The DIPs are multi-asset portfolios that each aim to generate steady income streams while also aiming for long-term capital appreciation. Both portfolios employ dynamic asset allocation and active security selection to balance risk and return with two risk levels available.

The ‘Diversified Income Portfolio Level 4’ (DIP Level 4) targets a moderate to moderately low level of volatility (variation of returns), while the higher risk ‘Diversified Income Portfolio Level 6’ (DIP Level 6) aims for a moderately high level of volatility, with both aiming to meet their goals over the medium to longer term (five years or more).

Both DIPs aim to generate natural income with possible capital growth. DIP Level 4 has a higher weighting to fixed interest which provides more clarity on the level of natural income that can be generated and, as a result, targets an income level of 4% per annum.

In contrast, DIP Level 6’s higher equity weighting means it does not have a set income target, but it aims to provide a higher total return than DIP Level 4, while providing a sustainable level of income.

The portfolios invest in a globally diversified mix of assets, investing across a range of underlying approaches, styles and geographies. This ensures that the risk associated with both income and capital return is diversified and therefore reduced.

While Mattioli Woods is the discretionary investment manager for this portfolio, advice regarding asset allocation and fund selection is provided by our strategic partner, T. Rowe Price.

Rowe Price was founded in 1937 and has been in the UK since 1979, with £1.3 trillion in assets under management and significant capabilities in multi-asset solutions. They offer an extensive range of solutions, predominantly in equity and fixed income, enabling them to help construct the multi-asset income solutions with competitively priced, in-house building blocks.

Their team includes over 8,100 associates, with the 76+ multi-asset professionals supported by 475+ equity and 248+ fixed income professionals (source: T. Rowe Price, as at Dec 2024).

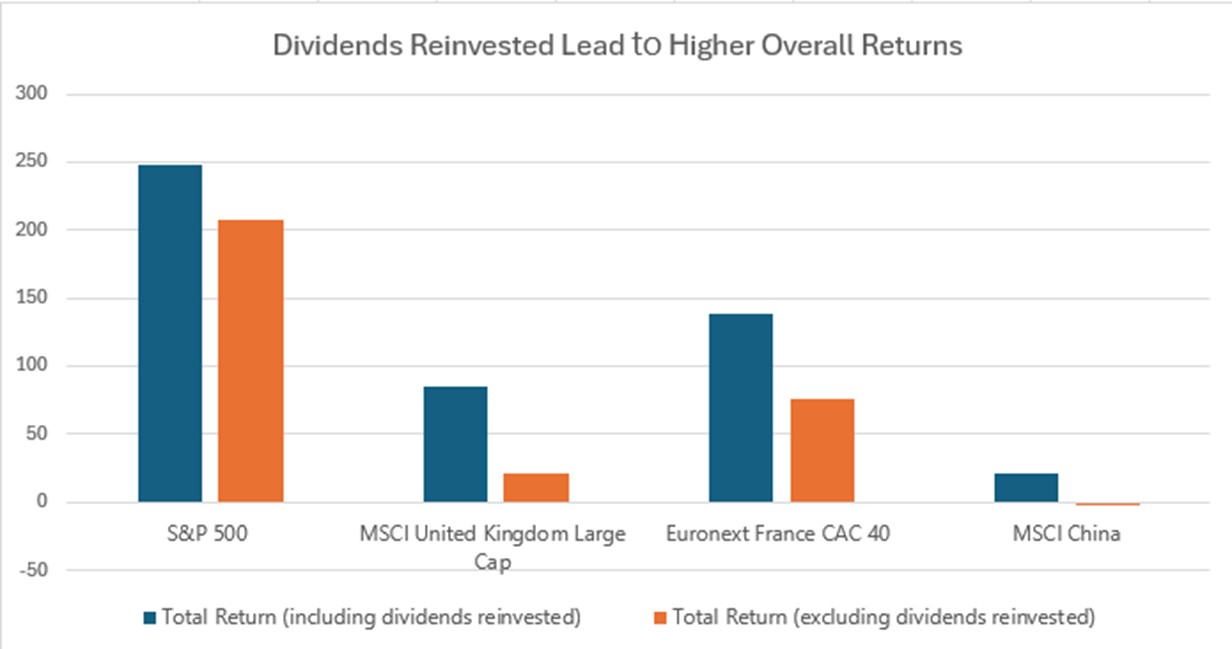

Dividend yield and dividend growth have been the strongest drivers of equity returns over the long term. The chart below clearly illustrates just how influential income has been across a number of developed markets over a 10-year time period.

Date: 10 years to 30 April 2025

Pricing Spread: Bid-Bid ● Data Frequency: Daily ● Currency: Pounds Sterling

Source: FE Analytics

There are a number of reasons why income investing within equities has been so advantageous over the longer term:

* Pound cost averaging is an investment strategy where an investor regularly invests a fixed amount of money into a particular asset or investment fund at predetermined intervals, regardless of the asset’s current price. This approach allows the investor to buy more units of the asset when prices are low and fewer units when prices are high, thereby potentially reducing the average cost per unit over time. Pound cost averaging helps mitigate the impact of short-term market volatility and allows investors to build a diversified portfolio gradually.

While equities per se offer inflation protection over the longer term, the growth of dividends paid generally outpaces the inflation rate. Unlike shorter-term inflation hedges (i.e. inflation-linked bonds) that are poor performers, if the inflation risk being hedged fails to materialise, equities that pay out a sustainable income should capture much of the market upside when inflation is less prevalent, while outperforming when inflation becomes more persistent. On this basis, equities can be a good long-term hedge against inflation thanks to the dividend-paying proportion carrying the wider equity universe.

Companies that distribute a steady income to shareholders typically trade at a discount to the broader market. This is usually for a number of reasons, both fundamental and behavioural. These cashflow positive businesses are generally mature and ‘ex-growth’ and the market prices a premium to faster growing companies. The market often also underestimates the benefits of the long-term compounding generated by the steady income by focusing too much on the shorter-term growth outlook.

The chart above incorporates a number of economic environments from recession to expansion and illustrates that income investing is the most influential driver of long-term equity returns.

But just because income investing has worked in the past does not automatically guarantee that it will work going forward. To quote Mark Twain, “history does not repeat itself, but it often rhymes” and by focusing on income within the Diversified Income Portfolios, we believe we are tilting the balance of probability in our favour to outperform going forward.

With inflation remaining ‘higher for longer’ and above the 2% targets set by Central Banks, albeit considerably below the recent highs, income paying stocks should remain attractive as the impact of inflation begins to erode growth prospects in non-cash generative businesses.

Interest rates rose quickly as we moved from an environment of Quantitative Easing (QE) to one of Quantitative Tightening (QT). With the rises in rates, we saw a resetting of bond yields across the credit spectrum.

Today, yields are attractive and are contributing to both the income generation and total return of the Diversified Income Portfolios. While bond yields have experienced significant fluctuations since their peak in 2023, they remain broadly elevated compared to historical norms and as such, continue to look attractive.

Bond markets are now readjusting their expectations for when rate cuts might commence but the consensus remains that we are at ‘terminal rates’ for this rate cycle. With many corporates in a strong financial position, credit fundamentals remain supportive.

The value of the underlying investments within the DIPs and income generated from these underlying investments can fall as well as rise and you may not get back the amount invested.

For funds investing globally, currency exchange rate fluctuations may have a positive or negative impact on the value of your investments.

Changes in interest rates will affect the value of, and the interest earned from, bonds held by the portfolio (and underlying funds). When interests rise, the capital value of the fund is likely to fall and vice versa.

Past performance is not a guide to future returns.