Pension and retirement planning are important if you want to maintain your desired lifestyle once you stop working.

Whether you’re taking control of your investments or allowing our specialist experts to look after them for you, you can be confident Mattioli Woods will look after you, your investments and your pensions. With a strong background in administering and advising on SIPP and SSAS arrangements, you’re in good hands.

Essentially, a pension is a tax-efficient, long-term savings vehicle, which aims to provide you with sufficient income throughout your retirement. These dedicated funds holds both yours and any employer matching contributions (via workplace schemes), and benefits from significant tax advantages.

Access to your pension becomes available upon reaching the minimum retirement age (currently 55, rising to 57 in April 2028).

At this point, you’re entitled to withdraw up to 25% as a tax-free lump sum, with various options for structuring ongoing income from the remaining balance.

• financial security

• employer contributions

• tax efficiency

• tax-efficient growth

• tax-free lump sum

• dedicated consultant

• holistic advice

• investment management and advice

• regular reviews

• peace of mind

SIPPs offer sophisticated investors enhanced control over their pension investments. The MW SIPP provides access to an extensive range of investment options, including direct commercial property holdings, supported by professional advisory services.

SIPPs offer a powerful combination of tax efficiency, investment flexibility, and retirement security, making them essential for anyone serious about building their financial future.

SSAS arrangements, typically utilised by company directors and key executives, offer maximum flexibility and control. Unique features include:

These features allow business owners to leverage their pension assets for company growth while maintaining control over investment decisions and potentially benefiting from tax advantages.

A personal pension is a pension you arrange yourself. Sometimes known as a defined contribution (DC) pension, these are the most common type of workplace pension, combining employee and employer contributions in a personally allocated investment portfolio. The final pension value varies depending not only on the level of contributions made but also the investment performance.

We prioritise delivering peace of mind through sophisticated advice and holistic investment management. Whether your objectives include early retirement, tax-efficient income structuring, or integrating pension planning with business strategy, your dedicated consultant will develop and maintain an appropriate strategy.

You will be assigned your own dedicated consultant who will work with you to ensure you are working towards your pension goals. You will also have your own client relationship manager (CRM) who will deal with the day-to-day running of your account.

By having your own dedicated team of people who know you and your goals, we can ensure you get the personal approach for your financial ambitions.

All our fees vary depending on your circumstances, and one of our consultants can discuss this with you.

Currently the annual allowance is £60,000 per year, per person (2025/26 tax year). In certain circumstances, you may be able to utilise unused annual allowances from the previous three tax years.

These depend on the type of pension you have/are looking to use, as explained above. Your consultant will be able to create a bespoke investment strategy relevant to the appropriate wrapper being used, but in summary, you may be able to invest in:

The minimum retirement age in the UK is 55, rising to 57 in April 2028. You will then be entitled to withdraw 25% of your pension pot tax free, subject to your lifetime limit (otherwise known as your lump sum allowance (LSA). Please speak to your consultant, who will be able to provide you with the most suitable advice for you.

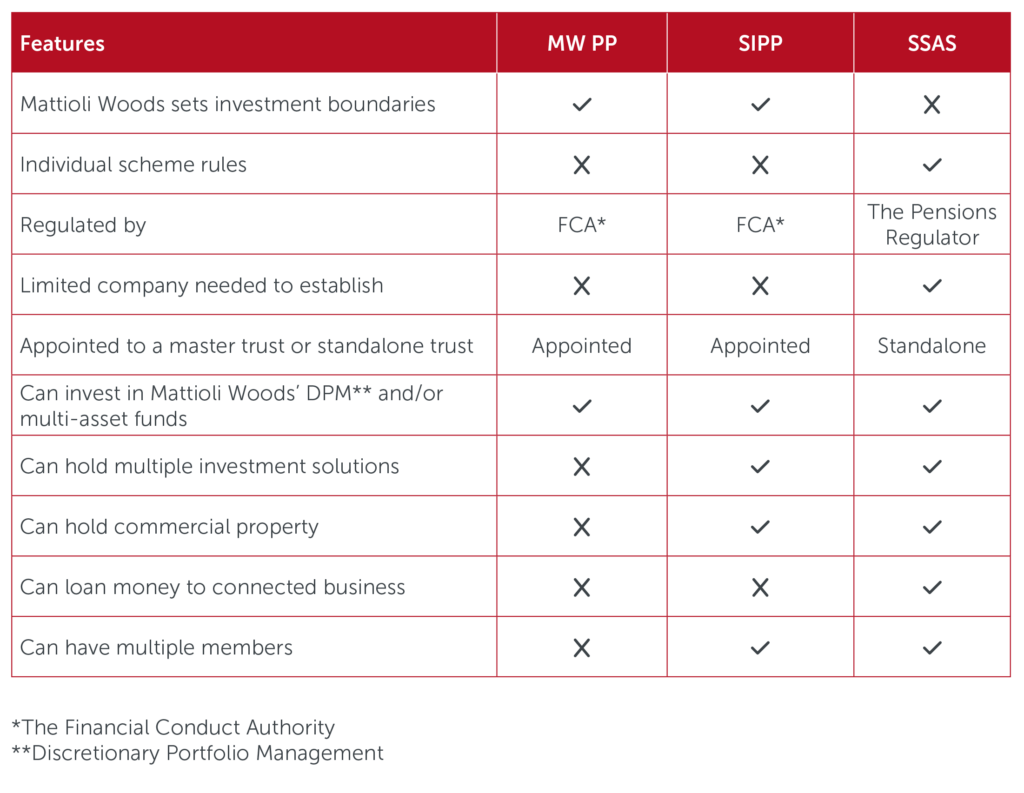

Both SIPP and SSAS pensions offer a wider range of investment opportunities than a traditional pension; however, there are some differences.

A SIPP is a personal pension arrangement and is primarily focused on personal retirement planning. These can be set up by anyone and are one of the most popular pensions in the UK.

By comparison, a SSAS is an occupational pension scheme. Each scheme is limited to a maximum of 11 members and these are usually directors or key employees. These members would act as trustees with direct control over the investments made.

One major difference is that a SSAS has the ability to provide ‘loanbacks’ to the sponsoring employer.

However, as a SSAS is more complex, there will be more administrative responsibilities, and costs. You will also need professional trustees and to comply with more stringent regulations.

If you wish to access your pension after age 55 (rising to 57 in April 2028) you can use flexi-access drawdown.

Using flexi-access drawdown means you can take up to 25% of your pension as a tax-free lump sum. The remaining 75% will stay invested. You’re then able to withdraw as much or as little as you require from the invested portion; however, it’s important to note these withdrawals will be taxed at your marginal income tax rate.

For the majority of us, the standard tax-free cash entitlement will be 25% of your total pension pot. This can be taken either through small amounts via flexi-access drawdown, or as a single lump sum.

However, there are some instances where this may differ so you should always discuss this with your financial adviser.

Yes. Mattioli Woods do not handle clients’ money.

This means all cheques or bank transfers must be made payable to the issuer of the investment unless it is for the settlement of our fees.

While Mattioli Woods is the provider of the pension, this essentially means we act as professional trustee and administrator. Your money is therefore ringfenced and held with the underlying investment provider or bank, for the benefit of your pension trust.

Commercial property

Pensions have been used to hold commercial property in one form or another since the 1970s. These days, not all SIPP providers can facilitate the purchase of commercial property, and there are always benefits and disadvantages of any such investment strategy within a SIPP or SSAS pension fund, so we strongly advise speaking with a Mattioli Woods consultant for more information. You can also request our ‘Pensions and commercial property’ brochure here.

Loanbacks

Loanbacks are a successful way for you to help with the cash flow needed to develop your business further, without having to approach a bank. Used as part of a SSAS, a loanback allows you to loan funds from your pension arrangement to your business, in return for capital and interest repayments.

There are several provisions that must be satisfied to facilitate a loanback. Therefore, it’s important to speak with one of the Mattioli Woods consultants who are well versed in these arrangements, to ensure said provisions can be met and that a loanback is a suitable strategy for you and your business.