relatively robust while fears of a sudden slowdown in the labour market were somewhat calmed by weekly jobless claims releases. These have shown a marked drop since recording an increase at the end of last month from hurricane-related disruption. US GDP was also considerably stronger than expected in Q2, with annualised growth of 2.8% against 2.0% expected, accelerating from 1.4% in Q1 while inflation moderated to its slowest pace since March 2021, with CPI up 2.9% year on year.

The fundamental picture for US equities does not cause alarm. In fact, the early August sell-off presented opportunities to invest in high-quality names at lower prices. We maintain a neutral stance to US equities, with exposure to a broad range of US companies within our portfolios via a blend of cost-effective index-tracking funds and actively-managed strategies with targeted exposure to value and growth stocks.

Europe - September 2024

Over the month, Europe underperformed most other developed market peers in local currency terms, returning 1.4%. Although the eurozone composite PMI (Purchasing Managers’ Index) came in higher than expected, largely thanks to the boost to the French service sector from the Olympics, the overall economic backdrop remained weak and earnings from cyclical companies disappointed.

A number of the region’s key industries face potent headwinds. It has been a particularly challenging period for Europe’s auto industry. Car sales are still nearly a fifth lower than pre-pandemic levels in Europe, and with efforts to compete with Chinese rivals and Tesla in electric cars faltering, German and French carmakers are heading towards a disruptive wave of factory closures.

Luxury companies continue to be pained by weaker consumer demand from China, with cosmetics company Estée Lauder the latest to report a drop in sales. Defence shares in the region also suffered, following a report that the German government will stop new military aid to Ukraine as part of the ruling coalition’s plan to reduce spending. However, the German Foreign Ministry has reportedly refuted claims that Berlin will not provide Kyiv with assistance next year. Instead, the German Finance Ministry clarified that bilateral assistance to Ukraine will be gradually redirected towards international programmes – such as supplying aid from frozen Russian assets.

There was some good news from the bloc over the month; headline annual inflation in the eurozone decelerated to 2.2% in August from 2.6% in July – the lowest level in three years and a shade above the 2% target of the European Central Bank (ECB). Higher energy costs a year ago were partly responsible for the decline. Core inflation, which excludes volatile food and energy costs, ticked down to 2.8% from 2.9%. However, services inflation – a data point that is closely watched by policymakers – quickened to 4.2% from 4.0%.

We maintain a neutral stance towards European equities. Although the macroeconomic picture has been improving, geopolitical uncertainty remains relatively high and has been further heightened by French elections. Additional challenges persist, such as trade disputes and a slowing China.

Rest of the world - September 2024

In a volatile month for equities, Japan was the hardest hit, with the TOPIX dropping 12% on 5 August – its largest daily drop since Black Monday in 1987. As we detailed in last month’s edition, the Bank of Japan’s (BoJ’s) surprise interest rate hike from 0.1% to 0.25% prompted investors to unwind the popular ‘yen carry trade’, injecting volatility into the stock market. The market stabilised towards month end with the TOPIX down -1.94% in sterling terms over August. The sell-off has not derailed the year-to-date performance of 8.77% but we have not turned positive on the region given the potential longer-term implications of a strengthening yen as well as the upcoming consumption tax increase. That said, economic indicators point to a reflationary environment and fundamentals are stable, supporting a neutral rather than negative stance.

Weakness in Chinese equities continued throughout August, as several economists reduced their 2024 growth forecasts amid the country’s prolonged property sector slump and sluggish domestic demand.

The uncertain outlook for China raised the prospect that the country may miss its official growth target of about 5% this year while also raising expectations that the central bank may further loosen policy in the near term. Nevertheless, the consensus from investors is that the government’s interventions have not yet gone far enough to meaningfully stimulate consumer demand. Chinese households have built up record levels of savings, but the real estate collapse and broader economic issues have driven consumer confidence to near-record lows. Indeed, transforming these savings into spending could be crucial to driving China’s economic recovery. Increasing exports have helped offset softer domestic demand, but trade tensions with the US and Europe remain a headwind. For instance, tariffs on electric vehicles have been imposed by both regions, making it even more vital to stimulate domestic demand.

Although tinged by the negativity around China, broad Asia Pacific markets recovered by the end of August and have been largely positive over the year. Taiwan’s stock market has delivered strong returns driven by the success of TSMC (Taiwan Semiconductor Manufacturing company), the world’s largest semiconductor company, which makes up a large part of the index. Despite a slight wobble following the unexpected election results, India’s economic growth has significantly boosted its stock market, which has risen by more than 50% in the past five years. Investors, both international and domestic, have seen India as a useful counterpoint to the harried Chinese stock market, which has led to increasing valuations for Indian companies with the region now valued as highly as the US market. We expect to see some profit-taking from Indian equities soon and indeed, the region saw outflows of $1 billion in August, largely driven by foreign institutional investors.

Emerging market (EM) equities did not evade the global market volatility in August but remain positive over the year so far, though continue to lag developed markets. Latin America has been one of the weaker regions while EM Asia has led, though this masks a wide range of market returns. Although we remain neutral on emerging market equities overall, we expect regions with US-dollar- dominated debt may hold up well in the coming months with Federal Reserve’s monetary easing cycle approaching.

Within portfolios, we maintain specific allocations towards Japanese, Asia Pacific (ex Japan), and broad emerging market equities. Our stance remains neutral on all three areas.

Fixed income - September 2024

August was generally a positive month for fixed income investors. The equity market tumult observed at the start of the month prompted a flight to quality while softer economic data led investors to discount more aggressive rate cuts from major central banks in the coming months. This led to yields on bonds falling (and prices on existing bonds rising).

Within government bond markets, US Treasuries outperformed other markets as investors priced in more aggressive interest rate cuts from the Fed in the coming months. At a recent conference, Federal Reserve (Fed) Chair Jay Powell was uncharacteristically bold, saying the “time has come” for rate cuts, noting weaker employment data and declining inflationary pressures and stating that the “upside risks to inflation have diminished and the downside risks to employment have increased”.

Markets moved to price in aggressive interest rate cuts from the Fed over August, but we continue to anticipate rates remaining higher for longer. Futures markets are still pricing around 100 basis points of rate cuts from the Federal Reserve between now and the year end. With just three meetings left in 2024, this implies that at some point the Fed will feel the need to cut rates by 50 basis points in one of their meetings. We doubt that the economic data is bad enough to justify a larger rate cut rather than a more gradual rate trajectory. Further, although goods inflation has come down sharply, services and wages are keeping inflation high while medium-term concerns about fiscal credibility persist.

Corporate debt also performed well, supported by a stable corporate earnings outlook. Global investment grade bonds benefited from the flight to quality, ending the month as the best performing fixed income sector while, in contrast to much of the year, high-yield bonds lagged. High-quality bonds continue to look attractive; they offer some protection from a more negative economic scenario and even if that does not pan out, they lend stability to a portfolio due to the attractive levels of income on offer.

Although we expect a more accommodative interest rate environment in the second half of 2024, the US presidential election remains a focal point for markets and could lead to increased volatility. As such, within our fixed income portfolio, we have maintained a globally-diversified approach, prioritising credit quality and managing duration to protect against interest rate risk.

As us anything - September 2024

Q: Should we worry about the recent falls in equity markets? Do they reflect a worsening picture of the global economy, particularly the US?

A: The magnitude of the recent drawdown implies a broad expectation that US inflation will fall well below the 2% target and will average just 1.5% in the next two years. However, the current economic data around employment and consumer health/demand does not support that case. The Atlanta Federal Reserve is still looking for 2.5% GDP growth; real incomes are still rising at a healthy rate; Q2 earnings season has been largely positive; and corporate margins are near a record high. Although there has been a softening in lead economic indicators, the data is not dramatically worse than we saw in previous months.

While we do not believe that a US recession is imminent, we do not deny that the risk of one has increased. Economic data has been softening this year and with two more CPI prints and a payroll number scheduled before the Fed’s next FOMC (Federal Open Market Committee) meeting, there are potential bumps ahead.

The US election and geopolitical upheaval also pose risks. In recent months, we have added greater exposure to actively managed equity strategies to core portfolios, aiming to add some defensive characteristics amid choppy markets as well as the ability to take advantage of market dislocations.

In the near term, we expect that both equities and bonds will remain highly sensitive to interest rate expectations and any signs of the US deviating from a soft landing. The sell-off in early August was driven by some idiosyncratic factors (such as thin markets and the unravelling of the popular yen carry trade) but we note that September can often be a tough month in markets. We expect that autumn will be a busy period for news flow and are prepared to cut through the noise, focusing on economic signals and the impact these have on expectations for earnings, monetary policy, and risk appetite.

If there is a question you would like to pose to our team, please reply to this email or write to investments@mattioliwoods.com.

The Monthly Market Commentary (MMC) is written and researched by Scott Bradshaw, Lauren Hyslop and Jonathon Marchant for clients and professional connections of Mattioli Woods and is for information purposes only. It is not intended to be an invitation to buy, or to act upon the comments made, and all investment decisions should be taken with advice, given appropriate knowledge of the investor’s circumstances. The value of investments and the income from them can fall as well as rise and investors may not get back the full amount invested. Past performance is not a guide to the future.

Mattioli Woods is authorised and regulated by the Financial Conduct Authority.

Sources: All other sources quoted if used directly, except fund managers who will be left anonymous; otherwise, this is the work of Mattioli Woods.