A structured product is a fixed-term contract, providing a return based on the performance of an underlying share or stock market index. Inherently, a structured product is designed to limit investment losses while still creating a return to investors. Some structured investments offer a degree of capital protection, while others do not. The growth is usually not guaranteed, and you may get no return on your investment. Even where there is capital protection, the deduction of fees and charges could mean you get back less than you put in.

It is important to mention that a structured product is not suitable for people who require access to their money invested during the investment term. Early redemption can be part of the whole amount invested, but investors may receive less than the original sum invested.

While the tax rules and rates that are used within any current recommendation to you are up to date, the rules and rates can change at any time. Mattioli Woods can accept no liability for any such changes and their potential effect on your plan. The value to you of any tax benefits will depend on your personal tax position at the relevant time.

The value of investments and the returns from them can go down as well as up, and you may not get back the amount invested.

Past performance is not an indication of future returns.

Investments need to be considered as medium to long term holdings.

Inflation will erode the purchasing power of your money.

There is no fixed cost for exiting this plan at maturity. Please note if you needed to sell this plan prior to maturity, the issuing bank will endeavour to provide quotes under normal market conditions for trading purposes on request, subject to a bid-offer spread of 1%. Please ensure you read the accompanying fact sheet. Citi Group has defined the holding period as ‘the recommended holding period for the product is until 13 November 2026, which corresponds to the product's maturity’.

Please also read the KID in relation to this statement.

There is no fixed cost for exiting this plan at maturity. Please note if you needed to sell this plan prior to maturity, the issuing bank will endeavour to provide quotes under normal market conditions for trading purposes on request, subject to a bid-offer spread of 1%. Please ensure you read the accompanying fact sheet. Goldman Sachs has defined the holding period as ‘the recommended holding period for the product is until 13 November 2026, which corresponds to the product's maturity’. Please also read the KIID in relation to this statement.

If you change your mind and do not wish to invest, please inform your Mattioli Woods contact by 22 October 2021, the start date for the structured product(s). After this date you will only receive the value of the structured product when sold back to the product provider which is likely to be less than your original investment.

These products offer no FSCS protection.

Mattioli Woods – our ‘restricted’ status

For over 30 years Mattioli Woods has been at the forefront of providing advice, pension administration/trusteeship, and investment products and services for clients across the country. Its key aim is to put clients first to help them reach the objectives they set. This is done with integrity and professionalism while maintaining a bespoke approach, and it continues with this ethos as part of its culture.

The Mattioli Woods website (www.mattioliwoods.com) provides a further history of the company and the products offered to achieve clients’ various requirements.

In terms of financial legislation, firms can be ‘independent’, or ‘restricted’, or both.

We offer our own discretionary portfolio management (DPM), self-invested personal pension (SIPP), personal pension (MW PP) and small self‑administered scheme (SSAS) services as our investment managers and consultants/client relationship managers are specialists in these areas of advice and management. For this reason, we are classed as a ‘restricted’ advice business and, only where it is suitable and in line with your objectives, we will recommend these solutions to you. Should your circumstances not be best served by our own propositions, we will look to the wider market to source the most appropriate solution for you.

In addition, as part of our centralised investment proposition, we offer the Custodian REIT plc, which is a real estate investment trust managed by Custodian Capital Limited, part of the Mattioli Woods Group.

Our solutions are designed to meet your needs and where appropriate we can also offer advice on pensions, investments, and non-investment insurances (protection policies) from the whole market.

Mattioli Woods is committed to ensuring the principles of ‘treating customers fairly’ set by the Financial Conduct Authority are applied with integrity throughout all aspects of our business.

Any tax-based calculations completed by Mattioli Woods are for illustrative purposes only, and we recommend you check these with your accountant or tax adviser.

If the recommendation is in relation to an ISA please read this section. ISAs are a tax-efficient wrapper with the option to save via cash and/or stocks and shares, making them ideal for investors as there is nothing to include on tax returns.

Full details are included in the investment guidance booklet that has been made available to you either online or provided to you, which we would refer you to, along with your supporting key information documents as appropriate.

As mentioned, you can draw funds from your ISA and replace the amount within the same tax year without losing the tax benefits or using up any further allowance in that tax year.

Specifically:

- Flexi-ISAs enable investors to draw cash from their ISA and subsequently replace this within the same tax year without it counting towards their annual subscription allowance.

- The replacement of cash must happen within the same tax year the cash is drawn.

- Any drawn cash not replaced before 5 April cannot be replaced and will be a new subscription counting towards the investor’s annual allowance.

- Payments into the flexi-ISA will be counted, first, as repayments of any outstanding flexible withdrawals made in the current tax year and, second, as a subscription against the current year annual allowance.

- There is no carry-over of either unused annual allowance or withdrawals between tax years.

- Repayments of drawn funds may only be made to the account from which the associated withdrawal was originally made.

- The full value of the ISA may be drawn, but withdrawals must not exceed the total value of the ISA (overdrafts are prohibited), even when the amount available for withdrawal is less than the total of current year contributions.

Guidance for the FTSE 100 Growth Plan October 2021

The FTSE 100 Growth Plan aims to provide a return of 6.8% per annum over a maximum of five years. This annual return is paid on the condition that the FTSE 100 index is at or above the autocall barrier on the autocall observation date. The autocall barriers are as follows:

- Years 1 to 5 if the index is at or above 100% of its strike level

- The initial strike level for this structured product is observed on 29 October 2021.

Capital protection - FTSE 100 Growth Plan October 2021

The capital protection for this plan is dependent on Citigroup fulfilling its obligations, along with the investment being held until maturity, unless there is a prior autocall. The initial capital is used to purchase securities in Citigroup that have similar characteristics to investing in corporate bonds. In the unlikely event of default, investors will be creditors of Citigroup.

Citigroup has been rated A+ by Standard & Poor’s, as at 9 August 2021. Standard & Poor’s is an independent credit rating agency that uses a scale to denote creditworthiness, ranging from AAA (highest) to D (lowest). Issuers within the A rating band are described by Standard & Poor’s as having strong capacity to meet their financial commitments but are more susceptible to the adverse effects of changes in circumstances and economic conditions than those issuers rated AAA or AA. Further information about ratings can be obtained via this website: www.spglobal.com/ratings/en/about/understanding-credit-ratings

Capital at risk – FTSE 100 Growth Plan October 2021

Initial capital is not 100% secure with this structured product. If at maturity on 3 August 2026 the index is below 65% of its initial level, the initial capital being returned will be reduced by any negative performance. For example, if the FTSE 100 index was 70% below its initial strike level, the initial investment would be reduced by 70%. Therefore, the return of the original capital invested is not guaranteed.

Guidance for the Pharma Basket Growth Plan October 2021

The Pharma Basket Autocall Growth Plan aims to provide a return of 8% per annum over a maximum of five years. This annual return is paid on the condition Astra Zeneca, GlaxoSmithKline and Pfizer shares at or above the autocall barrier on the autocall observation date. The autocall barriers are as follows:

- Years 1 and 2 if all the shares are at or above 100% of their strike level

- Year 3 if all the shares are at or above 95% of their strike level

- Years 4 and 5 if all the shares are at or above 90% of their strike level

- The initial strike level for this structured product is observed on 29 October 2021.

Capital protection – Pharma Basket Growth Plan October 2021

The capital protection for this plan is dependent on Goldman Sachs fulfilling its obligations, along with the investment being held until maturity, unless there is a prior autocall. The initial capital is used to purchase securities in Goldman Sachs that have similar characteristics to investing in corporate bonds. In the unlikely event of default, investors will be creditors of Goldman Sachs.

Goldman Sachs has been rated BBB+ by Standard & Poor’s, as at 9 August 2021. Standard & Poor’s is an independent credit rating agency that uses a scale to denote creditworthiness, ranging from AAA (highest) to D (lowest). Issuers within the A rating band are described by Standard & Poor’s as having adequate capacity to meet financial commitments but are more susceptible to the adverse economic conditions than those issuers rated AAA or AA. Further information about ratings can be obtained via this website: www.spglobal.com/ratings/en/about/understanding-credit-ratings

Capital at risk – Pharma Basket Autocall Growth Plan October 2021

Initial capital is not 100% secure with this structured product. If at maturity on 29 October 2026 the FTSE 100 index is below 65% of its initial level, the initial capital being returned will be reduced by any negative performance. For example, if the FTSE 100 index was 70% below its initial strike level, the initial investment would be reduced by 70%. Therefore, the return of the original capital invested is not guaranteed.

Economic overview – FTSE 100 Growth Plan October 2021

The FTSE 100 index is comprised of the 100 largest quoted U.K companies. But it would be a mistake to regard it as a reflection of the U.K economy.

First, more than two thirds of revenues made by FTSE 100 companies come from overseas. Either from the overseas production units of the mining, industrial and energy companies, or from exports out of the U.K made by these companies. This makes the FTSE 100 an index of global companies, and its fortunes are more aligned with the global economy than that of the U.K.

Second, the FTSE has a value bias. This means it is sensitive to the economic cycle, with corporate profits rising sharply as demand picks up. This reflects the high fixed cost base of many of the above-mentioned industries, compared to -say- many tech and service sector companies.

In addition, if inflation and interest rates pick up, they offer some protection since they are less sensitive to borrowing costs than growth-orientated sectors.

As the global economy shakes off Covid-19, we expect to see continued investor interest in global value stocks.

Economic overview – Pharma Basket Growth Plan October 2021

Pharmaceutical stocks have long played a role in investors’ portfolios. This reflects not just the U.K’s traditionally strong pharma sector, but their relatively low correlation with more economically-sensitive sectors, which helps to diversify portfolios.

For example, while we may eat out less during a recession, our consumption of painkillers and other drugs is relatively stable.

However, pharma companies are in many ways hybrids. They have the defensive qualities mentioned above, but their need to continually find new products -as patents on existing drugs expire- means that many are also, in part, growth science-based stocks.

And as science offers more and more specialised treatments, which aging populations in the west are demanding be provided by healthcare systems, the sector is likely to grow faster than many other industries over the coming decades.

Furthermore, the Covid-19 pandemic has highlighted the need for resilience in global healthcare systems. This is likely to lead to greater government, and multi-national, support for immunisation programs around the world that will need the involvement of pharma companies.

The most significant near-term risk to the sector is perhaps a curbing of drugs prices in the U.S under the Biden administration. However, this possibility has perhaps already been priced into the share prices.

A company called IDAD is employed on behalf of Mattioli Woods to conduct an auction with competing structured product providers. IDAD also settles the trade with our custodian and provides all the supporting documentation required by the FCA. To complete these tasks, IDAD charges a fee. For the FTSE 100 Growth Plan IDAD’s fee is 0.5%, with BNP Paribas’ estimated fee of up to 0.42%. The combined total of these fees cannot exceed 0.92% and as noted, they are built-in to the return of the plan so do not reduce the amount invested. For example, based on a monetary investment figure of £10,000 the fee would equate to £92.00. This charge has been accounted for in arriving at the stated potential return of 7% per annum and will not be deducted from that figure when the plan matures.

For the Emerging Markets and Growth Plan August 2021 IDAD charges a fee of 0.5%, with Morgan Stanley’s estimated fee of up to 1.15%. The combined total of these fees cannot exceed 1.65% and as noted, they are built-in to the return of the plan so do not reduce the amount invested. For example, based on a monetary investment figure of £10,000, the fee would equate to £165.00. This charge has been accounted for in arriving at the stated potential return of 8.3% per annum and will not be deducted from that figure when the plan matures.

Please be aware that the fact sheet states IDAD’s fee is ‘not expected to exceed 1%’; the actual IDAD fees have been disclosed above and are therefore more accurate for your information.

Pershing Securities Limited is the administration platform we have selected to operate the service. For further information please refer to the enclosed Pershing terms of business document.

Pershing Securities Limited

The administration platform we have selected to operate the service from is supplied by Pershing Securities Limited (‘Pershing’).

Pershing

Pershing is part of the Bank of New York Mellon (BNY Mellon) group, the world’s largest custodian and one of the world’s leading investment services groups with in excess of $35 trillion in assets under custody and administration as at Q1 2020. Pershing itself has circa $1.8 trillion under custody and administration globally. There were three main considerations in selecting Pershing from its rivals:

1. The security of your assets held on the Pershing platform is exceptional. Not only are your assets held by the largest custodian in the world, cash held within portfolios is managed across a wide range of banks to ensure diversification, and is covered by the Financial Services Compensation Scheme (FSCS) up to the £85,000 limit.

Pershing has specialised in the provision of custody, execution and settlement services since 1939 and has been present in the UK since 1987. It is highly selective in working exclusively on a business to-business basis and has chosen to partner with over 180 organisations in the UK.

2. As one of the largest global players in this market, our clients can have every confidence that Pershing systems and software will always be competitive and state-of-the-art.

3. Pershing’s wealth management platform, NexusComplete, offers unrivalled facilities for client firms who would like to benefit from an investment management and administration tool that can embrace their assets through various wrappers.

Pershing will provide you with quarterly valuations, annual tax documents and contract notes, all accessible electronically via an investor portal or via post. Quarterly custody statements confirming the holdings in your accounts on the Pershing platform will also be issued to you via post.

Pershing – capital gains tax service – only applicable if invested in taxable multi-holding portfolio

For taxable portfolios, Pershing can provide a capital gains tax (CGT) service for which the charge is £50 plus VAT per account, per year. We will switch this service on for multi-holding taxable portfolios, unless you opt out via the application form, and deduct £50 plus VAT in May each year for the previous tax year’s report. Pershing will then produce and send you a CGT report (which will be combined with your consolidated tax voucher) every year. The service also allows us to calculate notional CGT on your account on request.

Investment services charge

Charges relating to the provision of investment services are 0.2% per annum of the total value of applicable assets administered by Pershing.

This charge is calculated and deducted from your Pershing portfolio account quarterly in arrears. This charge is for the provision of investment services associated with the processing and servicing of investments and other costs incurred on behalf of clients, including access to the Pershing client portal. Pershing currently retains between 0.10% and 0.11% of this charge for the services it provides including dealing, clearing, settlement, safe custody and other associated services. The actual figure retained by Pershing will be dependent on the aggregate value of assets held by Mattioli Woods’ clients with Pershing. A full breakdown of the services provided by Pershing and their respective costs is available on request.

The balance of this charge is paid to Mattioli Woods. The actual figure paid to Mattioli Woods currently ranges between 0.09% and 0.10% and is dependent on the aggregate value of assets held by Mattioli Woods’ clients with Pershing. This charge is in addition to any advice or product fees Mattioli Woods may charge you and is explicitly detailed within all our literature as the investment services charge.

Management fee

Pershing charges a 0.5% per annum fee for managing the uninvested cash balance on your account (known as the money management fee) and this fee will be calculated daily and applied to the cash balance on your account. This charge may be higher than any interest that would otherwise have been credited to your account, in which case a charge in the form of debit interest may be charged for that balance.

Please note the cash balances within the Pershing account are entitled to interest at the central bank base rate for sterling, US dollars and the euro, and the applicable agent credit rate for other currencies less the 0.5% money management fee.

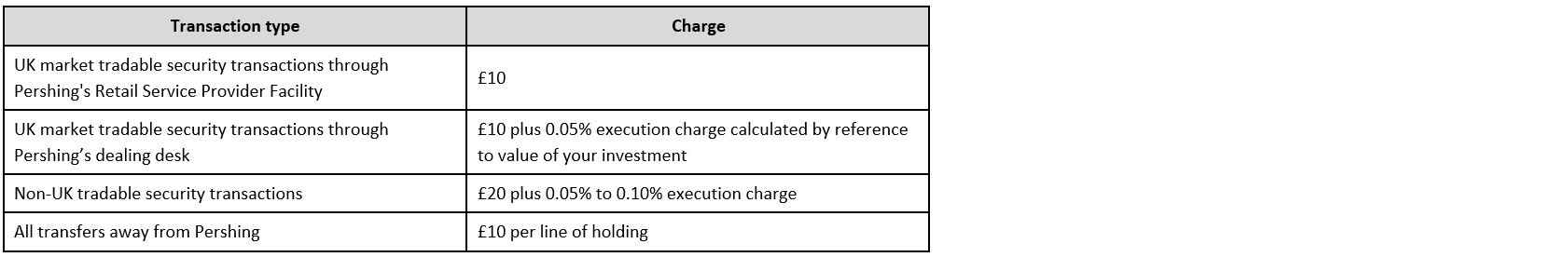

Additional Pershing transactional charges

In addition to the charges detailed within the cost disclosure table there are transactional charges applied by Pershing in addition to the platform and custody service charge. These are known as transactional costs and are applied when specific transactions are undertaken for your account. For advised and execution-only clients these fees will be disclosed on the formal contract note. For personal business only it is important to note any of the charges applied will be disclosed formally under our annualised aggregated disclosure statement when issued.

An indication of these fees is as follows: